According to the new legislation of the Russian Federation, entrepreneurs engaged in trading activities must use new generation cash desks for financial settlements with the function of transmitting information in real time to the tax service. To work legally, the equipment must be registered with the Federal Tax Service. Registering an online cash register is a procedure that consists of several stages and requires training and knowledge. You can register a CCP in one of the following ways:

- Register KKM via the Internet without visiting the offices of the Federal Tax Service.

- Register an online cash desk when you personally appear at the inspection with the help of an employee.

The advantage of the first option is that the procedure takes place as soon as possible and does not require spending time visiting the tax office. But in this case, you will have to deal with the nuances of remote work on a computer on your own. In the second case, an employee of the IFTS will help to overcome difficulties, but you need to come to the department and bring the equipment itself and provide a package of documents.

Important! If you encounter difficulties with registering an online cash register, use the services of intermediaries and specialized companies for a fee.

Registration of online cash desks in the Federal Tax Service via the Internet

In order to independently register a CCP with the tax authorities, you need to know the general procedure for registering an online cash desk and have some additional computer skills and knowledge in the field of computer programs. But if you understand the information presented below, then you can cope with the task without the help of outsiders.

What you need to know before starting the procedure

The online application process itself will take 10-15 minutes. But to start these actions, preparation and presentation of the process itself will be required.

What will be needed in the process:

- An entrepreneur must be registered on the official website of the Federal Tax Service and have a personal account.

- You will need an electronic digital signature registered in the name of an individual entrepreneur or legal entity. You also need to know how to work with it.

- The computer must be configured appropriately to establish a secure connection to the IRS website:

- cryptographic provider installed;

- Internet Explorer version 8 or higher is installed;

- Added a certificate from the IFTS.

If you communicate with computer technology on “You”, ask for help from friends or paid specialists. If you want to figure it out on your own, refer to the instructions that the Federal Tax Service provides for work. It can be downloaded from the link below.

The procedure for registering online cash desks in the Federal Tax Service

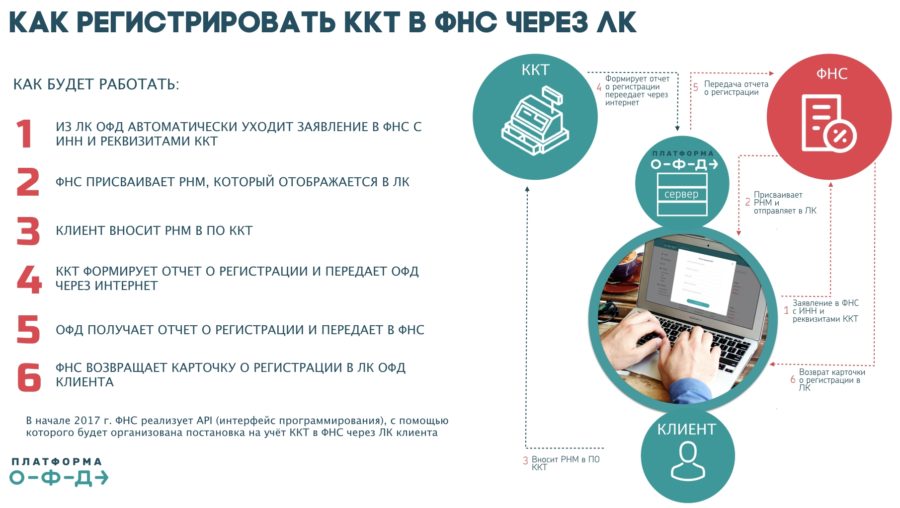

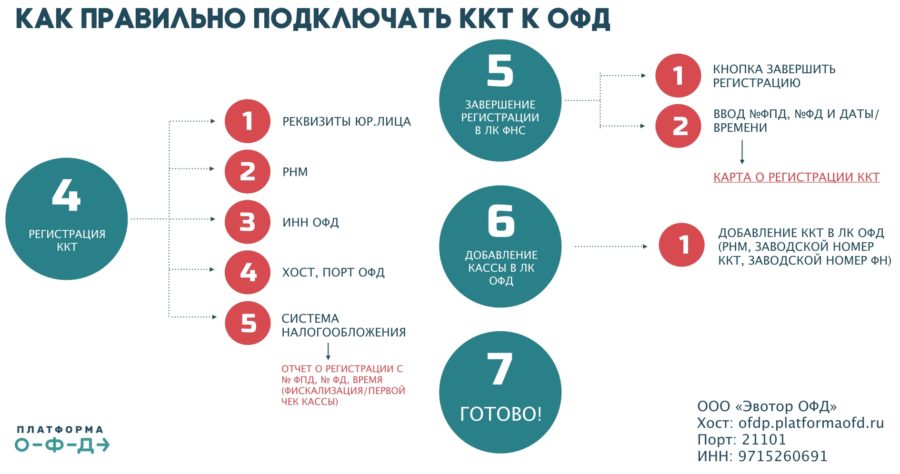

To proceed with the registration of a CCP in the tax office, you need to imagine for yourself what stages the procedure consists of. Briefly describe the actions of the entrepreneur as follows:

- Buy online cash register.

- Sign an agreement with the fiscal data operator.

- You send an application in your personal account on the website of the tax service.

- In response, you will receive a registration number.

- Fiscalize a new online cash register.

- You complete the procedure and receive a CCP registration card from the tax authorities.

- You link the online cash register to your personal account on the website of the fiscal operator.

Only after carrying out all the actions, you can start working with online equipment legally.

Important! It is possible to register KKM via the Internet only if there is an EDS (electronic digital printing). Otherwise, you will have to pay a personal visit to the IFTS at the place of residence or location of the enterprise.

Preparation for registration of an online cash register with the Federal Tax Service

The process of filing an application and registering a cash desk on the website of the tax service is simple and short. But it requires some preparation, because if you skip some steps, you simply will not be able to register a cash register.

What is the preparation:

- Deregistration of old cash registers. If you do not make it on time or forget, tax officials have the right to do this unilaterally, and they are not responsible for notifying you about this. In the event that an entrepreneur has not yet acquired new equipment and continues to work on an old, deregistered one, his actions will be recognized as illegal, and penalties will be applied to him for “Not using CCP”.

- Acquisition of a new online cash desk (you can upgrade the old equipment). Only equipment from the Tax Service Register that has been certified and meets the established standards and requirements is allowed for use. It is prohibited to work with KKM not included in the permitted list. Therefore, be careful when buying. The register also indicates the types of fiscal drives that are suitable for one or another CCP model.

- Conclusion of an agreement with OFD (fiscal data operator). The list of accredited fiscal operators is available on the official website of the Federal Tax Service. Please refer to this list for selection. The price of the service contract is 3000 rubles. Payment for OFD services is possible after registration of the cash register.

Important! Entrepreneurs located on the territory of the Russian Federation, which is classified as hard-to-reach, where there is no stable Internet connection, are exempted from concluding an agreement with OFD. They can use autonomous equipment, but they are required to register it with the federal tax service.

Step-by-step steps on how to register an online cash register with the tax office

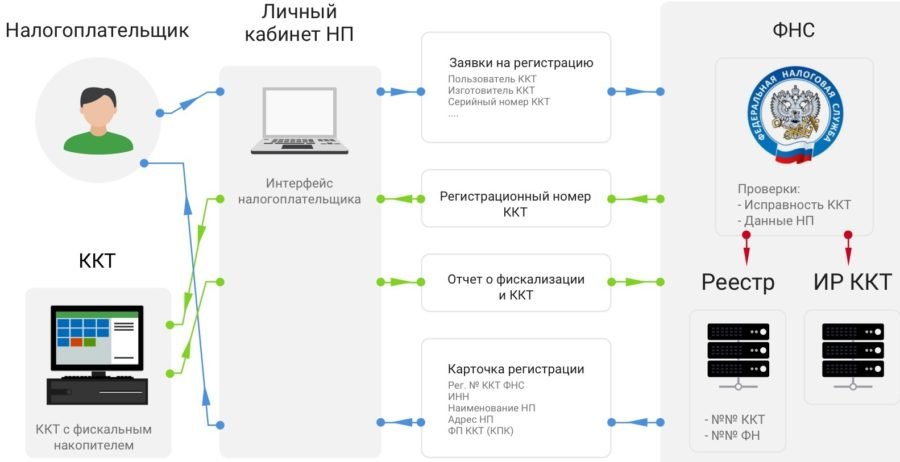

After a suitable cash register and a fiscal drive for it have been purchased, and an agreement has been signed with a fiscal operator, you can proceed directly to work with your personal account on the website of the Federal Tax Service in order to register an online cash desk.

Step 1. Fill out and send the application

- Log in to your personal account using your username and password.

- Select the tab "Accounting for cash registers" in the horizontal menu.

- On the new page, find the "Register CCP" button. The list of available actions can be expanded.

- Select the line "Fill in the application parameters manually" and enter the following data on the page:

- the address where the cash register is located (region, district, city, house, apartment or office number);

- name of the location of the cash register (this field is optional, you can write "shop", "office", etc.);

- serial number (look on the case);

- model (can be found in the documentation attached to the CCP in the package);

- serial number of the fiscal drive (look in the instructions for the fiscal drive);

- name of the model of the fiscal drive;

- the name of the OFD with which you have concluded an agreement;

- TIN of the organization providing fiscal operator services;

- number of the agreement with OFD;

- the date of signing the agreement with OFD.

Important! Some information can not be entered manually, but can be selected from the drop-down list (there is an inverted triangle icon on the line).

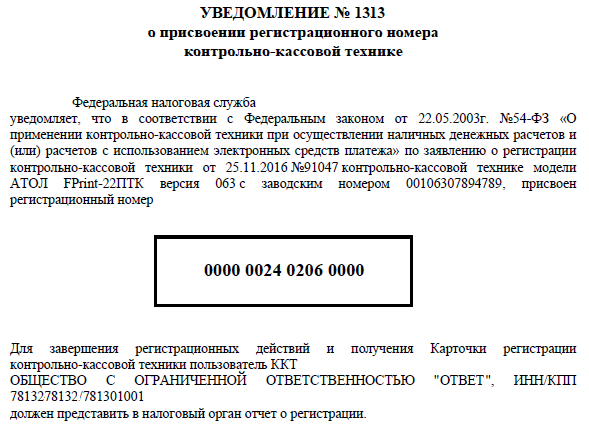

A window should appear on the page notifying you that the request has been accepted.

After that, during the working day (and more often in 1-2 hours), a document with the registration number of the CCP model and the status "Assigned CCP registration number" will appear in your personal account. This information can be viewed in the accounting tab of cash registers.

Step 2. Registering the fiscal drive

- Connect the cash register to the computer and press the power button on the machine itself.

- The computer will automatically detect a new connected device (if not, you will have to look for a connection through the settings).

- Run the fiscalization utility on your computer. This is a program that is usually provided by the manufacturer of the FN as part of the software. You can work through 1C-enterprise.

- Select the "Register" line.

- Enter the required data in the window that opens:

- CCP registration number that you just received from the tax office;

- the name of your individual entrepreneur or organization;

- address of the place of installation of cash registers;

- applicable taxation regime (check the box next to the relevant item). You can select multiple options when combining multiple modes;

- data of the fiscal operator with whom you cooperate.

Important! The menu for different programs is different, so when filling in the data, follow the instructions on the computer.

This completes the registration of the fiscal drive.

Step 3. We receive a CCP registration card

To complete registration and receive a CCP registration card, you will need information from the printed check in the “CCP Registration Report”.

Sequencing:

- Open your personal account on the website of the Federal Tax Service.

- Go to the "Accounting for cash registers" tab.

- Open the CCP registration number that you recently received.

- Select "Complete Registration".

- A new window will open, in which information from the first fiscal receipt is transferred. The following parameters are specified:

- date in the format хх.хх.ххх and per second time of receipt of the fiscal attribute;

- the number of the printed account receipt;

- fiscal sign.

After the completion of the procedure, the tax office within 5 days sends a CCP registration card with an electronic signature of an official, which gives the right to use the online cash register legally. It is already registered with the FTS.

You can view the card in the documents in the taxpayer's personal account. It is stored in PDF format. Print it out on paper if necessary.

In the future, this document will record the changes made when changing the fiscal accumulator after the expiration of the term, when reselling cash registers to another owner, when the company changes its legal address, etc.

Step 4. Registration of the cash desk in the OFD

The issuance of a CCP card means that the device is registered, but the cashier cannot yet carry out financial calculations with its help. The work of the online cash register is provided through an intermediary - OFD, which must send encrypted information to the Federal Tax Service. Therefore, at the end of the procedure, it is tied to a personal account on the OFD website:

- Open a personal account with a fiscal operator.

- In the "KKT" tab, select the "Connect KKT" item.

- A new window for registering the CCP will open. You need to enter the following information:

- registration number of the CCP;

- serial number (look on the body of the device);

- KKM model (choose from the available list);

- serial number of the fiscal drive;

- internal name of the cash register (come up with an arbitrary name).

Now the device is ready to work with customers.

How to register an online cash desk at the IFTS branch

If registering an online cash register via the Internet seems difficult, or you do not want to do this for other personal reasons (for example, there is no electronic signature), you can register the device through the IFTS branch. Moreover, according to the current legislation, you can apply to any tax office (previously this was done only in the subdivision at the place of registration of an individual entrepreneur or doing business). In this case, you will have to act the old fashioned way: collect documents and visit the IFTS 2-3 times. But before visiting the tax office, buy a cash register and sign an agreement with OFD.

The algorithm of actions will be as follows:

- Fill out an application on the prescribed form.

- Come to the tax office and hand it over to the operator along with other documents.

- You are assigned a date to bring the cash register for verification and fiscalization.

- At the end of the procedure, a CCP registration card is issued.

Important! According to the law, the term for registering a CCP is no more than 5 days from the date of application.

After receiving the card, do not forget to independently link the online cash register to your personal account in the OFD.

Documents for registering an online cash register

Regardless of whether you register via the Internet or at the IFTS branch, you will need to indicate the information contained in various documents. When registering on your own, you transfer information from documents to a computer, when contacting the IFTS, you submit them along with an application on a paper form.

The list of documents that will be needed to register an online cash desk with the tax service:

- Identification document (passport).

- Certificate of state registration of individual entrepreneur or legal entity.

- Individual taxpayer number (TIN).

- Agreement with the operator of fiscal data.

- Passport of cash register equipment.

- Documentation for the fiscal drive.

- Print, if any.

- Power of attorney for a third party, if necessary.

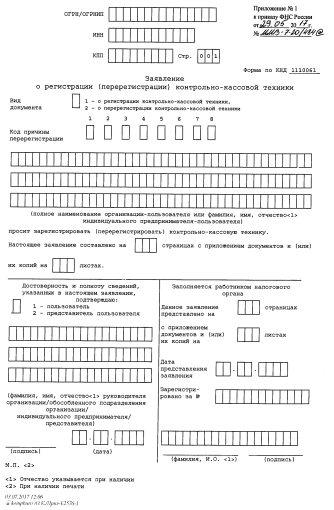

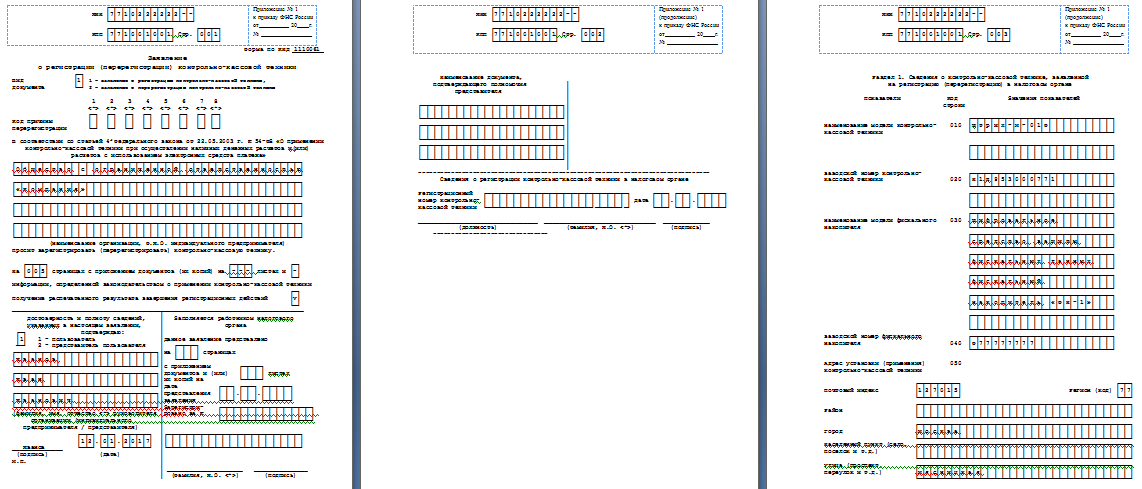

Sample application for online registration

The form of the application form is legally approved by the services of the Federal Tax Service. To fill out, you need a form in the form KND-1110061 (this is a new sample form).

The application must contain information regarding:

- Applicant's details.

- Locations of the online checkout.

- Characteristics of CCP and fiscal drive.

If you have any problems filling out the application, you can see a sample of filling out the form below.

Conclusion

The ability to remotely register a cash register is a great solution to save time. The procedure is free for the user. But the method is only suitable for people who are versed in computer programs or who have an assistant with the relevant knowledge at hand. If you wish, you can understand the procedure according to the above instructions. But, if you are not confident in your own abilities and are afraid to make a mistake, another option will be convenient for you - registering an online cash desk during a personal visit to the IFTS. In this case, you will have to spend time visiting the branch several times, but the procedure will be carried out without errors under the control of the tax authorities.

How to issue a power of attorney to represent the interests of an LLC to an individual?

How to apply for an IP: step by step instructions

Form of power of attorney to receive goods or material assets

The deadline for registering an individual entrepreneur in the tax

Business plan for a law firm: an example with calculations legal support for a business