Starting this year, companies and other business entities must use special equipment when accepting cash for the sale of goods, services, and works. The legislation defines a list of entities that must use these devices, as well as how to register an online cash register. This event is important, since violation of the established algorithm will not allow registering a cash register.

This technique has been available since 2016. According to the established rules, from February 1, 2017, all new devices that are registered must be online cash registers.

You can't even just change the ECLZ. Therefore, organizations that have expired must deregister the old cash register and buy and use a new one with an online function.

At present, organizations using OSNO or USN must have such control equipment, that is, companies that take into account the actual income received.

For firms and individual entrepreneurs that are on UTII or have bought a patent under PSN, the use of such cash registers will become mandatory only from July 1, 2018.

Since March 31, 2017, new amendments have introduced the obligation of merchants of alcoholic products to use cash desks with online transmitters when selling this product. It does not matter which tax regime they use. This means that, in this case, online cash desks should be with business entities using the preferential UTII and PSN systems.

What do you need to register an online cash register?

First of all, in order to register an online cash register, you need to select and purchase the device itself directly. Existing online cash desks that can be used are available for viewing on the website of the Federal Tax Service.

Making a choice, a business entity should be based on the capabilities of the cash register, as well as the number of goods or services in its nomenclature. In addition, there are special devices for online stores that do not print a paper purchase receipt.

This technique must transmit information to the Internet, so you also need to decide how this connection will be carried out.

Most tax authorities insist that online cash registers be registered through the payer's personal account on the website of the Federal Tax Service. Therefore, a business entity may require a qualified EDS. It can be obtained from a specialized operator. This will take several days.

Attention! To use the computer, there must be a specialized CryptoPro encryption program. A license for it will also need to be purchased and installed on a computer. The machine must also have an up-to-date version of Internet Explorer.

How to register an online cash register - step by step instructions

The Federal Tax Service requires that the registration of an online cash register be carried out only in electronic form through a personal account. This procedure is carried out for an additional fee by service centers or dealers selling cash registers. But you can register yourself.

Registration on the site of the operator of fiscal data

Before you start registering an online cash register, you must select an OFD company that will send checks to the tax office. The OFD must be accredited by the tax service, i.e., have the right to process the clients' FD. The website of the tax service has a registry that contains a list of all such companies.

Attention! You can download the register of operators on the tax website at the link www.nalog.ru/rn77/related_activities/registries/fiscaloperators/ . As of April 2017, there are five operators on the register.

The registration process is essentially the same. However, the personal account of each operator can provide different functionality and access to data. If there is such an opportunity, then before registering, it is better to test the account of each OFD in demo mode and choose the one that you like best.

When registering in the OFD personal account, you must specify the name of the company, TIN and OGRN codes, full name. and telephone number of the contact person. Sometimes during registration it is necessary to provide access to the digital signature, from which the site receives all the necessary information.

Conclusion of an agreement with OFD

After registering the cash desk, you need to draw up an agreement with the OFD. To do this, you need to find a button or item in the "Conclude an agreement" menu.

The main information will be downloaded from the EDS - the name of the company, its TIN and OGRN, full name. director. In addition, some data will have to be entered manually. In particular, it will be necessary to indicate on the basis of which document the head is acting, enter the legal and postal addresses. The latter is especially important, since it will later be used to send copies of documents in paper form - contracts, acts of work performed, etc.

Attention! After entering all the information, the contract can be sent by the system for verification to OFD specialists, and only after that it will be offered to sign it, or the action is performed immediately. The contract can be endorsed only with the help of a qualified electronic signature.

Get access to the personal account of the OFD

After signing the contract with OFD, you can go to your personal account. Currently, it is still empty - the data will appear only after connecting the cash register and working to nothing.

As a rule, the OFD personal account provides access to the following information:

- Information about punched checks, while each document can see its contents, and even download;

- Reports on the opening and closing of shifts;

- List of registered cash registers;

- Various kinds of reports - by the number of broken checks, average amounts for a period of time, etc.;

- Employees who have the right to access the OFD personal account;

- Document flow between the user and OFD - contracts, invoices, acts of work performed, etc.

Attention! The list of functions that are available from your personal account may vary for different OFDs.

Registration on the site tax ru.

In order for the online cash register to be registered with the Federal Tax Service, it is necessary to gain access to your personal account on the website of the Federal Tax Service. This is done using a qualified electronic signature.  If your personal account on the nalog.ru website is not yet open, you must first do this. For each type of taxpayer - companies and entrepreneurs, there is a personal account, a link to the entrance to which is located on the main page of the tax portal.

If your personal account on the nalog.ru website is not yet open, you must first do this. For each type of taxpayer - companies and entrepreneurs, there is a personal account, a link to the entrance to which is located on the main page of the tax portal.

After entering your personal account, you need to go to the section "Cash equipment", where you need to click on the button "Register CCP".

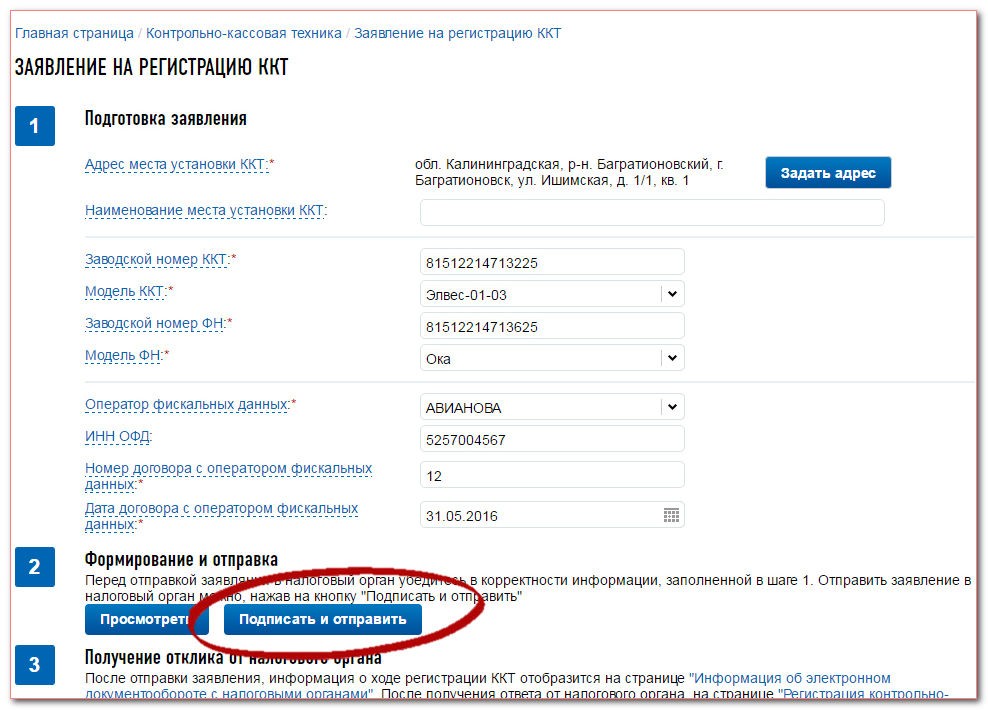

The window that appears contains the following information:

- The full address at which the cash register will be used - most of the information (names of the city, district, street, etc. are selected from directories);

- Name of the place of use - in any form, the name of the store or territory where the device will be located (for example, “Grocery store”, or “Cashier room”);

- KKT model and its serial number - is selected from the directory. If there is no required item in the window that opens, then the search is performed with an error, or this model is not included in the register of devices approved for use;

- Fiscal drive model and number;

- A special installation mode of the device - for example, an online store or a peddling trade. If the cash register is simply used in an ordinary store, nothing needs to be put;

- Selected OFD - is selected from the list, which includes only accredited OFDs. The site will substitute the TIN itself.

After that, all the information is checked again, after which the "Sign and send" button is pressed. In a response letter from the tax office, a notification is received about the registration of the device, which contains a registration number. It must be used when connecting the cash register in the OFD personal account.

Attention! The received number must also be entered into the cash register, after which it will print a special receipt with fiscal data. Next, in the personal account of the Federal Tax Service, click the "Complete Registration" button, and in the window that appears, indicate the information from the printed receipt - the exact date and time, the number of the fiscal document (FD line) and the fiscal sign (FN line). After that, the box office is ready to go.

Registering a cash register with OFD

In order to connect a cash register in the OFD personal account, you need to go into it and click the "Add CRE" or "Register CRE" button. This must be done only after the online cash register has been registered in the taxpayer's personal account, and the authority has assigned a number to it.

In the window that opens, you need to enter certain data:

- Registration number of the cash desk assigned to it by the tax office;

- Factory number of the cash desk from the passport or other documentation;

- The name of the cash desk model (from the passport);

- The number of the fiscal drive assigned to it at the factory (from the FN passport).

Some OFDs also offer to use some additional functions during registration. For example, they can remind you that the service life of the cash register is ending, or it has not been used for a long time. Often, for convenience, you can specify the short name of the cash register, under which it will be displayed in reports.

If, for example, a company has several outlets, and each has an online checkout, they can be named according to their location (the name of the store, the name of the street where it is located, etc.).

Attention! After registering the cash desk, you need to create an invoice for payment of the selected tariff plan. After the funds are credited, the device will be activated and it can be used to punch checks. After the paid period of time, the procedure for creating and paying an invoice will need to be repeated.

How to register an online cash register - a video with an example of registration

Do I need to keep a cashier-operator journal for online cash registers?

According to the old law on the use of cash registers, each company that uses the cash register was required to keep a cashier-operator journal and use other mandatory forms.

However, if the internal documents of the organization establish the obligation to maintain this register, the company or entrepreneur can use it at their own request.

Important! Only the forms established by the new law are mandatory for use. These include, for example, reports on the opening and closing of a shift, a statement of the status of settlements, etc.

How to issue a power of attorney to represent the interests of an LLC to an individual?

How to apply for an IP: step by step instructions

Form of power of attorney to receive goods or material assets

The deadline for registering an individual entrepreneur in the tax

Business plan for a law firm: an example with calculations legal support for a business