To deregister a UTII payer, an entrepreneur must submit a tax application in the form of UTII-4, which is approved by order of the Federal Tax Service No. ММВ-7-06/941 dated 12/11/2012. Consider the order of filling out the form and at the end you can download it in the format you need. You can read more about the deregistration procedure by clicking on the link. Organizations use

The TIN of the entrepreneur is indicated at the top of the sheet, below it is necessary to enter the code of the tax authority in which the payer is registered, consists of 4 digits. You can find it in the registration documents or find out with the help of the tax service, for this, follow the link.

Then indicate the reason why you deregister the entrepreneur as a UTII taxpayer, put the number:

- "1", in case of termination of activity.

- "2" if you switch to another tax regime.

- "3" if, according to the permissive conditions for the application of the tax system, you can no longer apply it, for example, you have exceeded the allowable staff.

- "4" if you close certain types of activities for which the tax regime was applied.

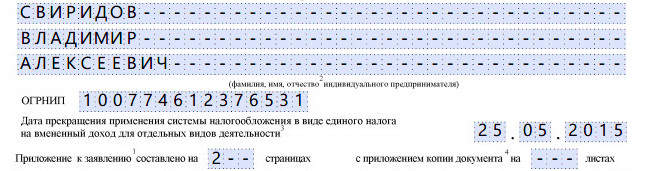

Below we enter the full last name, then the first name and patronymic, from each new line. Empty cells are filled with dashes, as in the example. Next, we enter the OGRNIP, as in the registration documents.

It is necessary to indicate the date of termination of activities falling under the single tax.

[important] You must submit this application within 5 days after the termination of the imputation activity [/important]

Indicate how many pages the application contains, if one, then put “1—“, as well as the number of attached sheets, if there are none, then put a dash.

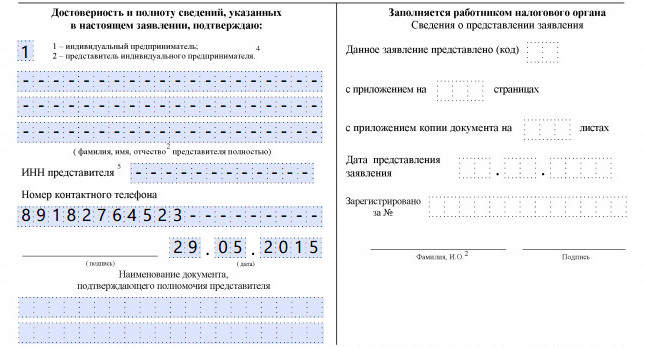

If the entrepreneur himself certifies the form, then put in the field “1” and put a dash in the fields with the full name, put a dash in the TIN field, indicate the contact phone number for communication, put the date of approval and signature below.

If filled out by a representative, it is necessary to enter his full name, indicate his TIN, contact number, sign and date. Below indicate the details of the power of attorney on the basis of which it acts, and a copy of the document must be attached to the application.

Filling out page 2

The page is filled in in the event that the entrepreneur deregisters a certain type of activity that falls under UTII.

How to issue a power of attorney to represent the interests of an LLC to an individual?

How to apply for an IP: step by step instructions

Form of power of attorney to receive goods or material assets

The deadline for registering an individual entrepreneur in the tax

Business plan for a law firm: an example with calculations legal support for a business