If an employee of an enterprise is injured at work, he can count on payment of monetary compensation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

But what kind of funds is he entitled to, in what amounts and in what cases? And did the rules that were in force previously remain relevant in 2019?

In some workplaces, there is always a risk of injury, while in others, an accident is an exception, an accident that puts everyone under stress.

The basic rules for assigning such payments, terms and amounts are specified in the regulatory documentation.

But not every one of them knows, remembers, or wants to comply. Let's figure out when a person will receive a lump sum and find out what permanent payments mean.

Required information

First, let’s find out whether all injuries received within the walls (on the territory) of the company can be classified as industrial. What nuances should be taken into account when investigating an incident?

What it is?

An industrial injury is considered to be damage sustained by an employee at an enterprise. But a prerequisite is that the injury must be sustained as a result of exposure to hazardous production factors.

The consequence of such an injury may be:

- the need arises to transfer an employee to another job;

- temporary or permanent loss (disability) of ability to work;

- human death.

An injury received when a person gets to the place of work, as well as while in the workplace, is also considered an industrial injury.

If an individual receives an injury during lunch break, then it is worth presenting certain evidence in order for it to be recognized as a work-related injury.

To do this, it is checked what hours the company allocates for breaks in accordance with the charter, what the employee was doing at that time, and where he was.

If a wound or injury is received by a citizen on the territory of the organization during non-working hours, it will be considered industrial if the employee fulfilled his obligations in accordance with.

Accidents that occurred due to the fault of a company employee are not considered industrial accidents.

- an employee who fulfills his obligations under an employment contract;

- the person who entered into a civil law agreement with the employer (insurance must be mandatory);

- the person who works by;

- students in practice in the organization;

- an individual who performs work on a voluntary basis.

Documenting

The employer must draw up documents established by law and take certain measures in the event of an accident.

After all, such situations influence the increase in tariffs for insurance premiums for compulsory accidents and occupational diseases.

Payment of compensation for a work injury is subject to certain conditions being met.

The procedure for the management of the organization will be as follows:

| Immediately after an accident, an employee should notify company management about the incident. | The administration must arrange for a staff member to be transported to the emergency room. Measures are being taken to prevent emergency situations |

| Next, a document is drawn up that will confirm that the injury was received during the performance of official duties. | Such a certificate reflects the severity of the injury and its nature. The scene of the incident should be filmed or fenced off to preserve the situation for the investigation. |

| The injured person receives a certificate | Which states the diagnosis established by medical professionals |

| Specialist responsible for occupational safety and health at work | Must notify the FSS of the incident |

| A special commission is being assembled | Which will study the accident. It should consist of 3 people. If death occurs, the prosecutor is involved |

| A report is drawn up after the inspection is completed | Namely, it is on the basis of such a document that compensation transfers will be made |

The company must notify the victim's relatives about the incident. Forms of documents that must be drawn up:

Normative base

The definition of work injury is discussed in Art. 3 of the normative act of the Russian Federation dated July 24, 1998 No. 125-FZ.

The procedure for action by the company's management in case of accidents is discussed in Art. 228 – 231 of the Labor Code of the Russian Federation.

The documentation that is drawn up after the inspection is approved by officials on April 15, 2005 No. 275.

List of payments and compensation for industrial injuries

There are several types of payments that are made to the injured person. Let's take a closer look at them.

For temporary disability

If an insured event occurs, an insurance payment will be assigned, which is made from funds paid for insurance against accidents and occupational diseases.

Such amounts are paid by the employer and are counted towards the transfer of insurance premiums.

According to Art. 9 adopted by Russian legislators, benefits are transferred for the entire time the employee is on sick leave until he recovers and regains his ability to work.

The payment amount is 100 percent of a person’s average salary. When calculating the average, annual earnings will be taken into account. The amount of compensation payment is not affected by the employee’s length of service.

The basis for making accruals is a certificate of incapacity for work. If a person was under the influence of alcohol or drugs at the time of injury, the amount of benefits may be significantly reduced.

Insurance payments

Compensation paid to the victim is not subject to taxation with insurance premiums. This is discussed in.

Company employees who are injured at work can count on the following type of compensation:

- one-time;

- monthly.

Additional costs may also be paid when a citizen undergoes rehabilitation.

One-time

A one-time payment is established according to the degree of disability of a person, based on the limit established by legislative acts in the Social Insurance Fund of the Russian Federation.

The result of the medical and sanitary examination, the rules for which are established, is taken into account.

How much is the lump sum payment for a work injury? A one-time payment in 2019 is paid in the amount of RUB 80,534.8.

Monthly

Monthly compensation is paid continuously until the ability to work is restored.

The amount of the monthly benefit in connection with an injury in production conditions is determined taking into account the average monthly salary of the employee, that is, it is equal to it.

If a person cannot restore his ability to work, then compensation will be paid to him throughout his life.

The maximum transfers are established by federal legislation on the Fund’s budget (clause 12 of Article 12 of Law No. 125-FZ). The monthly benefit is indexed every year. The amount of such compensation in 2019 is 61,920 rubles.

Payment of additional expenses

Additional costs incurred for medical, social, and professional rehabilitation of the injured employee include:

- provision of medical care after a work injury;

- purchase of medicines;

- purchasing special means to care for the injured;

- provision of equipment and necessary transport.

The rules for paying such expenses are specified in. All costs are paid by the insurer.

An exceptional situation is payment for additional vacations, travel to and from a medical facility, and costs of treatment in the event of a serious injury.

Such payments must be made by the company, which can then reimburse all amounts spent from the Fund.

Compensation for moral damage

There are situations when victims can apply to the court to receive compensation payments for moral damage caused, if there is not only physical, but also moral suffering.

Often such a document is drawn up if the management of the enterprise does not want to fulfill its obligations to pay compensation. The amount of payments is determined by the court.

Required conditions for accrual

Rights to compensation for work-related injuries arise if the relationship between the employee and the employer is based on an employment contract.

Additional benefits are also paid to those persons who are part-time workers and perform not only their main job, but also other instructions from management.

In this case, the payment will be calculated on the basis of earnings for all places. As mentioned above, compensation is awarded only if the injury is determined to be work-related.

And this fact is established by the commission. It will not be possible to receive compensation unless documents are submitted that confirm the presence of injury, injury, or illness.

Required package of documents

To receive payments, you need to prepare a number of certificates:

- , which is submitted by the victim himself or the person who represents his interests.

- , which will be issued by the commission after conducting an investigation based on.

- Conclusion of a medical examination.

- Work book (its copy), employment contract.

To confirm the costs of treatment, it is worth keeping all receipts.

When should payments be made?

The application of the injured employee is considered within 10 days by a representative of the Social Insurance Fund.

After this period, a decision will be made whether to satisfy the applicant’s demands or deny them.

When a decision is made, the terms of the transfer are approved. A one-time payment is made immediately after the decision is made by an employee of the authorized body.

In the event of a fatal accident, compensation will be given to the relatives of the deceased employee. All other transfers from the Social Insurance Fund are made within 30 days after the decision is made.

Sizing definitions (calculation example)

The amount of compensation will depend on the severity of the injury. It also takes into account how much is spent on treatment and rehabilitation.

The payment amount is determined as follows:

Let us also consider the features of taxation of compensation. Such amounts are not subject to personal income tax, as stated in paragraph 3 of Art. 217 Tax Code of Russia.

Neither the amount provided for treatment to an employee nor the amount paid for treatment is taxed.

The amount of temporary disability benefits is not affected by the employee’s length of service. It is 100% of the average salary.

The calculation rules are specified in (part 1 of Article 14). Let's look at an example of calculating payment using an example.

Company employee V.V. Ivanov was injured at the production site of the enterprise, which is why he did not work from March 24 to March 28, 2008.

The average salary per day is 2123 rubles. On sick leave, Ivanov was paid the amount of 10,615 (2123 / 5 days).

If the injury had not occurred on the job, the calculation would have been different. For example, Ivanov has 6 years of work experience, which means that he has the right to receive only 80% of his earnings.

The maximum benefit amount in 2008 was 17,250 rubles. The payout would be:

But there is a limit beyond which a person cannot receive (the amount that Ivanov will receive):

Let's look at another example. Stepanov S.A., while fulfilling his obligations under the employment contract, received an injury recognized as an industrial injury.

He was on sick leave from February 4 to February 8, 2008. After this time, the regional Social Insurance Fund sent him to sanatorium-resort treatment, which lasted 12 days (until February 20, 2008).

Video: after taking a vacation in advance, an employee quits - how to keep overpaid vacation pay

For this period, the employee received annual paid leave (in excess of the norm). The court also decided to pay compensation for moral damage in the amount of 5 thousand rubles.

In 2007, Stepanov took a vacation, which lasted from October 1 to October 28. His salary is 20 thousand and has not changed in the last 12 months.

The billing period is considered to be the last 12 months, which is the period from 02/1/2007 to 01/31/2008. It is worth excluding vacation days and the amount accrued during your stay.

Stepanov worked from October 29 to October 31, 2007, and during these days he received:

Earnings in the billing period:

The period itself taken for calculation contains 337 days (365 – 28). Benefit amount per day:

For the entire period during which the loss of ability to work occurred, the person will receive:

FAQ

There are some features, knowing which, you can solve a number of issues regarding payments after receiving a work injury. Let's look at the main ones.

For minor work injury

If you receive a mild occupational injury, the commission draws up a report within 3 days (if severe, within 15). If the commission representatives did not meet the deadlines, the inspection may be extended by 15 days.

Let's make a reservation that the degree of severity should be determined in accordance with the requirements.

A minor injury is considered to be a concussion, simple fractures, sprained muscle tissue, etc.

Where to complain about a small payment

A case of recourse payments for work-related injuries can be heard in a court of general jurisdiction (Russia).

Issues regarding payment for material damage are considered by the district court. The injured person can send a statement of claim to the regional branch of the judicial authority at the place of registration of the company or the Social Insurance Fund (the person responsible for the payment).

It is also possible to file a claim at your place of residence or at the place where the injury occurred (,).

This rule protects the interests of those persons who have lost the ability to move. Affected citizens do not have to pay state duty ().

05/23/2019, Sashka Bukashka

A work injury is a loss of ability to work due to an accident that occurs while working. What should an employee and an employer do if an employee is injured while performing his or her job duties? What compensation is available for an injury at work? We will examine these and other questions in the article.

What injury is considered work-related?

Harm caused to a citizen's health as a result of an accident at his place of work, which resulted in a temporary or permanent loss of his ability to continue working or, in the most severe cases, even led to his death, is called an industrial injury.

That is, we are talking about accidents if they led to damage to health, injury and if they occurred while the employee was performing his official duties:

- Time to prepare work equipment (tools, clothing, etc.).

- Time to put your work equipment in order after your shift.

- Performing any other actions before or after the work shift that are described in the employment contract and provided for by the employer.

- Periods.

- Work on weekends and holidays.

- On the way to work or back. This can be travel by official or personal transport, but if by personal transport, then the use of personal transport must be specified in the employment contract and agreed with management.

- The injury was sustained on the way to a business trip and back.

- During business trips on work matters, it does not matter - by public transport or by company car.

- On the way to the place of fulfillment of the work assignment given by the supervisor, and walking also counts.

- During inter-shift rest.

- During the inter-shift rest of the shift driver, conductor, mail car crew member, etc.

- The injury occurred in other cases when the employee performed actions on the orders of his superiors. For example, when working after accidents or natural disasters, disasters or accidents that need to be prevented or the consequences of which need to be eliminated. But this must be enshrined in the employment contract.

If the injury was received on the way to or from work outside of the working day and not on a work vehicle, then such an injury is not considered work-related.

There are situations where an injury occurs due to an accident that has nothing to do with the work or job duties or tasks. Such an injury will not be recognized as a work-related injury and you should not expect payment for it. It could be:

- death as a result of some general illness or suicide, which is confirmed by doctors, investigative authorities or the court;

- death, illness or injury as a result of alcohol, drugs or other toxic intoxication (poisoning), which is not associated with violations of the technological process. This must also be confirmed by doctors;

- the injury was sustained as a result of an accident that occurred while the victim was committing a criminal offense.

Example

The janitor was intoxicated in the yard and was injured.

He was cleaning the yard with a shovel and broom, and an icicle fell on his head, breaking his head. This is a work-related injury, for which the drunken janitor will be entitled to compensation according to the law. Why? Because the injury was caused precisely by the falling icicle and did not depend on the degree of intoxication of the worker. If the janitor had cleared the snow sober, this icicle would still have fallen and hurt him. So the presence or absence of alcohol in the employee’s body at the time of work does not matter in the context of labor law. Although, of course, this is not very good for health.

But if, while cleaning the yard, the same drunk janitor could not stay on his feet and broke his arm in a fall, then the main factor here will be his alcohol intoxication, and the injury will be considered domestic.

Who determines what kind of injury it is - work-related or not? This is the task of the commission to investigate every accident at work. Organizing such an investigation is the direct responsibility of the company's management.

During the investigation, the commission must take into account all existing circumstances that may be relevant in recognizing the accident as a domestic or industrial accident. As in the described example about the unlucky janitor: you need to determine both the person’s condition and the available facts about the icicle, the slippery yard, and so on. As a result of this work, an act is drawn up.

What to do if disagreements arise regarding the investigation, registration and recording of accidents? What if the injured employee does not agree with the commission's findings? If, as a result, a person died, and the members of his family who were left without payments are sure that it was a work-related injury and that the commission made the wrong conclusion, recognizing it as a domestic injury? In this case, you need to contact the State Labor Inspectorate (SIT) and appeal the results of the investigation. GIT specialists must conduct an examination and make a final conclusion.

If the State Inspectorate’s conclusion about a work-related injury does not satisfy the injured party, then all that remains is to go to court.

Work injury. Payments and compensations 2019

fracture, a bruise or other health injury received while performing work or on the way to work may or may not be recognized as a work-related injury.

If they are work-related injuries, as stated in a report, then the employee will have the right to:

- for sick pay;

- for insurance payments - one-time and monthly compensations;

- to pay for their expenses for treatment and rehabilitation (both medical, social and professional).

All these payments are made by the Federal Social Insurance Fund of the Russian Federation, except for sick leave, which is paid by the employer.

How is sick leave paid for a work injury?

Compensation and sick leave for work-related injuries are paid by the employer and subject to the following conditions:

- 100% of the victim’s average earnings are always paid for the entire period of sick leave until recovery or complete loss of professional ability to work is established (Article 9 of Law No. 125-FZ);

- sick leave is paid in full for all places of work of a person, regardless of where the accident occurred (Letter of the Ministry of Health and Social Development of Russia dated April 24, 2007 No. 3311-LG) - this is relevant, for example, for part-time workers;

- The maximum amount of sick pay per month is established in clause 2 of Art. 9 of Law No. 125-FZ. It changes every year and is indexed in accordance with the rules laid down in the law. In 2017, the maximum compensation was 72,290.4 rubles, in 2018 - 75,182 rubles. In 2019, the amount of monthly compensation from the Social Insurance Fund is 78,189.3 rubles.

One-time and monthly compensations are assigned and paid from the budget of the Social Insurance Fund of the Russian Federation to the employee if, according to the conclusion of a medical examination, the injury resulted in the loss of a professional. ability to work, that is, the person can no longer work under the same conditions.

What additional expenses can be paid to the injured person? We are talking about paying for rehabilitation treatment after a work injury. Such treatment must be prescribed by a doctor. This payment is also made by the FSS.

What should an employee do to receive benefits and payments?

In the event of a work-related injury, the first thing you need to do is bring sick leave to your employer and wait for payment on it.

The employer assigns benefits within 10 calendar days from the date of provision of the certificate of incapacity for work. The employee must receive compensation on the day of salary payment at the enterprise, which will be the closest after the benefits are assigned. That is, if salaries are paid on the 10th and 25th of each month, and sick leave is received on the 18th, then payment for it should occur on the 25th.

If the employer does not comply with the specified deadlines, it is worth filing a complaint with the State Tax Inspectorate or immediately filing a claim for recovery of unpaid amounts in court.

The following documents must be attached to the application requesting payments:

- report of an industrial accident;

- medical examination report;

- a copy of either the employment contract;

- certificate of average earnings.

The decision is made within 10 calendar days. Compensation payment terms:

- one-time compensation - no later than a calendar month from the date of their appointment;

- monthly compensation - in the month for which they are accrued, no later.

If, according to the conclusion of the ITU institution, a person required medical, social and professional rehabilitation after an industrial injury, then he can apply to the Federal Social Insurance Fund of the Russian Federation for compensation for such expenses: submit an application and attach documents confirming the expenses.

The decision on payments will also be made within 10 days, in accordance with the rehabilitation program for the accident victim drawn up by the doctor.

Rehabilitation payments are made by postal order at the place of residence or by transfer to the bank account specified in the application. The employee has the right to choose the method of receiving payments himself. The period is no later than 20 calendar days from the date of adoption of the corresponding decision by the Federal Social Insurance Fund of the Russian Federation, and for certain expenses - monthly (expenses for outside care) or quarterly (routine repair of a vehicle).

Responsibilities of the employer in the event of an accident at work

If an accident occurs and an employee is injured, the employer must:

- Provide assistance to the victim. To provide first aid to victims, each organization must have a first aid kit equipped with everything necessary (the requirements for the first aid kit are approved by Order of the Ministry of Health and Social Development of Russia dated March 5, 2011 No. 169n). If the injury allows, the employee must be taken to a medical facility. There, the injury should be characterized as mild or severe. This determines which authorities the employer must report the accident to, which commission and within what time frame to organize an investigation.

- Take measures to prevent an accident. It is necessary to notify other workers about a possible accident and its consequences. It is necessary to remove all workers to a safe distance and, if possible, neutralize the source of danger. After which you need to enter a high alert or emergency mode.

- Preserve the situation at the scene of the accident or otherwise record it. If there is a danger of an accident, draw up a map of the accident site, photograph or video the place where the work injury occurred.

- Report the incident to the regulatory authorities, as well as to the relatives of the injured employee.

- Organize an investigation.

In addition, the employer must prepare documents for Social Insurance:

- medical report of injuries;

- protocol of the commission's investigation;

- reports on payment of contributions for the employee;

- a certificate of income of the victim;

- certificate of payment of benefits.

Documents must be drawn up in accordance with legal requirements.

Compensation for moral damage

If an employee who has suffered a work injury wants to receive compensation for moral damages, he must go to court. When drawing up an application, it is necessary to indicate the grounds for payment of such compensation and make calculations that would show the appropriateness of the demand. But even with apparent grounds for compensation for moral damage, one must adhere to the principle of reasonableness and fairness.

Employer's liability in case of an accident at work

If an incident occurs at an enterprise as a result of which an employee is injured, an investigation commission is created. As a result of the investigation into the causes of the work injury, the degree of guilt and responsibility of each party is determined.

There are several types of employer liability:

- material;

- disciplinary;

- criminal;

- administrative.

The material includes:

- payment of compensation to an employee for loss of ability to work;

- one-time payments;

- the employer may be required to pay moral damages.

An employer may be subject to disciplinary liability for failure to fulfill or improper performance of duties related to the organization of work activities (for example, refusal to insure employees, improperly equipped workplace).

For concealing an insured event, the manager is subject to a fine:

- for an individual - 300-500 rubles;

- official - 500-1000 rubles;

- legal entity - 5,000-10,000 rubles.

In case of violation of labor laws, fines increase:

- for an official - 1000-5000 rubles;

- for an employer who is not a legal entity - 1000-5000 rubles, suspension of activities for 3 months;

- legal entity - 30,000-50,000 rubles, suspension of activities for 3 months.

Criminal liability is the most severe. It can only apply to individuals. Criminal liability may be brought if a serious injury was sustained at work or if the accident caused the death of an employee.

Injuries are something that cannot be insured against. And anyone can have an accident at work. Therefore, you should prepare for such situations.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

It's fast and FOR FREE!

You need to know that injuries at work in the Russian Federation in 2019 are subject to insurance and compensation. But in this regard, there are many nuances that determine not only the size of the payment, but also its availability.

Main aspects

In the second instance, you can apply for disability benefits - full or partial. May be required.

How this manual works

The employer is responsible for:

These actions should be completed as soon as possible. Because it is required by both legislation and standard procedure.

All documents for such a case must be prepared in advance so that registration takes as little time as possible.

Time frame for investigation

There is a division of investigation periods. Thus, in the event of an incident with a minor injury, the legislation provides three for carrying out all organizational actions.

But if an employee was seriously injured or a death was recorded, then the investigation period increases to 15 days.

When the employer was notified of the incident also plays a role. If this did not happen on the same day, then he is given the opportunity to carry out all activities within a month from the date of receipt of information about the accident.

Required documents

The injured employee must provide the following package of documents:

- in the form of a copy;

- passport document;

- an injury at work is determined by its severity;

- receipts for medicines and medical services;

- act of recording an incident.

The employer submits the following documents to the Social Insurance Fund:

- statement of injury;

- investigation report;

- confirmation of payment of insurance contributions for the employee;

- average salary per employee;

- a certificate confirming the availability of payments for a work injury.

Algorithm for calculating damage caused

To do this, use a formula with the following indicators:

- maximum benefit amount;

- number of days of sick leave;

- days due to incapacity for work.

Who should compensate the victim?

It should be understood that if there are contributions to the Social Insurance Fund, all payments that are made for the injured person fall on this government organization.

This is a kind of insurance for both the employee and the company.

Payment amount

With the help of an injury at work and sick leave payment will be made with the transfer of the entire amount of wages for the employee for the period of his incapacity for work.

The maximum amounts are intended for those workers who received severe work injuries.

Last changes

It is necessary to understand that the state keeps records of payments for contributions in this area. Because this allows for the availability of compensation for many workers.

In this regard, control over the payment of contributions to the Social Insurance Fund in 2016 was transferred to the Tax Service of Russia.

Thanks to this, you can more reliably monitor all insurance premiums and their payment to employees.

Obtaining compensation for injuries at work is a complex procedure due to many bureaucratic issues.

Therefore, each employee should know in advance all legal norms and use them if necessary to protect their rights.

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

If an employee is injured at work, he is entitled to compensation payments. However, not every injury is recognized as work-related.

Such situations require the right approach and preparation of appropriate documents. Then payments for a work injury will be justified, the employee will receive funds for treatment and rehabilitation, and the employer will avoid unpleasant consequences.

What nuances in filing industrial injuries may cause difficulties in 2019? Let's figure it out.

Concept of work injury

Situations when an employee receives a work injury are strictly and clearly described by legislation in the field of labor relations.

- bodily injuries, including those caused by another person;

- heatstroke; burn; frostbite; drowning; electric shock, lightning, radiation;

- bites and other bodily injuries caused by animals and insects;

- damage due to explosions, accidents, destruction of buildings, structures and structures, natural disasters and other emergency circumstances;

- other health damage caused by external factors.

If they entail the need to transfer the victims to:

- another job;

- temporary or permanent loss of their ability to work;

- death of the victims.

Compensation for work-related injuries directly depends on the extent of the injury. Highlight:

- Serious injuries that threaten the life and health of the employee.

- Minor health damage.

Signs by which the severity of damage in an accident can be determined are:

- the nature of the injuries received and complications associated with them, as well as the development and aggravation of chronic diseases in connection with the injuries received;

- the consequence of the injuries received is permanent loss of ability to work.

- Damage to health, the acute period of which is accompanied by shock, coma, blood loss (more than 20%), embolism, acute failure of the functions of vital organs and systems;

- Health injuries qualified during the initial examination of the victim by doctors at a hospital, trauma center or other healthcare organizations as: penetrating wounds of the skull, brain contusion, body fractures, dislocations, abdominal wounds, chest injuries, rupture of internal organs, thermal and chemical burns, etc.

- injuries that do not directly threaten the life of the victim, but have serious consequences: loss of vision, hearing, speech, mental disorders, etc.

Occupational diseases are a chronic or acute disease of an insured employee, which is a consequence of exposure to a harmful production factor and resulted in temporary or permanent loss of professional ability or death. Harmful production factors can be considered:

A person who does not comply with safety regulations may lose most of the entitlement payments.

- chemical;

- biological;

- radiation;

- vibration and others.

Legislative regulation

In the Russian Federation, there is legislative regulation of the procedure for registering an injury, payment of compensation and the employer’s liability in case of failure to fulfill its obligations to employees.

State support for an employee in case of injury at work is regulated by the following standards:

- Article 184 of the Labor Code of the Russian Federation regulates the procedure for issuing monetary compensation by an employer to an employee who has received an industrial injury.

- Federal Law No. 255-F3 of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” establishes the amount of monetary compensation in case of an industrial injury.

- Federal Law No. 125-F3 of July 24, 1998 “On compulsory social insurance against industrial accidents and occupational diseases” prescribes that the following are subject to compulsory social insurance against industrial accidents and occupational diseases: individuals performing work on the basis an employment contract concluded with the policyholder and individuals sentenced to imprisonment and recruited to work by the policyholder.

At the same time, the main law in the Russian Federation is the Constitution of the Russian Federation, which guarantees safe working conditions for every working person.

Download and print for free

Do you need information on this issue? and our lawyers will contact you shortly.

Causes of industrial injuries

All cases of injury in the workplace are thoroughly investigated.

As a rule, the main reasons for this are:

Compliance with safety regulations at work is legally monitored by an authorized employee, but this does not relieve responsibility from the worker himself.

- negligent attitude of the employee to compliance with safety regulations;

- performing a job function or being at the workplace in a state of alcohol (drug) intoxication;

- unprofessional use of equipment and other equipment;

- admission of unqualified personnel to perform complex operations;

- lack of regular safety training.

Objects of relationship and place of incident

It is necessary to understand that in such a complex situation there are always two objects of relations at work. This is the employee and the administration of the enterprise (employer). Each of them is required to take all necessary steps to document the fact of their work injury in accordance with the law.

Failure of the parties to fulfill their obligations may lead to irreparable consequences entailing legal liability of the parties.

Subjects of the accident

There is some confusion regarding who is paid such compensation and who can claim it.

In accordance with labor legislation, workers injured at work include:

Partners also have the right to compensation for damages on a general basis in the event of injury.

- an officially employed employee performing his duties under an employment contract;

- employee and other persons receiving education in accordance with a student agreement;

- students undergoing practical training;

- persons suffering from mental disorders who participate in productive work at medical and industrial enterprises in the form of occupational therapy in accordance with medical recommendations;

- members of production cooperatives and members of peasant (farm) households who take personal labor participation in their activities;

- a citizen engaged in the production of public works under a court decision;

- a convicted person involved in industrial work;

- persons working on a voluntary basis.

Time and place of the accident

When conducting an investigation into an industrial accident, the most important factor is establishing the location and time of injury.

There is a list of places where a person can receive an industrial injury, in which he is compensated for the costs of treatment.

These include negative events that occurred:

- during working hours on the employer’s premises or in another place where work is performed (including during breaks, when putting production tools in order or when preparing for work);

- when traveling to or from work (both on personal and official transport. In this case, personal transport can be used for work purposes only by agreement with the employer);

- when traveling to and from the place of a business trip (regardless of how the employee went there - on foot, by public transport or by a company car);

- when traveling in a vehicle as a shift worker during a rest period between shifts;

- when working on a rotational basis during rest periods between shifts, as well as when being on the ship during free time from the watch and ship work;

- when carrying out other actions within the framework of labor relations, including actions aimed at preventing a disaster, accident or accident.

These cases also apply to persons involved in preventing an accident or emergency and eliminating their consequences.

If it is established that the culprit of the injury is the employee himself, then this is not considered an industrial accident. However, the work of a special commission in this situation is mandatory.

Sequence of actions when identifying (receiving) an injury

Witnesses will have to testify to members of the commission investigating the industrial accident. It is recommended that you remember exactly the circumstances of the incident.Algorithm of administration actions

When receiving messages about In any accident at work, the administration of the enterprise is obliged to:

- Immediately organize first aid for the victim, and, if necessary, transport him to a medical facility.

- Take measures to ensure the safety of other workers and to prevent the development of an emergency situation.

- Fence the scene of the incident to ensure its safety in the condition in which it was at the time of the incident (provided that this does not threaten the life and health of other people).

- Report an accident to:

- regional branch of the FSS;

- prosecutor's office

- If the injuries are severe, call the victim's relatives.

- If more than five people died, then the State Labor Inspectorate of the Russian Federation must be informed about such an industrial accident.

- Take other necessary measures to organize and ensure a proper and timely investigation of the accident.

- Issue an order to begin the work of the special commission. It must consist of at least three people. Namely:

- employer representative;

- representative of the elected body of a trade union organization;

- specialist in the field of labor protection (except for the employee directly responsible for this area of work).

The commission is headed by the employer or his representative.

If a part-time worker was injured, then his other employer must be informed.

Payment procedure

If an employee is injured at work, he or she may be entitled to the following compensation:

All money comes from the Social Insurance Fund. However, the management of the organization is obliged to pay them immediately as soon as the relevant documents are received.

- Payment. This payment is calculated from the average monthly earnings, including bonuses. It does not depend on the insurance period.

- Compensation for additional treatment. The amount depends on the extent of damage.

- Payment for health procedures, according to the doctor’s recommendations.

- One-time payment from the Social Insurance Fund.

- Monthly benefits from the Social Insurance Fund.

- Compensation for moral damage is determined by agreement of the parties or in court.

- Payment to relatives in the event of the death of an employee.

Mutual settlements

If the commission recognizes that the employee has suffered a work injury, then the employer is obliged to make charges for treatment (as stated above). That is, the employee receives payments from the company.

But according to current legislation, the FSS subsequently transfers these funds to the employer.

If the administration does not want to pay for sick leave or rehabilitation of the victim, citing a lack of funds, the employee has the right to appeal.

What amounts can a victim expect?

Treatment and recovery are expensive. The legislator has taken this into account.

A person injured at work has the right to receive the following amounts:

- Sick leave pay for the entire period of incapacity. Amount: 100% of average monthly earnings with all allowances.

- Compensation for additional procedures, purchase of medical supplies. Calculated on the basis of payment documents.

- One-time payment from the Social Insurance Fund. This amount is determined by a special formula that takes into account the maximum amount of compensation for damage of the corresponding severity level.

Namely:

- Sk. = MP/Day x dB, where:

- Sk. - amount of compensation;

- Mp. -maximum payment for the injury;

- Day - number of days of incapacity for work;

- db. - days of sick leave.

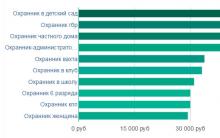

- This amount cannot exceed the threshold set by the government. The amount may increase depending on the coefficient existing in the region. In 2019, the amount of payments was:

- for a one-time payment - 94,018 rubles;

- for monthly compensation - RUB 72,290.40.

- Financial assistance from the enterprise, if it is stipulated by a collective agreement.

- Compensation for moral damage. It is accrued only by court decision or by agreement of the parties.

It is necessary to collect all payment documents and receipts during treatment. They must be provided for the corresponding payments to be calculated.

However, treatment costs do not include:

- payment for a trip to the hospital;

- additional vacations (at your own expense);

- funds spent on the treatment of injuries and illnesses received before or after the accident specified in the act.

Package of documents to the FSS

In order for both the employee and the company to receive all the money, it is necessary to collect all the relevant documents. They are provided as a package to the FSS.

The victim is required to:

- statement;

- a copy of the agreement with the employer;

- a fully completed sick leave certificate;

- passport or other identity document;

- report of an industrial accident;

- conclusion of the state labor inspector;

- work book or other document confirming the employment relationship with the employer;

- a court decision establishing the fact of an industrial accident;

- conclusion of a medical and social examination institution on the degree of loss of professional ability to work or the establishment of an occupational disease;

- salary certificate for the selected period;

- victim rehabilitation program;

- payment documents for medicines and medical services.

If the victim dies, then payments are made to his heirs (minor dependents).

They will be required to provide the following documents:

Important: the Social Insurance Fund compensates for expenses even if the heir changes. To do this, you must provide a supporting document to the organization.

- conclusion on the connection between the death of the insured and an industrial accident;

- salary certificate of the deceased;

- his death certificate;

- confirmation of treatment costs;

- documents on the right of inheritance (dependency);

- documents containing information about the family composition and dependents of the deceased insured.

The enterprise where the accident occurred is obliged to submit to the Social Insurance Fund:

If it is determined that the injury was caused by a drunk employee, then he is paid the minimum wage for only one month. No other compensation is provided to the violator of labor discipline.

- a notification about an insured event is sent within 24 hours after the incident;

- a copy of a medical report on the nature of health injuries received as a result of an industrial accident and the degree of their severity (form 315/у);

- protocol of interviewing the victim, eyewitnesses, officials, inspection of the scene of the incident, a copy of the order to investigate the causes;

- a copy of the employment contract or work record book of the victim;

- copy of SNILS;

- communication about the consequences of an accident at work and the measures taken;

- a certificate of the final diagnosis of the victim;

- accounting documents confirming the payment of legally required amounts;

- an extract about the average salary of the victim;

- a certificate confirming the transfer of a lump sum benefit to his account.

February 17, 2017, 23:40 May 16, 2019 17:14

Work injury– this is a consequence of an industrial accident in the form of a deterioration in the employee’s health or death.

Damage qualified in this way can be received during the performance of official duties, a business trip, as well as a break, overtime, or on the way to or from work.

What happened for both parties – the victim and the company – was a very unpleasant and troublesome situation.

Types of injuries at work

When you receive an injury, you need to fill out a number of documents and visit more than one institution. We invite you to familiarize yourself with a kind algorithm, which will help you navigate this difficult topic.

The injury is classified according to the following criteria:

- The number of victims is one or a group of people.

- Severity – mild, severe, fatal. It is determined by the medical institution to which the victim turned for help.

- The nature of the incidents that occurred was chemical, thermal, electrical, mechanical. These types include various burns, electrical shocks, damage to the skin, eyes, bruises, fractures, dislocations.

During the investigation of an accident, several reasons for its occurrence are identified:

Who might get hurt?

Unfortunately, no one is immune from troubles at work. Employees are more often exposed to injuries during the working day.

According to statistics from the Federal Social Insurance Fund of the Russian Federation, most injuries are caused by metal cutting machines: mutilate the upper limbs.

Traveling on business matters in vehicles often leads to spinal damage and fractures. The most dangerous areas are identified as: industrial alpinism And construction.

If the employee was in a business trip, the case is also production.

It is worth explaining the receipt of damage as a separate point. on the way to work or on the way home. If a person used the employer’s transport or his own car by order of management, the injury is considered work-related.

In other options - moving on foot, by bus, trolleybus, in a minibus or in your own car - injury as such does not qualify.

Actions after an accident

The situation of industrial injury is regulated by Russian legislation, according to which each employee is provided with insurance against industrial accidents.

In other words, the organization transfers part of the employee’s earnings to the Social Insurance Fund of the Russian Federation ( FSS), which subsequently participates in the formation compensation package.

There are many stories where an enterprise avoided responsibility, did not transfer funds to the Social Insurance Fund, and even simply “disappeared.” As a result, the injured person was left with nothing.

Considering this point, it is very important choose correctly employer, definitely enter into an employment contract and ask all the necessary questions during the interview, without fear of seeming annoying and stupid.

However, the absence of a document on cooperation with the organization may not be an obstacle to registering an injury as an industrial injury. An investigation initiated at the initiative of the victim, legal proceedings are often restore justice.

After receiving an injury, a person should first call a doctor or emergency medical care. In case of severe injuries, this issue will be dealt with by colleagues.

Then the chief is invited to the scene of the incident, witnesses are interviewed or the material obtained from the cameras is studied CCTV. This is how the fact of injury is recorded.

The manager draws up protocol, which reflects all the nuances of the situation, convenes a commission to investigate.

The output is a document called

» .

It describes all the circumstances of the injury, participants, witnesses, as well as doctor's report medical institution about the severity of the injury in the form of a diagnosis.

It is mandatory to indicate the cause of the incident, the responsible party and measures to prevent similar incidents in the future.

The act is drawn up in three copies: one remains with the employer, the second is sent to the Social Insurance Fund, the third remains with the victim.

An event is recognized as an accident if after it it is necessary to change working conditions or position, as well as if loss of ability to work is established.

The percentage of loss of professional ability to work is determined by a commission of medical and social examination. The medical institution issues direction, which reflects the diagnosis, conclusions of doctors of various specialties, results of tests and examinations, recommended rehabilitation measures.

A package of documents consisting of an accident report, the nature of the work performed, extracts from the hospital, a conclusion from a medical commission and an outpatient card are examined by expert doctors.

After the manager announces a positive decision, the victim at work is given relevant information:

- Two "blue" with the percentage of loss of professional ability written on them.

- One "pink", if moderate, severe or pronounced dysfunctions of the body are detected. This is a certificate of disability group.

- A rehabilitation program for an industrial victim, drawn up on the basis of the conclusion of the medical commission of a medical institution. The treatment plan may include medications for the consequences of injury, medical products, a wide range of technical equipment - from a cane to a multifunctional medical bed, the possibility of staying in a sanatorium in the absence of contraindications.

Depending on the severity of the violations and rehabilitation prognosis The period for carrying out restoration measures, as well as cash payments, is determined. The minimum period lasts up to a year, the maximum – indefinitely.

An employee who was injured at work applies for a lump sum payment and monthly compensation.

Lump sum formula: percentage of loss (established by the ITU commission) of the maximum amount designated by the FSS. In 2016 it amounted to 90 401,9 rubles

Monthly payment– this is the percentage of loss of professional ability to work from the amount of wages accrued during the period of injury.

So, if 10% is determined and the monthly salary is 10,000 rubles, the amount of compensation will be within one thousand rubles.

Both types of these payments are financed by the Social Insurance Fund. The fund's branch is determined by the legal registration address of the insurer.

Temporary disability benefits are paid by the employer (who is the insurer) in 100% of the amount, regardless of work experience.

It is also possible to receive compensation from the employer for moral injury. The size is determined by what both parties agree on. If the employee rejects the proposed amount, it can be challenged in court by filing a statement of claim.

Providing financial assistance and paying treatment costs to an injured employee is possible. However, this comes only from the desire of management or upon positive consideration of the victim’s application.

Russian legislation obliges the organization to pay only temporary disability benefits (sick leave). The FSS is responsible for other payments.

The procedure for receiving payments, the list of required documents

If, based on the results of a medical and social examination, documents were received confirming functional disorders of the body ( blue, pink certificates), to apply for a one-time and monthly benefit, you must contact the Social Insurance Fund.

You need to have the following package of basic documents with you:

- It is mandatory to have a report on an industrial accident, which has form N-1. It must be remembered that one copy remains in hand, the second is stored in the Social Insurance Fund.

- Blue certificates, which reflect the percentage of loss of professional ability to work. The first certificate will be taken by a fund specialist, the second will be returned and presented at the next medical and social examination commission.

- Rehabilitation program for victims at work (PRP).

- Conclusion of the medical commission. The original document is given to the FSS.

- Certificate of average salary. The certificate form is provided by fund employees.

- Work book.

- Passport.

Each case of work injury is individual, so the list of documents may be adjusted.

We bring to your attention an interesting video on the topic of the article.

Such work" Sergey Demyanov

Unsweetened life Can a diabetic work as a security guard?

How long does it take for a parcel from China to Russia from Aliexpress?

How to find a good job - a detailed guide for those who want to get their dream job!

Presentation on the topic “Acmeism