What applies to fixed assets (OS) of an organization in accounting and tax accounting, we told in ours. And what is meant by fixed production assets (OPF) and how is the average annual cost of OPF calculated?

How to determine the average annual cost of fixed assets

There is no concept of OPF in the current legislation. Usually, OPFs are considered as opposed to non-productive fixed assets. The former refers to a part of fixed assets that are directly involved in the production of products, performance of work or provision of services or create conditions for these processes (for example, buildings and structures, machinery and equipment, computers, transport, etc.). And non-production fixed assets are objects of cultural and community purposes (for example, a canteen or a cinema). However, from the point of view of a commercial organization, non-production assets are not related to fixed assets in principle. Therefore, the terms "OPF" and "OS" are often considered as equivalent.

However, for the purposes of planning and analyzing indicators, an organization can group OS objects, referring them to BPF or other types based on any other criteria. For example, only the active part of the OS, which is involved in production (for example, machine tools), can be considered the BPF, and the plant management building may no longer be attributed to the BPF.

Accordingly, according to accounting data, the cost of the OPF can either correspond to the balance of account 01 “Fixed assets”, or be only a part of this indicator. In the latter case, analytical accounting information is used to allocate the share of fixed assets in the cost of fixed assets.

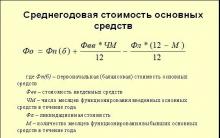

The average annual cost of OPF (OPF SG) can be calculated in various ways. The simplest - as the arithmetic mean of the OPF at the beginning (OPF N) and the end (OPF K) of the reporting year:

OPF SG = (OPF N + OPF K) / 2In this case, both and can be used.

Taking into account that the cost of the OPF can change significantly during the year, a formula similar to that used to determine the average annual cost when calculating property tax can be used to smooth out possible jumps and more accurate averaging (

The average annual total book value of fixed assets (fixed assets, funds) is calculated by accountants for the following purposes:

- preparation of relevant accounting and statistical reporting,

- determination of the property tax base;

- achievement of internal goals of a managerial and financial nature.

The full book value of fixed assets is the original price of the object, which is adjusted for the amount of the revaluation (depreciation). Revaluation may be caused by reconstruction, additional equipment, modernization, completion and partial liquidation.

During operation, fixed assets are subject to wear and tear, while they completely or partially lose their original properties. For this reason, the calculation of the average annual value of fixed assets has an impact on the calculation of residual value.

The residual value is calculated by subtracting the amount of depreciation from the amount of the initial cost.

Fixed assets, as a rule, transfer their value to finished products over a fairly long period, which may include several cycles. For this reason, the organization of accounting is organized in such a way that there is a one-time reflection and preservation of the original form, including price losses over time.

Before considering the formula for calculating the average annual cost of fixed assets, you should consider the classification of fixed assets.

The main production assets (means) include:

- Buildings, which are architectural objects that are designed to create working conditions (garage, warehouse, workshop, etc.).

- Structures that include engineering and construction objects that are used to carry out the transportation process (bridge, tunnel, track devices, water supply system, etc.).

- Transmission devices (electricity transmission, gas and oil pipelines).

- Machinery and equipment (press, machine tool, generator, engine, etc.).

- Measuring devices.

- Electronic computing and other equipment.

- Vehicles (locomotive, car, crane, loader, etc.),

- Tool and inventory.

To calculate the average annual cost of fixed assets, the following formula is used:

C \u003d Spn + (Svv * FM) / 12 - (Svbh FMv) / 12.

Here C mon is the initial cost of the OS,

Svv - the cost of the introduced OS,

Chm - the number of months of operation of the introduced operating systems,

Svb - the cost of retired fixed assets,

Nmv - the number of months of retirement,

The formula for calculating the average annual cost of fixed assets uses all indicators at historical cost, which is formed at the time of acquisition. If the organization had a revaluation of fixed assets, then the cost is taken as of the date of the last revaluation.

The formula for the average annual value of fixed assets according to the balance sheet

The formula for calculating the average annual cost of fixed assets can be calculated according to the balance sheet. This method is used in determining the profitability of the enterprise.

The formula for calculating the average annual value of fixed assets on the balance sheet is the sum of the indicators for the balance sheet line "Fixed Assets" at the end of the reporting year and at the end of the base year (previous), then the amount is divided by 2.

To calculate the formula, use information from the balance sheet, which covers transactions not only for the period as a whole, but also for each month separately.

The formula for calculating the average annual value of fixed assets according to the balance sheet is as follows:

C \u003d R + (W × FM) / 12 - / 12

Here R is the initial cost of the OS,

W is the cost of fixed assets introduced,

FM - the number of months of operation of the introduced OS,

D - liquidation cost of fixed assets,

L is the number of months of operation of retired OS.

Task #1. Determine the average annual cost of the fixed production assets of the company, if the cost of the fixed production assets owned by the enterprise at the beginning of the year, the amount of equipment retired due to depreciation in early March and the amount of equipment that the enterprise purchased and installed at the end of September of this year are known.

Table 1.1

|

OF cost: |

|

|

at the beginning of the year, in million de |

|

|

introduced, in million de |

|

|

dropouts, million de |

F SG - the average annual cost of fixed assets;

FNG =280 million de - the value of fixed assets at the beginning of the period;

Ф вв =38 million de, Ф vyb =54 million de - the cost of input and retired (withdrawn) fixed assets;

m 1 =3 - the number of full months of operation of the introduced fixed assets from the moment of introduction until the end of the current year, months;

m 2 =10 - the number of full months of inactivity of retired fixed assets from the moment of withdrawal until the end of the current year, months;

Answer: ![]()

Task number 2. The cost of the company's fixed production assets as of January 1 of the reporting year is known, as well as the fact that at the beginning of the II quarter new equipment was purchased, and at the end of the IV quarter the worn-out equipment was liquidated. Determine the average annual cost of fixed assets on January 1 of the next year, using the data from the table below.

Table 2.1

|

OF cost: |

|

|

at the beginning of the year, in thousand de |

|

|

introduced, in thousand de |

|

|

retired, in thousand de |

F NG \u003d 705 thousand de -

Ф вв =210 thousand de, Ф vyb =208 thousand de - the cost of input and retired (withdrawn) fixed assets, de;

m 1 =9 - the number of full months of operation of the introduced fixed assets from the moment of introduction until the end of the current year, months;

m 2 =0 - the number of full months of inactivity of retired fixed assets from the moment of withdrawal until the end of the current year, months;

Answer: ![]()

Task #3. During the year, a certain amount of new equipment was installed, and part of it was put into operation on April 1, 2003, and the rest - from July 30, 2003. On September 1, 2003, 12% of the equipment owned by the enterprise dropped out due to their high degree of wear. Determine the average annual cost of fixed assets using the data from the table below.

Table 3.1

|

Parameters |

|

|

Number of units of equipment introduced: |

|

|

The cost of a unit of commissioned equipment, in thousand deu |

|

|

Number of equipment owned by the enterprise as of 01.01.2003, pcs. |

|

|

Cost of a unit of retired equipment, thousand deu |

F SG - the average annual cost of fixed assets, de;

FNG =2.4 million de - the cost of fixed assets at the beginning and end of the period, de;

F vv, F vyb - the cost of input and output (withdrawal) of fixed assets, de;

m 1 - the number of full months of operation of the introduced fixed assets from the moment of introduction until the end of the current year, months;

m 2 - the number of full months of inactivity of retired fixed assets from the moment of withdrawal until the end of the current year, months;

F choice = 47 105 = 4.935 million de.

Task #4. Determine the average annual cost of fixed assets according to the data from table 4.1. Moreover, it is known that the cost of transport services amounted to 12% of the cost of acquired fixed assets, and installation - 9%.

Table 4.1

|

Parameters |

|

|

The cost of fixed assets at the beginning of the current year, in thousand deu |

|

|

The cost of OF acquired: amount, in thousand de |

September |

|

The cost of OF, retired: amount, in thousand de |

F SG - the average annual cost of fixed assets, de;

F NG \u003d 400 thousand de. - the cost of fixed assets at the beginning and end of the period, de;

F cc, F vyb \u003d 28 thousand de. - the cost of input and output (withdrawal) fixed assets, de;

m 1 \u003d 3 - the number of full months of operation of the introduced fixed assets from the moment of introduction until the end of the current year, months;

m 2 =2 - the number of full months of inactivity of retired fixed assets from the moment of withdrawal until the end of the current year, months;

Answer: ![]()

Task number 5. Determine the average annual cost of FA in the planning year, based on the following data for the base and planning years.

OPF - tangible elements that repeatedly participate in the production process, do not change their original form, and transfer their cost in parts to the cost of manufactured products.

The average annual cost of the OPF in the reporting period is determined by the formula:

Where:  - cost of OPF at the beginning of the year;

- cost of OPF at the beginning of the year;

- the cost of received OPF;

- the cost of received OPF;

- the cost of retired OPF;

- the cost of retired OPF;

m - the number of months of deregistration of retired OPF in the reporting year.

million rubles

million rubles

The cost of OPF at the end of the reporting year:

Million rub.

1.2 Calculation of BPF usage indicators

Return on assets is an indicator that expresses the ratio of the cost of construction and installation works produced in one year (or other period of time) to the average annual cost of the OPF. Shows how much production (in monetary terms) received from each ruble of operating capital.

Capital intensity is an inverse indicator of capital productivity. Shows what share of the OPF is in 1 ruble of construction and installation works performed on their own.

The renewal coefficient is the ratio of the value of the received OPF to the value of the OPF at the end of the reporting year.

The capital-labor ratio of labor is an indicator that characterizes the cost of the active part of the OPF per one worker employed in construction.

Table 2. Calculation of indicators for the use of OPF

| No. p / p | The name of indicators | Conventional designation | Period Values | |

| Base | Reporting | |||

| 1. | return on assets    | 2,007846 | - | |

| - | 1,912368 | |||

| 2. | capital intensity    | 0,4982 | - | |

| - | 0,5228 | |||

| Continuation of table 2 | ||||

| 3. | OPF renewal factor   | - | 2,18 | |

| 4. | OPF disposal rate   | - | 2,121 | |

| 5. | OPF reproduction rate   |

| - | 0,069 |

| 66. | Labor capital-labor ratio    | 62,22 | - | |

| - | 60,72 |

Output: as can be seen from the calculation of indicators of the use of the OPF:

A decrease in the return on assets in the reporting year relative to the base year indicates a decrease in the volume of construction and installation works, which could occur due to inefficient and irrational use of new equipment, as well as due to the short time spent by production assets in operation.

2. An increase in the capital intensity indicator in the reporting year in relation to the base year indicates a decrease in production efficiency, since the manufacture of this construction product is provided at high cost of the OPF.

3.Refresh rate- the main indicator characterizing the rate of reproduction of fixed capital. It is calculated as the ratio of the value of injected physical capital to the total value at the end of the year. For a construction organization it is 2.18%. This value indicates a certain share of the renewal of the BPF in the construction organization. The leading areas of renewal are an increase in the scale of disposal of physically and morally worn-out means of labor and a corresponding increase in the share of new ones aimed at replacing the former.

4.Retirement rate- the value reflecting the intensity of the renewal of production assets, is calculated as the ratio of retired capital investments to the total value at the beginning of the year (taking into account the capital that retired due to physical and moral depreciation, since it also retires for reasons not related to its aging). It is equal to 2.121%. This value means that the organization is updating obsolete equipment to some extent. An increase in the degree of renewal is possible by attracting new equipment or overhauling (modernizing) the old one, provided that the costs for this should not lead to an increase in the cost of production.

5.Reproduction rate- reflects the relative increase (decrease) in the OPF due to their renewal (retirement). It is equal to 0.069%, which indicates that the retirement of OPF does not exceed their renewal. The tangible difference between the retirement rate and the renewal rate indicates that the BPF is more updated than retired.

6. Capital-labor ratio- characterizes the equipment of workers of enterprises of the OPF. A decrease in this coefficient indicates that in the reporting year, in comparison with the base year, the share of manual labor increased and the share of mechanized labor decreased.

1.3 We determine the shares of intensive (due to changes in capital productivity) and extensive (due to changes in the size of OPF) factors of changes in the volume of construction and installation works.

The successful functioning of fixed assets depends on how fully the extensive and intensive factors for improving their use are implemented.

Intensive factors changes in the volume of construction and installation works are factors in the development of the production activity of a construction organization through a more complete use of each unit of resource potential due to an increase in labor productivity, a more complete use of materials, an increase in the return on fixed assets, and a better use of working time.

Extensive factors changes in the volume of construction and installation works are factors involved in the development of construction production, an increase in the output of finished construction products by attracting additional resources without increasing the efficiency of their use.

extensive path development involves a way to increase production through quantitative factors while maintaining its former technical basis: additional involvement of labor, the number of enterprises, workshops, sites, and an increase in the construction of new facilities. With this path of development, a large amount of resources (natural, labor, material) is involved in production, but there are no significant changes in technology and technology, labor organization, and the qualifications of workers.

Intra-production reserves for improving the use of existing production capacities are divided into extensive and intensive reserves.

To extensive factors include reserves for increasing the useful time of equipment operation within the regime fund. These include eliminating intra-shift and day-to-day equipment downtime, as well as reducing the duration of scheduled repairs.

Group intensive reserves includes measures for a more complete loading of equipment per unit of time, advanced training of workers and, on this basis, a more complete use of the productivity of machines, an increase in the output of finished construction products, etc.

extensive Improving the use of fixed assets implies that, on the one hand, the operating time of existing equipment in the calendar period will be increased, and on the other hand, the share of existing equipment in the composition of all equipment available at the enterprise will be increased.

Although the extensive way of improving the use of fixed assets has not yet been fully utilized, it has its limits. The possibilities of the intensive path are much wider.

intensive improving the use of fixed assets involves increasing the degree of equipment utilization per unit of time. This can be achieved by modernizing existing machines and mechanisms, establishing the optimal mode of their operation. Operation under the optimal mode of the technological process ensures an increase in output without changing the composition of fixed assets, without an increase in the number of employees and with a decrease in the consumption of material resources per unit of output.

Intensity the use of fixed assets is also increased through the technical improvement of labor tools and the improvement of production technology, the elimination of "bottlenecks" in the production process, the reduction of the time to achieve the design productivity of equipment, the improvement of the scientific organization of labor, production and management, the use of high-speed methods of work, advanced training and professional skills workers.

The development of technology and the associated intensification of processes are not limited. Therefore, the possibilities for an intensive increase in the use of fixed assets are not limited.

1.3.а Dynamics of construction and installation works volumes in the reporting year due to changes in capital productivity:

Million rub.

1.3.b. Dynamics of the volume of construction and installation works due to changes in the size of the OPF:

Million rub.

Dynamics of construction and installation works volumes:

;

;  (1.3)

(1.3)

Million rub.

Million rub.

- therefore, the calculations are performed correctly.

- therefore, the calculations are performed correctly.

2. CALCULATION OF INDICATORS RELATED TO THE LEVEL OF LABOR PRODUCTIVITY

1.2 Calculation of the average annual cost of fixed production assets

Fixed production assets (OPF) are the means of production of long-term use: buildings, structures, machinery and equipment, etc.

To calculate depreciation charges and performance indicators for the use of fixed production assets, their average annual cost is calculated.

We calculate the average annual cost for each type using the following formulas, depending on the initial data:

1) if months of input or disposal of funds are planned

F BB × t 1 F SEL × t 2

F PL \u003d F NG + ---------- - -----------, (3)

where F PL is the average annual cost of the OPF, thousand rubles;

F NG - cost of OPF at the beginning of the year, thousand rubles;

Ф ВВ - the cost of commissioned fixed assets, thousand rubles;

F SEL - the cost of the BPF being retired, thousand rubles;

t 1 - the number of full months remaining until the end of the year from the moment the BPF is put into operation;

t 2 - the number of full months remaining until the end of the year from the date of retirement of the BPF from operation.

F PL vehicles = 58900 - 2800 × 4 / 12 = 57966.6 thousand rubles.

2) if the time of input and disposal of funds is not planned

∆Ф 1 Ф = Ф NG + ----- , (4)

where ∆F 1 is the cost of the introduced OPF, thousand rubles.

F PL BUILDINGS = 607700 thousand rubles;

F PL MACHINERY AND EQUIPMENT \u003d 427300 + 84300 * 7/12 \u003d 476475 thousand. rub.;

F PL PER DEVICE \u003d 646,000 thousand rubles;

F PLTRANSP FACILITIES \u003d 58900 thousand rubles.

The calculation results are summarized in Table 2.

Table 2 - Average annual cost and structure of the OPF

| Types of OPF | Average annual cost of OPF, thousand rubles | OPF structure, % |

| 1 Machinery and equipment | 476475 | 26,5 |

| 2 Transfer devices | 630337,5 | 35,1 |

| 3 Buildings | 607700 | 33,8 |

| 4 Vehicles | 57966,6 | 3,2 |

| 5 Tools | 16400 | 1 |

| 6 Computing | 7110 | 0,4 |

| Total | 1795989,2 | 100 |

The predominance of buildings and transmission devices in the structure of the BPF characterizes the specifics of the enterprise

Job description of the head of the tender department

On the indication and change of NMCC in the procurement schedule, notification and documentation on the procurement of NMCC at the planning stage

Master class painting how to make a brush from cat hair wool

Where to start your business?

What is the similarity between the efforts of a manager in managing employees A and D?