All these years I have heard from clients about various “alternative” methods of liquidation and I am already tired of answering questions about whether it is possible to abandon an unnecessary company, counting on the fact that the tax office itself will close it on the basis of Art. 21.1. Federal Law of 08.08.2001 N 129.

Conditional disqualification can be applied to an unscrupulous manager, even if the company’s liquidation record was made before the well-known changes to the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” come into force.

Amendments to this law establish a temporary 3-year ban on the creation of new legal entities and on participation in the management of existing legal entities for citizens who have previously shown bad faith.

That is, these are those directors whose companies at the time of exclusion of the organization from the Unified State Register of Legal Entities as inactive had tax arrears on their personal accounts. Or this debt was recognized by the tax authorities as uncollectible due to the presence of signs of an inactive legal entity.

Let's take this case for example. A citizen who, according to the Unified State Register of Legal Entities, is the happy owner of shares of various sizes in 482 companies and the head of 543 organizations, was denied liquidation in all lower courts. Then he appealed to the Constitutional Court of the Russian Federation with a complaint that the refusals to register actions with his firms were made illegally, since the requirements of paragraph “F” of the mentioned article apply to relations that arose from January 1, 2016, and do not have retroactive effect. The exclusion of problematic legal entities in which he was a director occurred before the entry into force of the norm.

But the Constitutional Court of the Russian Federation pointed out that the challenged norm does not violate the rights and freedoms of citizens, and the courts used it correctly. Since the temporary ban on registration actions is designed to ensure the relevance of information in the Unified State Register of Legal Entities and the protection of the rights of third parties and is in accordance with the law and the Constitution. In the opinion of the Constitutional Court, this restriction is not excessive, since it affects only unscrupulous persons and is established for a limited period.

Clause "F" can be applied to relations that existed before 01/01/2016. This ensures equal protection of the rights and legitimate interests of participants in civil transactions from unfair manifestations that took place both before and after the specified date. Therefore, the Constitutional Court of the Russian Federation, by its ruling of March 13, 2018 No. 580-O, refused to consider the complaint of a citizen who challenged the constitutionality of subparagraph “F” of paragraph 1 of Article 23 of the Federal Law of August 08, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs ".

We will not tire of repeating that it is simply uncivilized to “throw away” a legal entity. And to hope that debts on them (especially tax debts) “will be forgiven by themselves” is not at all logical.

In addition to disqualification for abandoned companies, tax arrears and other debts of a legal entity can be recovered directly from the head as an individual since June 28, 2017- from the moment when amendments to the legislation came into force, which made it possible to collect debts from controlling persons even after liquidation, bankruptcy and exclusion of a legal entity from the Unified State Register of Legal Entities.

There are clients who have heard such a scheme from “consultants”: first change the director and founder to “Uncle Vasya”, to an “offshore” or a citizen from not very far abroad, and then also leave their company in anticipation of liquidation.

So I declare with bewilderment - do you really think that the responsibility for the activities that you carried out will be borne by a person who did not conduct financial and economic activities, did not make decisions and did not sign documents that led to the formation of debts?

Usually people realize that there is nothing legal in such a “scheme”, and leaving the company, they will be afraid for another three years that creditors can find and collect debts from them. And the court will interpret the actions to change to “third parties” as aggravating circumstances.

Liquidating a Russian company by joining an offshore company is a popular method of liquidation. It is believed that by joining the company to a non-resident, the company and its founders relieve themselves of responsibility for all violations and, in general, any actions of the company that occurred before the moment of liquidation. The tax authorities, having no agreement on the exchange and legal assistance, as well as on the collection of taxes, formally cannot impose any penalties on the offshore company.

For this purpose, for relatively little money, an offshore company is registered and a legal entity registered in the Russian Federation is attached to it.

This is how some consulting companies explain the alternative liquidation procedure. But despite the fact that the above explanation sounds logical at first glance, alternative liquidation, in fact, is not liquidation at all. Let's see what this procedure really is and what consequences those who decide to use it may face.

Alternative liquidation: the procedure behind the name

Alternative liquidation - sounds nice. They decide to resort to it, often focusing on the name. It's no secret that troubled firms, whatever those problems are, pose some threat to their founders, owners, and directors. That is why the decision to liquidate is made.

The accession of a company to an offshore company is in fact not a liquidation, but a replacement of a shareholder. In some cases, directors are also changed. The company actually continues to exist. Moreover, scammers can take advantage of it and use it for their own purposes. It's just the owner that changes.

The company does not die, but continues to exist. You pay money for this service, but you do not receive a liquidation certificate.

Subsidiary Liability

What could happen next? If new nominal directors use your company for their own purposes, while violating the law, then the police, the investigative committee or the tax authorities will begin to search for the perpetrators. And they will not look for mythical nominal directors, but for real, actual owners, as a result of which a criminal case may be opened against you, as the actual founder. Considering that no one abandons good companies, the owners will also be reminded of past “merits”, coupled with subsidiary liability for new actions.

Unfortunately, there is no alternative liquidation in the legal sense of this concept. And there is a change of director and shareholder to someone else. Problems do not go away, but remain, and with the risk of new, much more serious ones.

The tax authorities will never allow a “problem firm” to join another company. It's just legally impossible. Even within the country, joining a company from another region is now virtually impossible, the tax authorities are preventing this in every possible way.

Liquidation is always accompanied by the issuance of a certificate of liquidation, which is issued by the tax authorities. All the rest are illegitimate actions that do not free from problems, but entail serious consequences.

If you want to liquidate your company, do not look for easy ways, but take advantage of the opportunities for legal liquidation that can still be realized with the help of experienced lawyers. They will describe to you all the pitfalls and help you get a certificate of liquidation.

#Lawyer Help #Registration of Companies #Liquidation of Companies #ooopravoved_yuridicheskieUslugi #ooopravoved_LegalAddress

Alternative in Moscow - a simple and quick way to terminate the company's activities. This procedure is an opportunity to avoid obligations to creditors. All rights and obligations are transferred to the new members of the company, and the client, in turn, receives documents confirming the changes in the members and the director, registered in the manner prescribed by law.

Benefits of Alternative Liquidation

- Getting rid of debt without significant financial costs.

- A small package of documents.

- Termination of business activities in 3 weeks.

- Preservation of assets.

- Possibility to avoid tax audit.

- The procedure is carried out legally.

Documents for alternative liquidation

- Certificate of state registration of the organization.

- Certificate confirming the fact of tax registration.

- Extract from the state register.

- Charter of the organization and its copy.

- Copies of passport details of current participants and leader.

- Protocol (decision) on the establishment of a legal entity.

- Protocol (decision) on the appointment of the head.

- Organization seal.

Types of alternative liquidation

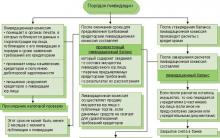

Alternative liquidation of an LLC is carried out in three ways:

- Reorganization. Takes place in the form of a merger or accession. In the first case, companies make a decision to merge, hold general meetings, develop a merger agreement, a charter, a deed of transfer. The obligations of the reorganized firms, including those that they did not fulfill, are transferred to a new legal entity. Firms that decide to merge are excluded from the Unified State Register of Legal Entities. When joining, the founders of the companies sign an agreement that specifies the stages of reorganization, the procedure for financing procedural actions. The final stage of the procedure is the entry of information into the Unified State Register of Legal Entities about the new company. Reorganization allows you to exclude information about a legal entity from the register. Since then, the company has officially ceased operations. The disadvantage of the procedure is the high risk of bringing to responsibility persons who performed business management functions from the moment the company was established until the end of the reorganization procedure.

- Sale. This method allows the company to function, but with new owners and management. An alternative liquidation of a business is carried out by selling shares in the authorized capital or by introducing new persons into the number of founders and "recombining" the shares. The deprivation of powers of former members of corporations in the first case occurs at the time of signing the sale and purchase agreement, in the second - from the date of registration of changes in the Unified State Register of Legal Entities. Before or after the completion of the procedure, the executive body changes in the company. The transaction must be registered with a notary. To make changes to the Unified State Register of Legal Entities, a notarized application is sent to the registration authority. To enter new persons, an application is required for their entry into the number of members of the company, a document confirming the payment to the authorized capital, a decision on the exit from the company of the former participant and the distribution of its share. The sales process takes about a month. The legal entity retains assets, receivables and payables. The disadvantage of the procedure is the possibility of applying subsidiary liability measures to the former owners, since they managed the organization before its sale.

- Liquidation initiated by the tax authority, resulting in a break in the use of the company. This type of alternative liquidation of an LLC is acceptable if the company has never submitted tax reports over the past twelve months, has not carried out any operations on open accounts, or if there is an entry in the Unified State Register of Legal Entities about the inaccuracy of information about the legal entity for more than 6 months from the date of entry. In accordance with the law, an organization excluded from the state register immediately ceases to conduct commercial activities.

Alternative Liquidation Procedure

The service for the liquidation of an LLC includes two stages: the introduction of a new person who was not previously an employee of the organization into the list of founders, and the submission of a package of documents to the tax authority:

- Notarized statement.

- The protocol of the participants of the organization or the decision of the founder to change the leaders of the company.

- Copies of the charter.

- Extracts from the state register.

- Passport data of a new member of the company or the general director.

Prices for alternative liquidation of an LLC

The cost of alternative liquidation of an LLC is from 50,000 rubles.

The Pravoved company conducts an alternative liquidation of legal entities.

Advantages:

- Advice on the nuances of the transaction.

- The optimal scheme of the procedure.

- Minimal risks.

- Professional support of all stages of the company closing process.

- Strict adherence to deadlines.

- Confidentiality.

Fill out the feedback form and entrust the liquidation of the company to professional lawyers!

Alternative liquidation of an LLC is a procedure in which a legal entity is liquidated with a minimum of costs and tax audits. This technology is quite in demand, as it reduces the time for all operations. It does not involve significant costs, as a standard procedure. There is no need to go through many checks by government agencies, which is important if a legal entity has debts and other controversial issues.

There are two main ways of alternative abolishment: through the change of CEO and reorganization. In the second case, the company ceases to exist, while with a change of key persons, it can continue to work.

Liquidation through the change of the general director and founders of the LLC: features of the procedure

This alternative liquidation of an LLC is a procedure in which the company is sold to third parties. The new owner can independently decide the issue with her future fate:

This alternative liquidation of an LLC is a procedure in which the company is sold to third parties. The new owner can independently decide the issue with her future fate:

- Terminate the business of the company;

- Change her specialization and continue working;

- Continue activities without making changes.

After changes are made regarding the composition of the legal entity, the old owner ceases to be responsible for the current activities of the company.

Consider the advantages of this option:

- It will take only 10-25 days to complete the procedure;

- This is one of the most inexpensive elimination methods;

- The founders of the LLC take a minimal part in the process.

However, it also has a lot of disadvantages:

- The information remains in the Unified State Register of Legal Entities, and therefore the sword of Damocles continues to hang over the old owner in the form of criminal liability for previous operations within the company;

- Increased risk of vicarious liability. Information about the concept of subsidiary liability;

- If a purchase and sale transaction is being drawn up, a large package of documents will be required;

- To complete a transaction at a notary, a person expects high fees.

If violations were revealed during the past stages of the company's activities, then even after the change of owners and management of the company, the responsibility will be borne by the past owners.

Reorganization of a legal entity

The reorganization of a legal entity can be carried out in various ways. However, in any case, the procedure involves the termination of the existence of the company in its current format. It passes into the ownership of the recipient company. Reorganization is carried out in two ways:

The reorganization of a legal entity can be carried out in various ways. However, in any case, the procedure involves the termination of the existence of the company in its current format. It passes into the ownership of the recipient company. Reorganization is carried out in two ways:

- merger. It involves the abolition of the former legal entity. All rights to the company are transferred to the new LLC. To do this, you will need to register a new person in the Unified State Register of Legal Entities. The procedure will take about a week.

Before the end of the procedure, the liquidated company is required to go through certain legislative processes. These include notifying creditors of the transaction. It is necessary to send them special notices with confirmation of their receipt, as well as publish the news of the abolition in the State Registration Bulletin.

A merger is carried out, after which a certificate of termination of the legal entity is provided. A certificate of registration of the successor is also issued. All LLC tax liabilities must be paid by the new owners. - Accession. It looks like a merger, but the mechanisms differ in the following way - when merging, all companies complete their work except for the one to which the rights to all the other abolished LLCs will be transferred.

Among the advantages of the event, it can be noted that it is not required to obtain a certificate of absence of debt from the FIU. This simplifies the process, makes it faster. After the procedure is carried out, you can get a certificate confirming it, as well as the termination of the activities of other companies.

The merger involves the abolition of the former LLC.

Consider the benefits of reorganization:

- There is an exclusion of a legal entity from the Unified State Register of Legal Entities;

- It is not required to collect many documents;

- The event will take about three months.

Among the disadvantages of the procedure are:

- If creditors submit their claims, it will be impossible to reorganize. First you need to fulfill all the necessary requirements;

- Increased risk of subsidiary liability of the former owners.

These are the most common methods, which are an alternative to the standard procedure. Their choice depends on the preferred timing of the event, as well as on the organization's debts.

When are alternative methods the best solution for a business?

The standard process of abolition is fraught with trips to various authorities, the collection of a large package of documents. List of documents for the liquidation of an LLC. You will need to obtain all necessary permits, extracts. This is a lengthy undertaking, especially if the liquidation is carried out through bankruptcy. The longer the process drags on, the more expenses it will require. You will have to pay not only fees, but also pay salaries to the current state.

The standard process of abolition is fraught with trips to various authorities, the collection of a large package of documents. List of documents for the liquidation of an LLC. You will need to obtain all necessary permits, extracts. This is a lengthy undertaking, especially if the liquidation is carried out through bankruptcy. The longer the process drags on, the more expenses it will require. You will have to pay not only fees, but also pay salaries to the current state.

Alternative liquidation of an LLC will be appropriate in the following cases:

- Need to save time;

- Additional costs must be avoided;

- The company has debts;

- The organization has violations related to taxation.

In all these cases, the methods will make the whole process easier and more economical.

The easiest method of liquidation is to change the CEO and founders.

Possible risks

If alternative methods are used, the organization is likely to face increased scrutiny. They are carried out in order to prevent fraud and tax evasion.

If alternative methods are used, the organization is likely to face increased scrutiny. They are carried out in order to prevent fraud and tax evasion.

When liquidating a legal entity, the following risks are possible:

- Criminal liability. It occurs if the change of leadership was carried out with the participation of nominees. Liability risks are greatly increased if the operation was carried out solely for the sake of abolition;

- Return of the person to the previous owner. Produced if checks have been carried out. If the new organization to which the rights to the LLC are transferred does not perform any activity, this may become the object of attention of the tax authorities. The company returns to the former founders. This leads to wasteful costs and the need for a second eradication exercise;

- Declaring bankruptcy intentional. A similar result may occur as a result of checks on the capacity of a new company that was formed as a result of reorganization. Risks increase if there are uncovered liabilities.

You can significantly reduce the likelihood of negative scenarios. To do this, the LLC should not arouse any suspicion. She should not have debts, disputed obligations. How to close an LLC with debts. It is easier to carry out both with the standard and with the alternative procedure. Therefore, if the company has violations, it is better to eliminate them first. If this is not done, all liquidation actions may be spent in vain.

In any case, the previous owners are responsible for the violations committed in the course of past activities.

As a result, they will have to spend money not only on the liquidation itself, but also on the repayment of debts, a repeated abolition event.

When would alternative methods be appropriate? It is optimal to use them when the organization has covered all its debts and paid taxes. It may happen that the procedure will be carried out without any consequences. However, the probability of this is very low, because if the LLC has problems, it will have to go through various checks.

Closing the company in alternative ways looks tempting only at first glance. Here you need the help of a competent lawyer, and you yourself need to be prepared, at least theoretically. Here is the opinion of experts on this topic:

Alternative options for the abolition of a legal entity can be applied. However, it is recommended to do this only in order to reduce the time for the event, as well as costs. In this way, it is difficult to avoid paying debts and paying taxes. Most likely, the founders will incur double costs and problems if they decide that this is a way out of the current situation. The simplest method of liquidation is to change the CEO and founders. This process takes a minimum of time. It does not require a lot of documentation, and costs are reduced. Reorganization is also considered a good option.

Photo by Denis Yakovlev, Clerk.Ru

Recall that the so-called "alternative liquidation of a legal entity" is usually understood as a set of measures, the implementation of which ultimately allows to achieve the desired result - the exclusion of the company from the Unified State Register of Legal Entities without any checks and consequences for the controlling persons.

It's no secret that the legislation in the Russian Federation is changing not only rapidly, but somehow quite lightning fast. New laws are stamped, high-profile decisions and explanations are issued, formal and informal “pointers” are sent down to various regulatory and judicial authorities. The “rules of the game” that govern the procedures for the alternative liquidation of legal entities were no exception, having undergone cardinal changes in the blink of an eye. Amendments were made to Federal Law 127 “On Insolvency (Bankruptcy)”, amendments were made to Federal Law 129 “On State Registration of Legal Entities and Individual Entrepreneurs”, the Civil Code of the Russian Federation was updated, as well as a number of other legal acts regulating procedures and technologies alternative liquidation of firms. Simply put, the liquidation was completely different from what it was just a month ago.

However, the abundance of commercial proposals for the closure of legal entities that are replete with the Internet, as well as spam mailing, which with enviable regularity breaks through the filters to corporate mail, forced us to take a deeper look into this issue. A healthy legal curiosity arose - and maybe there are still some ways and detours, gaps and loopholes in the updated legislation (as is often the case). Yes, such that it would be possible to build on their basis something like "green corridors" for the liquidation of firms without inspections. To find an answer, commercial offers for the liquidation of legal entities, highly specialized forums, as well as a number of websites of freelancers and law firms in several regions of the Russian Federation were analyzed. For half a day, two lawyers, posing as owners and directors of commercial structures, specially corresponded, called up the “liquidators”, made inquiries, collected information, sent a “client” (data from one of our organizations) for verification by the OGRN. The conclusions were disappointing. Commercial proposals for liquidation, to put it mildly, do not correspond to the realities of law enforcement practice. What they are proposing contradicts what the authors of the proposals themselves are discussing behind the scenes. Here we make a small important reservation - if someone sees inconsistencies in the examples below, in some regions the situation is different, please write in the comments, because the purpose of this material is not to denigrate or “throw a stone” at someone side, but, on the contrary, to warn against traps. After all, as you know, forewarned is forearmed.

So, here the summer flared up with the heat of June, and with it the market for alternative liquidation of legal entities literally blazed with heat - “reorganizations by merger”, “sales” of companies, “change of director and founders to offshore” and the like. It should be noted that any procedures, measures and half-measures that allow ultimately to liquidate a legal entity without inspections are fairly popular in our country in view of objective and subjective reasons - after all, the taxpayer in the Russian Federation is always to blame by default, so look for "escape routes" - liquidation without checks - his natural right. In this regard, the scale of the “unexpected” fire of alternative liquidation procedures has affected hundreds, if not thousands of legal entities. So many things hung, how many have never hung. It can be said that the “alternative liquidation apocalypse” has happened.

From June 14, 2016, all forms 16001 “Application for state registration of a legal entity in connection with its liquidation”, submitted to the Federal Tax Service No. 46 for Moscow, began to issue decisions on the suspension of state registration. Formally, for a period of one month, for a thorough check of the submitted information. However, according to confirmed information, the suspensions will be followed by mass refusals to complete the initiated reorganizations. The same, a little earlier, happened in Kazan, which has recently become the “Hong Kong” of alternative liquidations, as well as in other regions of the Russian Federation. Thus, procedures for the liquidation of firms were frozen almost throughout the country. Order of the Federal Tax Service dated February 11, 2016 No. ММВ-7-14/ [email protected]"On the approval of the grounds, conditions and methods for carrying out the activities specified in paragraph 4.2 of Article 9 of the Federal Law "On State Registration of Legal Entities and Individual Entrepreneurs", the procedure for using the results of these activities, the form of a written objection to the upcoming state registration of changes to the charter of a legal entity or the upcoming entry of information to the Unified State Register of Legal Entities, the application form of an individual about the unreliability of information about him in the Unified State Register of Legal Entities" has entered an active phase.

It should be recalled that around the end of 2015, the screws were “tightened” in the so-called “liquidation of firms through offshore”, when the tax authorities began to massively issue refusals on attempts to change the sole executive body and participants of liquidated firms to foreign companies and oblige the latter to register branches on territory of the Russian Federation, with the corresponding payment of six-figure state duties. The “liquidation of an LLC through a change of director and founders” became much more complicated, when the fiscals began, among other things, to demand notarized decisions of the participants. In addition, the "stop lists" of mass managers and nominal shareholders were finalized and fully implemented. In a number of regions, police officers joined this “service”, and they began to wonder why this or that person needs so many organizations that he is listed as a director or participant there. From 01/01/2015, it was very difficult to change the region of tax registration of a legal entity (migration), and from 01/01/2016 in the vast majority of regions it became virtually impossible.

The technology of liquidating a company through a simplified bankruptcy procedure for a liquidated debtor, which was widely used until recently, also lost its meaning. Amendments to the main law regulating this procedure, namely, 127-FZ “On Insolvency (Bankruptcy),” introduced norms that deprive the debtor of independently indicating the desired candidate for a “loyal” arbitration manager. Article 37 of FZ-127 "on insolvency (bankruptcy)", subject to amendments, began to sound as follows: "... The debtor's application indicates the name and address of the self-regulatory organization, from among whose members an interim manager, determined in the manner established in accordance with paragraph 5 of this article ... 5. For the purpose of indicating the self-regulatory organization of arbitration managers in the application of the debtor, it is determined by random selection in the manner established by the regulatory body, when publishing a notice of filing an application with the arbitration court by the debtor.”

The rules of the game have changed - laws have changed, law enforcement practice has changed. However, despite this:

- The Internet is brightly full of announcements about “reorganization of an LLC by merger”, “liquidation of an LLC through reorganization” and the like. Moreover, when, out of really healthy legal curiosity, questions were asked with a request to indicate the region of assignees and the OGRN of organizations that passed in June, not a single law firm gave us a clear answer, referring to the "commercial secret of this information."

- Proposals for changing the region of location of the legal address of LLC (migration), despite all the changes, have also become no less, but rather more. And here, a “specific” truncated portfolio was sent to the request for the OGRN of past companies - no more than 3-5 companies that went to a fresh address. But we never saw the next one. Conclusion - there will be a clean, "zero" address - there is a big chance to move to it, but you need to manage to get into the top five.

- Worked out commercial proposals for the "liquidation of an LLC through offshore". And the most beautiful - with clever words and business pictures. We were offered to make the first payment in rubles, the second at the exchange rate in foreign currency - apparently for greater entourage. To the question “send the OGRN of completed projects” - silence again. Apparently, the passion for prepayment took its toll here too.

- Several times they tried to find out from legal organizations offering bankruptcy services for a liquidated debtor under a simplified procedure - how they are going to nominate their “loyal” arbitration manager, because this is really interesting. So far, no clear answer has been received from anyone.

- It is worth noting that several law firms gave us reasonable guarantees of alternative liquidation (the cost, however, exceeded even the cost of the bankruptcy procedure). However, their offers are a drop in the ocean, which is completely clogged by the aggressive marketing of unscrupulous salesmen.

Scenario New Year's holiday "meet the year of the monkey"

Situational Marketing What reasons for situational content can be used in November

Effective ad formats in Yandex

Getting money at the airport

How is the Tax Free refund amount calculated?