1. obtaining initial information on all compared enterprises;

2. the initial information is presented in the form of a matrix in which the values of indicators are entered in the rows (i = 1, 2..., n), and in the columns - the compared enterprises (j = 1, 2..., m);

3. Correlate the initial indicators with the corresponding indicators of the competitor enterprise (the best in the industry, the reference enterprise) using the formula:

Where x ij - relative indicators of the enterprise’s economic activity:

4. for the analyzed enterprise, the value of the rating assessment at the end of the time period is determined using the formula:

![]()

5. Competing enterprises are ranked in descending order of rating. The company with the maximum value of the comparative assessment, calculated using the formula above, has the highest rating.

Rating methods can take into account not only tangible assets, but also intangible assets (reputation of management, organizational abilities, etc.), for example: overall quality of management, quality of products or services, financial stability, degree of social responsibility, etc.

The methodology for assessing the competitiveness of an enterprise, based on a comprehensive study of the internal environment of the enterprise, involves two directions:

- determining a list of internal factors and assessing their impact on the efficiency and quality of the enterprise’s activities,

- identifying strengths and weaknesses in each functional area.

The first direction of the study - identifying the composition of internal factors and assessing their impact on the efficiency and quality of the company's activities - is carried out to establish reserves for improving activities. The study is based on the use of methods of comprehensive analysis of production and economic activities and financial management. Therefore, as a rule, the analysis begins with a consideration of the financial condition of the company. This analysis aims to find out how the future development of the company is consistent with the availability of sufficient financial resources and the solvency of the company. Financial indicators can be grouped into the following four groups:

First group - These are indicators for assessing the profitability of economic activity:

- Overall profitability of the enterprise (total profit to assets).

- Net profitability of the enterprise (net profit to assets).

- Return on equity (net income to equity).

- Total profitability of production assets (total profit to the average value of fixed production assets and working capital).

Second group- these are management efficiency assessment indicators:

- Net profit to product sales volume.

- Total profit to product sales volume.

Third group - These are indicators for assessing business activity:

- Return on assets (revenue from sales of products to assets).

- Return on fixed assets (revenue from sales of products to fixed assets).

- Turnover of working capital (revenue from sales of products to working capital).

- Accounts receivable turnover (revenue from sales of products to accounts receivable).

- Turnover of banking assets (revenue from sales of products to banking assets).

- Return on equity capital (revenue from sales of products to equity capital).

Fourth group - These are liquidity assessment indicators:

- Current liquidity ratio (current assets to current liabilities).

- Other assets to current liabilities.

- Permanent asset index (fixed assets and other non-current assets to equity).

- Autonomy ratio (own funds to balance sheet currency).

- Provision of inventories with own working capital (own working capital to inventories).

Analysis of these indicators will make it possible to find out the patterns of their changes and assess the effectiveness of financial activities.

Characteristics indicating a decrease in financial performance:

- persistently low liquidity ratios;

- constant shortage of working capital:

- high level of overdue accounts payable and receivable;

- high share of borrowed funds in the total amount of sources of funds;

- lack of long-term contracts;

- low production profitability;

- insufficient diversification of activities;

- high level of financial risk:

- low level of return on financial investments;

- declining production volumes and rising production costs, etc.

The second direction of research - identifying the strengths and weaknesses in each of the functional areas - is carried out in order to identify areas of activity and resources (opportunities) that can become the basis for the company's future strategy and the creation of sustainable competitive advantages. This analysis can be done cross-sectionally.

Assessing the competitiveness of goods and services, as well as the company itself, is an important element in the analysis of competition in a particular market due to the fact that it allows a realistic approach to assessing both the strengths and weaknesses of the organization and determining directions for increasing the competitiveness of the enterprise and its products. This analysis is especially relevant when a business plan is developed for “internal use,” i.e. represents a development program for the company as a whole. The scientific literature identifies the following methods for assessing the competitiveness of an enterprise:

- 1) score;

- 2) assessment from the position of comparative advantage;

- 3) assessment based on the theory of effective competition;

- 4) assessment based on quality theory;

- 5) matrix methods;

- 6) methods of the American Management Association;

- 7) indicator method;

- 8) methodology for assessing competitiveness used in marketing research.

When scoring the competitiveness of enterprises, the performance indicators of competing enterprises are numerically compared. Then the average score of these indicators is found. By its level one can judge the position of the enterprise. The scoring of individual indicators is presented in table.

Scoring of individual indicators

|

Index |

|||

|

Quality of management |

|||

|

Quality of goods and services |

|||

|

Financial condition |

|||

|

Resource usage |

|||

|

Ability to work with staff |

|||

|

Long-term capex |

|||

|

Ability to innovate |

|||

|

Responsibility to society and nature |

|||

|

Average score |

As can be seen from the table, the highest level of competitiveness is for enterprise A, and the lowest for enterprise B.

However, for a more accurate objective analysis of the competitiveness of enterprises, it is necessary to take into account the different influence on it (the different significance) of each of the properties under consideration. In this case, the maximum score for each competitiveness indicator is taken equal to 5 points, and the sum of the weighting coefficients of the competitiveness indicators is equal to 1 point. The second condition is met quite simply by using the appropriate expert ranking technique. The results obtained are shown in table.

Assessment of competitiveness indicators taking into account weighting coefficients

|

Competitiveness indicator |

|||||||

|

Quality of management |

|||||||

|

Product quality |

|||||||

|

Financial condition |

|||||||

|

Resource usage |

|||||||

|

Work with personnel |

|||||||

|

Long-term capex |

|||||||

|

Ability to innovate |

|||||||

|

Responsibility to society |

Legend:

Kv - weighting coefficients of competitiveness indicators, characterizing their significance in the overall assessment of the competitiveness of these commodity producers;

Ra - assessments of the competitiveness indicators of enterprise A;

Republic of Belarus - assessment of the competitiveness indicators of enterprise B;

Rv - assessments of the competitiveness indicators of enterprise V.

The competitiveness of enterprises is determined by the formula

Thus, the competitiveness of enterprise A:

Ka = 0.68 + 0.45 + 0.56 + 0.16 + 0.3 + 0.14 + 0.68 + 0.12 = 3.09 points.

For enterprise B:

KB = 0.51 + 0.6 + 0.28 + 0.32 + 0.3 + 0.07 + 0.51 + 0.48 = 3.07 points.

For enterprise B:

Kv = 0.34 + 0.45 + 0.42 + 0.32 + 0.2 + 0.35 + 0.17 + 0.6 = 2.85 points.

Advantages of enterprise A: quality of management, stable financial condition, ability to innovate.

Advantage of enterprise B: quality of goods.

Advantages of enterprise B: long-term capital investments, increased responsibility to society.

Thus, enterprises A and B have better chances in the market. At the same time, the relative equality of competitiveness portends an intensification of competition between them.

Identification of an enterprise's comparative advantage is based on the assumption that firms specialize in the production and export of those goods that cost them relatively little. To determine the degree of competitiveness of a manufacturer, the performance of competing enterprises is compared according to an accepted criterion, for example, profit volume, sales level, market share, etc. However, it must be borne in mind that it is impossible to measure the comparative advantages of an enterprise in a complex of many indicators. Thus, if you focus only on production costs, then the quality of products and many other factors that determine the level of competitiveness and potential of the organization will not be taken into account.

In the theory of effective competition, methods for determining competitiveness are based on the assumption that an industry is considered more competitive if its member firms have strong market positions. The main method of analyzing the competitiveness of an industry is to compare the indicators of its member companies with the indicators of competing firms.

To develop a criterion for the level of competitiveness, two main approaches are used: structural and functional.

The assessment of competitiveness based on the structural approach is carried out based on an analysis of the level of monopolization of the industry in the market (concentration of production and capital, barriers to entry of new companies into the market).

In the functional approach, as a rule, the following main groups of company activity factors are compared:

- 1) indicators reflecting the efficiency of production and sales activities (the ratio of net profit to the net value of tangible assets, the ratio of net profit to net working capital);

- 2) indicators reflecting the production sphere of activity (the ratio of net sales, respectively, to the net value of tangible assets, to net working capital, to the value of inventories, to the value of tangible assets, to net working capital);

- 3) indicators characterizing the financial activities of enterprises: the period for paying current bills, the ratio of current debt during the year to the value of tangible assets, etc.

Indicators of labor productivity, return on investment, and profit margins are also compared. Methods for determining competitiveness based on the theory of effective competition are widely used in Western Europe and the USA.

Based on the theory of product quality, methods have been developed for assessing the competitiveness of a manufacturer based on a comparison of quality indicators. In a subjective assessment, product quality parameters are compared based on one’s own requirements for the product or the requirements imposed by an individual consumer; with an objective assessment - with a similar product from a competing company. If an enterprise produces heterogeneous products, then it is not possible to judge its competitiveness in a generalized form only on the basis of the qualitative characteristics of the product and a comparison of a system of indicators characterizing the economic potential of the enterprise is required.

Matrix methods are based on the idea of considering competition processes in dynamics. The theoretical basis of these methods is the concept of the life cycle of a product and technology, which distinguishes the following stages of this cycle from the moment the product appears until its disappearance on the market: introduction, growth, saturation and decline. Matrix methods are a convenient practical tool and are widely used by American firms.

Developed in the mid-70s. XX century The marketing firm Boston Consulting Group uses a matrix method for assessing the competitiveness of various goods both to analyze the characteristics of goods and to study the competitiveness of “strategic business units”: goods, individual companies, and the sales activities of industries. The matrix is built on the basis of two indicators. The vertical axis indicates the growth rate of market capacity on a linear scale, and the horizontal axis indicates the relative share of the entrepreneur or company in the market. All strategic business units are located on this matrix depending on their parameters and market conditions. The most competitive are those that occupy a significant share of it. To develop a strategy for behavior in the market, using the matrix method, they evaluate the level of competitiveness of the potential of both their enterprise and competing enterprises.

The competitiveness of an enterprise can also be determined using the methods of the American Management Association (table).

Checklist for analyzing the strengths and weaknesses of an enterprise in competition

Each column in the table is assigned a value:

- 1 - better than anyone. Clear leader;

- 2 - above average. Business performance indicators are quite good and stable;

- 3 -- average level. Stable position in the market;

- 4 - you should take care of improving your position in the market;

- 5 - the situation is truly alarming. The company found itself in a crisis situation.

sales market competitor products

This methodology offers a wide range of groups of indicators that allow, using a scoring system, to determine the weak point of an enterprise in comparison with competing enterprises.

The level of competitiveness of an enterprise's economic potential can be determined using the indicator method, which allows one to identify ways to increase competitiveness and develop a new strategy and management tactics. This method is based on a system of indicators, with the help of which a quantitative assessment of the competitiveness of the potential of an enterprise, company, corporation is determined. Each indicator - a set of characteristics that formally describe the state of the parameters of the object under study - includes a number of indicators that reflect the state of individual elements of this object.

The selected indicators are compared with similar standard or actual indicators from competitors. Each level of competitiveness of an enterprise corresponds to a certain set of indicators in the form of specific indicators. They form a matrix of the competitiveness of the enterprise's potential, which reflects the relative values of the selected indicators and their percentage-point expression.

To fill out the matrix at an enterprise, the creation of a data bank and the ability to receive and process external information are required. Without knowledge, study and comparison of information about the work of similar enterprises, none of the prestigious companies can count on long-term business success.

In the competitiveness matrix, the highest level of the indicator today is taken as 100% and, accordingly, 100 points. The scoring of the level of competitiveness is determined both for individual indicators and for the entire complex as a whole.

The methodology for assessing competitiveness used in marketing research is intended to:

- * to assess the competitiveness of an enterprise and its products during marketing research;

- * to evaluate and select optimal options for production plans (current and future) resulting from marketing programs;

- * to evaluate and select optimal programs for the reconstruction of production and enterprises, developed on the basis of marketing research;

- * to assess the performance of the structural divisions of the enterprise, as well as assess the results of the labor of employees to ensure the competitiveness of the enterprise;

- * to assess the technical and economic level and select optimal technological processes, equipment and structural materials used for the manufacture of products, in order to ensure the same thing - the competitiveness of the enterprise.

The methodology can be used as an independent method, when it is impossible to economically evaluate the compared decision options based on the totality of costs and results or other cost indicators, and also as a complementary one, when the compared options are economically approximately equivalent, but certain non-economic characteristics (social, economic) are important. , technical), based on the totality of which the assessment and selection of optimal solutions is carried out.

To compare and evaluate various solution options and select the optimal one, a table is compiled, where each row corresponds to a specific solution option, and each column corresponds to an evaluation indicator, based on the totality of which a comparison is made and the optimal option is determined. The number of compared options, as well as the number of evaluation indicators in each of them, can be any.

If the estimated indicators have the same units of measurement and are values of the same order, then you can evaluate and select the optimal solution based on their totality by simply summing up the indicators and comparing the results obtained. In this case, for each option (i.e. for each line), the sum of the estimated indicators taken with their own signs (“+” or “-”) is calculated. The line with the maximum (minimum) value of the amount will correspond to the optimal solution; the remaining amounts will correspond to less efficient options.

Since estimated indicators, as a rule, have unequal units of measurement and are quantities of different orders (they differ from each other by 10-100 times, and therefore the summation will be incorrect), it is impossible to evaluate and select the optimal option based on their totality without additional transformation or difficult. As such a transformation, it is advisable to reduce heterogeneous indicators to a dimensionless (relative) form as follows.

- 1. In each column of the table, the best of the compared evaluation indicators is found (the maximum value is selected for indicators, the growth of which increases the efficiency of decisions; the minimum value is chosen for indicators, the decrease of which increases the efficiency of decisions); the best values are underlined, and indicators requiring minimization are indicated with an asterisk.

- 2. The best estimated indicators found in each column are equal to one, and all other indicator values are expressed in fractions of one in relation to the best indicator of the corresponding column: if the maximum value of any indicator is selected as the best, then all other indicator values of this column divided by it, and if the minimum value of any indicator is chosen as the best, then it is divided by all other indicators of this column.

- 3. A new table is compiled from the obtained dimensionless (relative) values of the estimated indicators with an additional, not yet filled in column C.

- 4. For each of the rows of the table, consisting of dimensionless (relative) quantities, i.e. for each compared solution option, the sum of the indicators is determined, which is then divided by their number, so that the resulting result (arithmetic mean) is also expressed in fractions of unity and shows the difference between the real optimal solution option and a certain ideal one (which incorporates all the best estimated indicators) , which the unit must correspond to. The results obtained are entered in the additional column (C) of the table.

- 5. The line with the maximum value of the calculated arithmetic mean dimensionless (relative) indicator will correspond to the optimal solution; the remaining arithmetic average values will correspond to less effective options.

In the described method for assessing competitiveness, we proceed from the assumption of the same importance and equivalence of all evaluation indicators, on the basis of which decision options are compared. It can be used in cases where all estimated indicators are either truly equally important (equal), or when it is impossible for some reason to rank them by importance.

To take into account the unequal importance, unequal value of estimated indicators, due to various factors of a social, economic, scientific and technical nature, these indicators can be ranked and each of them can be given a numerical characteristic or coefficient, expressed in fractions of a unit and showing how many times (or by what percentage) some indicators are more important (priority) than others. In this case, it is necessary to comply with the condition: the sum of the specified significance coefficients (importance) for all evaluation indicators must be equal to one.

The ranking of estimated indicators and assignment of significance coefficients to them should be carried out by an expert or a group of experts, who can be economists, managers, scientific and technical specialists. To increase the reliability of their estimates, you should use well-known methods for processing results using mathematical statistics or probability theory.

After ranking and assigning significance coefficients, the dimensionless (relative) values of the estimated indicators of each column are multiplied by their corresponding significance coefficients and recorded in a new table. The optimal solution will correspond to the line with the maximum sum of dimensionless values of the evaluation indicators multiplied by their corresponding significance coefficients; the remaining amounts will correspond to less efficient options.

Competition (derived from the Latin word “concurre”, which means “to collide”) is the rivalry of independent economic entities for their segment in the sales market and economic resources. Competitiveness, accordingly, is the opportunity and ability of enterprises, industries, goods to compete for clientele, position, place in the economic pyramid, etc. - depending on the type of economic unit. Analysis of product competitiveness makes it possible to identify the strengths and weaknesses of competing companies, and increase the competitiveness of their products by improving their quality, introducing innovative methods and technologies.

An analysis of the competitiveness of an enterprise shows that the level of its competitiveness directly depends on the degree of support that it can receive from the state in the form of loans, insurance, exemption from part of taxes, provision of subsidies, provision of up-to-date information on market conditions, etc. In conditions of government support for the manufacturer, measures to increase the competitiveness of the enterprise can be carried out on a state scale, taking into account the market situation, and in accordance with the current problems of the manufacturer.

There are such concepts as “perfect competition” and “imperfect competition”. Perfect competition represents a situation where there are many consumers and producers in the product market; sellers (manufacturers) occupy such a small part of the market that they cannot dictate terms to others. Imperfect competition implies the presence of a significant quantitative difference between consumers and producers (some are few, others are many); in this case, competition consists in suppressing other producers and ousting them.

Imperfect competition is expressed in various forms: in the form of monopoly (monopolistic competition) and oligopoly. Monopoly is a form of ownership in which the right to own something belongs exclusively to one subject (object) or group of persons: the right to produce, sell, buy any good or product. It is implemented by setting prices, either monopolistically high or low. As a rule, there are antimonopoly organizations. Oligopoly is a type of economic market when an industry of a certain type of product is dominated not by one firm, but by several (usually 3 or more participants).

The goal of any competition is to obtain the most advantageous position in the market for its products.

Analysis of the competitiveness of an enterprise is determined by the competitiveness of the product, which is its ability to stand out from similar products and be exchanged for money under appropriate conditions. The competitiveness of a product is determined by such factors as the production activities of enterprises, the efficiency of the design bureau, the work of foreign economic organizations involved in the sale of goods in foreign markets, etc. It is also necessary to take into account the close relationship between the competitiveness of a product and its quality and technical level (although these concepts are not equivalent).

Each product has several stages of its existence, which are schematically expressed by the “product life cycle curve.” The first stage is introduction, one of the most costly periods in which the manufacturer must convince the consumer that the product is commercially useful. Next, the growth stage, during which the demand for the product grows rapidly. And finally, the maturity stage, when the demand for a product has reached its peak and is now gradually declining. The final period is the aging stage, when the demand for the product falls and, as a result, comes to naught. Correct calculation of the product life cycle helps to assess the competitiveness of the product over time, which allows you to draw the necessary conclusions and avoid unnecessary costs, as well as predict the further development of the sales market

Analysis of the competitiveness of an enterprise and analysis of the competitiveness of products is a qualitative or quantitative characteristic of a product. A single criterion is considered to be a simple characteristic, for example, the price of a product. The complex criterion, in turn, is divided into group and generalized. The group criterion includes the level of quality, level of novelty, image, price of consumption, and information content of the product. The generalized criterion takes into account such factors as product ratings.

In a market economy, an enterprise (company, firm) that has been profitable for a long period of time can be considered competitive. Analysis of the competitiveness of an enterprise in this case includes indicators that determine its competitiveness:

- - share in the global and domestic market;

- - the amount of net income per person employed in production;

- - the total number of people employed in production;

- - number of main competitors.

Assessment of the product market and its competitiveness

- 3. Assessment of competitiveness and stage of the product life cycle

- 1. Stages and methods of product market research

Structure of work on comprehensive market research

Comprehensive market research:

- 1. Study of market conditions

- - Determination of capacity and market share

- - Demand research

- - Demand forecasting

- 2. Product research

- 3. Analysis of competitors' activities

- - Study of prices and sales volumes

- 4. Sales analysis and forecasting

- - Study of consumer behavior

- - Product promotion research

Marketing Research Process Flowchart

- 1. Identifying problems and formulating research goals

- 2. Development of a research plan and selection of sources

- 3. Choosing a research method

- 4. Collection of information

- 5. Analysis of collected information

- 6. Presentation of the results obtained to management

- 7. Monitoring the reliability of the results

Markets are ranked according to the following criteria:

- · Market volume

- · Market share

- · Investment policy

- · Growth rates of industries consuming goods planned for sale in these markets

- · Geographical position

- · Import regulation (in case of foreign economic transactions)

- · Stability of the legal regime of the countries to which the goods are exported

- · Intense competition

- 2. Determination of capacity and market share

The market capacity (E) of any product (service) is calculated by determining the volume of its consumption using the formula:

E=Vp+Vi -Ve+ S0 - SK

where Vр is the volume of production and consumption of goods in the territory of a given market (physical units or monetary units);

Vi -- volume of imports of this product (physical units or monetary units);

Ve-- volume of exports of the same product (physical units or monetary units).

S0 - inventories at the beginning of a given period;

Sк - inventories at the end of a given period

In the simplest case of directly proportional dependence on demand, when forecasting the capacity of the sales market for a product (service), you can use the following formula:

where Еt is the market capacity in the forecast period t, t=1,2,...;

Et-1 -- market capacity in the base period;

Dt-1, -- demand for a product (service) in period (t-1);

Dt is the predicted demand for a given product (service) in the period

If a product is consumed over n periods, then the degree of market saturation with this product can be characterized by the following market saturation coefficient (Ksas):

P0 -- potential need for a product at the time it enters the market (potential demand);

Pt -- change (increase, decrease) of potential demand in period t;

Rt -- volume of sales (sales) of goods in period t.

Change in potential demand for goods Rt in period t:

Rt = lt + rr + bt x mt

lt - change in need (potential demand) due to the influence of various factors (advertising, the emergence of new substitute products, socio-economic policy, etc.);

rr is the volume of goods requiring replacement (consumed or expired) in period t;

mt - change in the number of buyers;

bt is the average quantity of goods purchased by one buyer in period t.

Knowing the market capacity and sales volume of a given product allows you to determine the market share owned by the enterprise

vi -- actual or forecasted sales volume of the i-th enterprise for a certain period (for example, a year), den. units;

E - actual or projected market capacity (total sales volume in a given market for the corresponding period), den. units

Bolodurina V.A.

Student, Khabarovsk Academy of Economics and Law

METHODS FOR ASSESSING COMPETITIVENESS OF AN ENTERPRISE

annotation

The article discusses several methods for assessing the competitiveness of an enterprise, which will allow for a qualitative analysis of specific competitive positions.

Keywords: competitiveness, methods for assessing competitiveness

Bolodurina V.A.

Student, Khabarovsk Academy of Economics and Law

METHODS OF ASSESSING THE COMPETITIVENESS OF ENTERPRISES

Annotation

The article deals with several methods of valuation of competitiveness of the enterprise that will make a qualitative analysis of the specific competitive position.

Keywords: competitiveness, competitiveness evaluation methods

1.The concept of competitiveness

In the activities of modern enterprises, the concept of competitiveness has begun to play an important role.

The competitiveness of an enterprise is usually understood as its ability to be in demand and successful in the market, compete with competing companies and receive more economic benefits compared to companies supplying similar products.

In general, competitiveness is a complex characteristic and it can be expressed through a set of indicators. To determine the position occupied by an economic entity in the domestic and foreign markets, it is necessary to assess its competitiveness.

The assessment of competitiveness that companies need to conduct is often based on intuitive feelings, however, it can be formalized by describing a range of indicators that allow the assessment itself and allow identifying areas for increasing competitiveness through identifying influencing factors.

The indicators that can be used to assess the competitiveness of a company are different and their set may differ depending on the assessment methodology used.

In modern science, there are six main approaches to determining competitiveness.

In accordance with the first approach, competitiveness is considered in terms of advantages over competitors.

The second approach is based on A. Marshall's theory of equilibrium. The manufacturer has no reason to switch to another state, and he achieves maximum profits and sales levels.

The third approach is to assess competitiveness in terms of product quality based on the compilation of polygonal profiles for various competence characteristics.

The fourth approach is a matrix method for assessing competitiveness, which is implemented through the compilation of matrices and preliminary selection of a strategy.

The fifth approach is structural, according to which the position of an enterprise can be assessed through such indicators as: the level of monopolization of the industry, the presence of barriers to new enterprises appearing on the market.

The sixth approach is functional; its representatives determine the relationship between costs and price, the volume of production capacity utilization, the number of products produced and other indicators. In accordance with this approach, companies are considered competitive if the production and further sale of goods are better organized and the management of financial resources is more efficient. For example, this approach is used by Dun & Bradstreet, a well-known American consulting firm.

The first group is indicators that characterize the efficiency of the production and trading activities of the enterprise. Among them are: the ratio of net profit to the net value of tangible assets, the ratio of net profit to net sales, and the ratio of net profit to net working capital is also used.

The second group of indicators represents indicators of the intensity of use of fixed capital and working capital. Representatives of this group include: the ratio of net sales to net working capital, the ratio of net sales to the net value of tangible assets, the ratio of fixed capital to the value of tangible assets, the ratio of net sales to the value of inventories and the ratio of inventories to net working capital.

The final group of indicators is represented by financial performance indicators. These are characteristics such as: the ratio of current debt to the value of tangible assets, the ratio of current debt to the value of inventories, the ratio of working capital to current debt, the ratio of long-term liabilities to net working capital.

We believe that the latter approach to determining competitiveness is the most accurate and reflects the market situation as fully as possible.

2. Methods for assessing the competitiveness of enterprises

To date, many methods have been developed for assessing the competitiveness of enterprises; they can be classified as follows (Table 1).

Table 1 – Methods for assessing the competitiveness of enterprises

3. Analysis of existing assessment methods

Matrix evaluation methods are quite simple and provide visual information. Moreover, they are based on an examination of the process of competition in development and, if true information is available, make it possible to carry out a fairly high-quality analysis of competitive positions.

Methods that are based on assessing the competitiveness of products link the competitiveness of an enterprise and the competitiveness of a product through the concept of “effective consumption”. It is believed that competitiveness is higher, the higher the quality of the product and the lower its cost. Among the positive features of these methods are: simplicity and clarity of the assessment. But at the same time, they do not give a complete picture of the strengths and weaknesses of the enterprise.

Let's consider methods that are based on the theory of effective competition. In accordance with it, the most competitive firms are considered to be those in which the work of all departments and services is best organized. Assessing the effectiveness of any such structure involves assessing the effectiveness of its use of resources. This assessment method is used most often in the assessment of industrial enterprises and includes all the most important assessments of economic activity, excluding duplication of specific indicators, and makes it possible to create an overall picture of the company’s competitive position in the domestic and foreign markets quickly and accurately.

The implementation of complex methods for assessing the competitiveness of an enterprise is carried out using the integral assessment method. This method includes two components: firstly, a criterion characterizing the degree of satisfaction of consumer needs, and secondly, a criterion of production efficiency. A positive feature of this method is the simplicity of the calculations and the ability to unambiguously interpret the results. At the same time, an important drawback is the incomplete description of the enterprise’s activities.

4. Choosing the best assessment methodology

Having analyzed the methods developed to date for assessing the level of competitiveness of an enterprise, we came to the conclusion that there is no method for comprehensively assessing the competitiveness of an enterprise that is ideal from all sides. The identified shortcomings of the existing approaches to assessing the competitiveness of enterprises cause very limited possibilities for the practical application of most of them. For example, the reliability of the results obtained, the ease of their identification and the possibility of further application significantly depend on the method by which the competitiveness of a non-manufacturing company is assessed.

For a correct assessment and further increase in the competitiveness of an enterprise, many methods have been developed that can be used both individually and in combination, depending on the tasks set before the assessment begins. The variety of methods existing today makes it possible to select the most effective and simple assessment method for each specific enterprise.

Literature

- Gryaznova A.G., Yudanov A.Yu. Microeconomics. Practical approach. – M.: KnoRus., 2011.

- Ilyicheva I.V. Marketing: educational and methodological manual / Ulyanovsk: Ulyanovsk State Technical University, 2010. – 229 p.

- Lazarenko A. A. Methods for assessing competitiveness [Text] / A. A. Lazarenko // Young scientist. - 2014. - No. 1. - pp. 374-377.

- Microeconomics. Textbook / ed. G.A. Rodina, S.V. Tarasova. – M.: Yurayt, 2012.

- Polyanichkin Yu. A. Methods for assessing the competitiveness of enterprises [Text] / Yu. A. Polyanichkin // Business in law. - 2012. - No. 3. - pp. 191-194.

References

- AG Gryaznov, Yu Yudanov Microeconomics. A practical approach. – M.: KnoRus., 2011.

- Ilicheva IV Marketing: teaching aid / Ulyanovsk: Ulyanovsk State Technical University, 2010. – 229 p.

- Lazarenko A.A. Methods of assessing the competitiveness / A. Lazarenko // Young scientist. – 2014. – No. 1. – S. 374-377.

- Microeconomics. Textbook/Ed. GA Homeland, SV Tarasovoy. M.: Yurayt 2012.

- Polyanichkin YA Methods of assessing the competitiveness of enterprises / Yu Polyanichkin // Business Law. – 2012. – No. 3. – S. 191-194.

It is set out in the Methodological Recommendations for the use of scoring in relation to competitive bids and qualifications of suppliers participating in competitions for placing orders for the supply of goods, works and services to meet government needs. These recommendations are also contained in the Letter of the Ministry of Economy of the Russian Federation dated June 2, 2000 No. AS-751/4-605 (hereinafter referred to as Methodology 2, section 2). In addition, the scoring method is quite widely represented in the scientific literature.

Method 2 is intended for use by government customers - recipients of funds from the federal budget and extra-budgetary sources. It allows you to obtain an individual and integral assessment of the price and non-price criteria contained in the applications of resource suppliers, and based on this, select a winner, as well as conduct a comprehensive assessment of the qualifications of suppliers and rank them according to this criterion. It can also be used by customers - recipients of funds from the budgets of the constituent entities of the Russian Federation, local budgets, extra-budgetary sources of financing, purchasing products for state and municipal needs.

The point method is currently quite often used in the domestic procurement practice of government and corporate structures. This is due to the simplicity of its calculations and clarity. The initial point of using this method is the formulation by the competition commission of the composition of the most important indicators for evaluating competitive applications.

- professional knowledge and qualifications of the supplier;

- supplier experience;

- reputation (image) of the supplier;

- supplier reliability;

- availability of financial resources, equipment and other material capabilities to fulfill the contract;

- bank guarantees, guarantees;

- availability of the necessary labor resources to fulfill the government contract.

The following are recommended as criteria (indicators) for evaluating proposals coming from alternative suppliers:

- bid (contract) price;

- payment terms distributed over time;

- validity period of the price declared for the competition;

- price adjustment conditions;

- operating, maintenance and repair costs associated with the purchased goods;

- terms (periods) of delivery of goods, completion of work (provision of services);

- functional or qualitative characteristics of the product (quality of work, services);

- forms of payments;

- payment procedure;

- conditions for providing guarantees for goods (work, services);

- the period for providing quality guarantees for goods (works, services);

- the scope of providing quality guarantees for goods (works, services).

A specific list of criteria characterizing the qualifications of suppliers and the content of competitive applications, as well as the relative importance of these criteria and the algorithm for selecting the winner, must be reflected in the competition documentation.

The criteria provided for in the tender documentation must be as objective and quantifiable as possible. In the case of using indicators that do not have a quantitative assessment, their expert assessment is used in compliance with the rules and procedures required when implementing expert methods (formation of an expert commission, procedure for interviewing experts, processing expert information, constructing the resulting assessment).

The essence of the scoring method outlined in Method 2 is as follows. Each criterion contained in the competitive application, characterizing the qualifications of the supplier, receives a score on a ten-point scale. For this purpose, the values of the analyzed criterion in natural units of measurement are ranked for all suppliers. The worst criterion value is assigned one point, the best - 10 points. Application of the interpolation method in the range of 1-10 points allows us to determine the score value of the criterion for each alternative supplier.

It is recommended to determine the score of the y-th criterion for the i-th supplier using the formula

where B y - score of the analyzed y"-th criterion (indicator) for the i-th supplier;

Ny- the value of the analyzed y"-th criterion (indicator) for the i-th supplier, in natural units of measurement;

N thin y - the worst value of the analyzed y"-th criterion (indicator) among all suppliers, in natural units of measurement;

L^ray - the best value of the analyzed y"-th criterion (indicator) among all suppliers, in natural units of measurement;

Bshchakh - maximum score (equal to 10);

Emin - minimum score (equal to 1).

![]()

Introduction into formula (9.8) for each y"-th criterion of the i-th resource supplier of two constants, namely 1 and (B max - B min), only

complicates it and accordingly increases the complexity of calculations. It is not possible to understand the meaning of introducing these constants into the formula under consideration.

Expression - ,J--hd/ , present in formula (9.8),

^ray y - -^khud U

is a well-known method for normalizing various criteria, i.e. reducing them to dimensionless quantities. Thanks to its isolated use, it becomes possible to scientific basis rank the criteria, set intermediate scoring values corresponding to them, and subsequently identify the winner of the competition (i.e., the resource provider). The advisability of assigning a unit to the worst criterion value among the suppliers participating in the competition also raises doubts. The worst numerical rating of a particular criterion should be assigned a zero, but not a unity, through which the value of the corresponding criterion is artificially inflated. Meanwhile, this problem is automatically solved in the case of separate use of the above formula, with the help of which the criteria normalization procedure is performed. In addition, using the same formula, the difficult problem of obtaining numerical estimates for criteria that occupy an intermediate position between the worst and best values is automatically solved.

According to Method 2, each criterion is assigned its own coefficient of importance (weight). It is established by expert means, taking into account the achievement of the goals of the competition, which most fully satisfy the customer’s requirements. When establishing weight coefficients, it is necessary to comply with the condition that the sum of the weight coefficients of all criteria must be equal to one. With the help of importance coefficients, numerical estimates for each individual criterion are weighed and their subsequent summation. The resource provider with the highest weighted total score is considered the most economically preferable. A contract is usually concluded with him for the supply of necessary goods to the customer (buyer).

If among the indicators characterizing the competitive application and (or) the qualifications of the supplier there are criteria that cannot be quantified, then an expert scoring of such indicators is used. For example, if the degree of compliance of a criterion with the requirements of the competition documentation is assessed by an expert on a ten-point scale, then the assessment according to Method 2 can be formed based on the following conditions:

- 1-3 points - partial compliance with the competition documentation;

- 4-6 points - full compliance with the competition requirements;

- 7-8 points - the criterion characterizing the supplier partially exceeds the requirements of the tender documentation;

9-10 points - the criterion characterizing the supplier significantly exceeds the requirements of the tender documentation.

The families of point estimates recommended above, in our opinion, were established subjectively, by uniformly distributing points across four groups. At the same time, such concepts as “partial and significant superiority of the criterion over the requirements of the competition documentation” remained unformulated in Method 2. Meanwhile, members of the same competition commission and experts may interpret these concepts differently, which makes it difficult to obtain objective scores based on the relevant criteria.

If obtaining reliable scores for various criteria is accompanied by the involvement of a significant number of experts, then in this case, to determine the degree of their validity, we recommend using concordance method, allowing to assess the level of consistency of expert opinions. If there is a very significant spread of opinions regarding the scores given at the previous stage, they can be clarified at a subsequent stage.

The use of the scoring method should provide for the preliminary determination of the working scale on the basis of which scores will be given for the criteria under consideration.

The most commonly used types of scales

Table 9.3

The best assessment by specialists and the most widespread use was the scoring scale proposed by T. Saaty. Taking this circumstance into account, it is advisable to use this scale when solving problems in the competitive bidding system.

The price, adjusted to take into account the timing of payments, is calculated using the formula

where Ts 3 is the price set in accordance with the application;

Q- annual refinancing rate of the Central Bank of the Russian Federation at the time of summing up the results of the competition, %;

K - number of days of payment delay.

To illustrate the calculation system in accordance with the scoring method given in Method 2, we will use the example of calculations given in it (Table 9.5).

Justification for choosing a supplier in accordance with the scoring method

Table 9.5

|

Criterion |

Criterion weight coefficient |

Unit measured |

Criterion values for different suppliers |

|||

|

Supplier number |

||||||

|

Competition item price |

||||||

|

Possibility of increasing the payment period with a maximum payment period after submitting payment documents |

||||||

|

1. Total: The price of the competition item, taking into account the timing of payments for Q = 40% |

||||||

|

Number of points |

||||||

|

Points based on weight |

||||||

|

2. Proposals to speed up the execution of the contract |

||||||

|

Reduced delivery time |

||||||

|

Number of points |

||||||

|

Points based on weight |

||||||

|

3. Experience in performing similar contracts |

||||||

|

Number of completed contracts |

Contract |

|||||

|

Number of points |

||||||

|

Points based on weight |

||||||

|

4. Availability of mobilization capacities |

||||||

|

Share of mobilization capacities in total production capacity (capacities of all suppliers are assumed to be equal) |

||||||

|

Number of points |

||||||

|

Points based on weight |

||||||

|

5. Overall assessment of suppliers' proposals |

||||||

Based on the calculations contained in table. 9.5, we can conclude that the economically preferable supplier is number four, since it has the highest total weighted estimate.

The disadvantage of the above calculation system is that it provides for an artificial transition from deterministic to point estimates. It is known that scoring, as mentioned above, is characterized by subjectivity, which negatively affects the reliability of the calculations.

It is advisable to use the scoring method when it is not possible to have deterministic, or interval, numerical estimates of the criteria under study. In the example discussed above, the experts had such numerical estimates. Therefore, converting them into scores seems unnecessary. This complicated the calculations and increased their labor intensity. To work with numerical assessments, it was necessary to use a normalization procedure in relation to the criteria, which allows one to reduce criteria with different units of measurement to dimensionless quantities. With such quantities it is possible to perform various mathematical operations, almost completely eliminating elements of subjectivity in calculations.

The scope of application of the scoring method extends to situations where, according to the criteria under study, it is impossible to obtain numerical deterministic estimates in those units that are characteristic of this criterion (for example, rubles, days, percentages, etc.). It can be used when all assessment criteria have only verbal (verbal) characteristics. However, solving the problem associated with choosing the most competitive resource supplier in this case will require the use of special calculation methods.

The scoring method, as well as the sum of places and the sum of first places methods (discussed below), is advisable to use to solve problems when all the criteria appearing in the calculations are characterized by a unidirectional influence on the desired result (for example, the change in profit volume desired for a business is usually directed towards in the direction of increase, and costs or expenses - in the direction of decrease). The problem associated with the need to simultaneously consider in the problem criteria that change in the directions of maximization and minimization can be easily solved if we use the natural procedure for their normalization (reduction to dimensionless quantities).

The advantage of the scoring methods and the sum of places and the sum of first places is their simplicity and the relatively low complexity of calculations.

Thus, the significant disadvantages of the scoring method set out in Method 2 are the following.

- 1. The feasibility of using the method applies mainly to simple, standard products, the main properties of which are quantitative certainty (in number, size, weight), simplicity and qualitative homogeneity, divisibility and replaceability with any other product from the same batch.

- 2. Subjectivity in assigning the number of points occupying an intermediate value between the maximum and minimum numerical scores of the criteria.

- 3. The emergence of additional difficulties in establishing the most appropriate rating scale, presented in the form of a certain acceptable range of variation (for example, delivery times for goods can be set with an accuracy of several weeks).

- 4. Excessive (or artificial), unjustified complexity and laboriousness of calculations associated with the transition from numerical assessments of criteria to subjective scoring.

- 5. The possibility of choosing as the winning supplier one that has sufficiently high values (in points) of private criteria (i.e. less significant compared to others) and at the same time low values of weight coefficients is not excluded. This solution cannot be considered the best.

- 6. Creating expert councils to establish scores for various criteria is a rather lengthy and expensive process.

Note that at present there are no sufficiently strict methods for selecting experts to ensure unconditional success during the examination. Modern mathematical methods for establishing expert estimates are mainly methods of statistics of objects of a non-numerical nature.

To make informed management decisions when conducting competitive bidding, it is always necessary to rely on practical experience, scientific knowledge and intuition of specialists acting as experts. At the same time, methods of expert assessments are methods of organizing work with specialist experts and processing their various opinions, expressed in quantitative and (or) qualitative form, in order to prepare information for decision makers (DMs).

To carry out work related to obtaining expert assessments, a working group is created at the site. Her responsibility includes organizing, on behalf of the decision maker, the activities of experts united in an expert commission.

A sufficient number of methods for obtaining expert assessments are known from the specialized literature. In one situation, they work with each expert separately; he does not even know who else is an expert, and therefore expresses his opinion regardless of authorities. In another situation, experts are brought together to prepare materials for decision-makers. At the same time, experts discuss the problem with each other, learn from each other, and discard irrational proposals. In some cases, the number of experts is fixed and such that statistical methods of checking the consistency of opinions and then averaging them allow informed decisions to be made. In other cases, the number of experts increases during the examination process, for example, when using the snowball method.

Currently, there is no scientifically based classification of expert assessment methods, as well as unambiguous recommendations for their use. At the same time, very useful information can be found in the book “Statistical methods for analyzing expert assessments”.

As noted above, to take into account the different economic significance for a specific object (enterprise, organization) of the criteria used in the calculations, importance coefficients are used. Their establishment is the decisive moment in obtaining the final solution to the problem. In some cases, the possibility of manipulation by the customer with the final results of competitive bidding by establishing very specific weighting coefficients for the criteria under consideration cannot be ruled out. The consequence of changing the importance coefficients according to the criteria will be a change in the winner (i.e., the supplier with the greatest potential). Taking into account this circumstance, it is fundamentally important to know modern methods for establishing reasonable weight coefficients. Let us give a classification of these methods.

Rating an estimation of competitiveness of the processing enterprises of agriculture

Mansurov Ruslan Evgenievich

Candidate of Economic Sciences,

Deputy Director of the Research Institute,

Associate Professor, Department of Marketing and Economics, IEUP

Annotation. This article presents one of the possible approaches to assessing the competitiveness of the activities of processing enterprises of agro-industrial holdings based on the formation of ratings.

In present clause one of the probable approaches to an estimation of competitiveness of activity of the processing enterprises of the agroindustrial companies is submitted on the basis of formation of a rating.

Keywords. Competitiveness, economic efficiency, agro-industrial complex, processing enterprises.

Competitiveness, economic efficiency, agriculture processing enterprises.

In the context of the ever-increasing global financial crisis, methods and methods for qualitatively assessing the competitiveness of agro-industrial enterprises, based on indicators that comprehensively characterize the effectiveness of their economic activities, are becoming particularly relevant. Processing enterprises are no exception to this; on the contrary, the holding management structure currently established in agro-industrial companies requires the use of the latest methods for assessing the competitiveness of each division. In particular, processing enterprises in order to identify “strong” and “weak points” in the activities of the entire holding.

An analysis of literary sources indicates a certain interest shown by the management of a number of agro-industrial companies in the issues of rating assessment of the activities of the enterprises that are part of them. Thus, some authors propose to carry out this assessment based on a number of financial indicators, which makes it possible to evaluate the financial activities of the enterprise under study for a certain reporting period, but does not allow a comprehensive assessment of the results of all economic activities of the enterprise.

We will consider the proposed approach to assessing the competitiveness of a processing enterprise using the example of the activities of a conventional sugar factory (with industry average values of economic activity indicators).

where is the rating assessment of the competitiveness of the agro-industrial enterprise; - meaning i– th rating indicator; - weightiness i– th rating indicator, n– number of indicators.

To assess the competitiveness of a sugar factory, a table was first filled out, which reflected the values of competitiveness indicators previously determined by experts for the reporting quarter (Table 1, columns 1-8).

Thus, a deviation of the values of actual indicators of economic activity from planned, normative or actual for the previous year was obtained.

|

Indicator name |

Unit. |

Norm |

Plan |

Fact for the past period |

Fact |

Off in n.e. |

Estimation of the indicator in USD |

Weight of the indicator |

Estimation of the indicator in USD taking into account weight |

|

|

Marketing performance indicators |

||||||||||

|

fulfillment of sales plan |

||||||||||

|

return on sales |

||||||||||

|

Financial performance indicators |

||||||||||

|

debt level |

||||||||||

|

accounts receivable |

||||||||||

|

creditor |

||||||||||

|

execution of cash flow budget |

||||||||||

|

execution of the consumable part |

||||||||||

|

fulfillment of the revenue part |

||||||||||

|

Economic performance indicators |

||||||||||

|

profitability of production |

||||||||||

|

profit growth |

||||||||||

|

Intellectual capital development efficiency indicators |

||||||||||

|

staff turnover |

||||||||||

|

Performance indicators of production activities |

||||||||||

|

Output of granulated sugar |

||||||||||

|

Performance indicators in the field of quality |

||||||||||

|

costs of processing defective products |

||||||||||

|

X – these cells are not filled in |

0,889 |

|||||||||

The approach provides the possibility of comparing the actual indicators of the enterprise under study with industry average indicators or indicators of the leading company.

The next stage of assessment is to bring the resulting deviations into a form commensurate with each other in order to obtain a single rating value. For this purpose, the values of the existing deviations were reduced to a conditional form. It is proposed to accept that a certain deviation in natural units (n.e.) corresponds to a certain value of the deviation in conventional units (a.u.). The rules by which this comparison is made are set out in Table 2.

table 2

Rules for bringing natural values of indicators of competitiveness of agro-industrial enterprises to a conditional form

|

Indicator name |

Off in n.e. |

Evaluation of the indicator in USD |

Matching rules |

|

|

|

||||

|

Fulfillment of the sales plan |

||||

|

Return on sales |

The value of this indicator is defined as the ratio of fact to plan |

|||

|

|

||||

|

Debt level |

||||

|

accounts receivable |

If the normative value is not exceeded by fact, this indicator takes the value of 1.u., otherwise 0.u. |

|||

|

creditor |

||||

|

Execution of cash flow budget |

||||

|

execution of the consumable part |

In case of overexpenditure, the value of this indicator is taken as 0.u.; in case of saving, the value of this indicator is determined as the ratio of plan to actual |

|||

|

fulfillment of the revenue part |

||||

|

|

||||

|

Execution of the expenditure side of the budget of income and expenses |

When there is an overexpenditure for this item, the value of the indicator is taken as 0 cu; when saving, the value of this indicator is determined as the ratio of the fact to the plan. |

|||

|

Profitability of production |

The value of this indicator is defined as the ratio of fact to plan. |

|||

|

Losses from accidents and failures caused by personnel |

If there are losses due to the fault of personnel, the value for this indicator is assessed as 0 cu, otherwise as 1 cu. |

|||

|

Return on equity |

||||

|

Innovation profitability ratio |

The value of this indicator is determined as the ratio of the fact to the fact of the previous year |

|||

|

Profit growth |

If this indicator exceeds the level of the previous year, the value is calculated using the formula 1+X cu, where X is the value of the existing increase in profit, which is defined as the ratio of the column “deviation in cu.” to the column "actual for the previous period". Otherwise 0.u. |

|||

|

|

||||

|

The cost of a company's intellectual capital |

If this indicator exceeds the level of the previous year, the value is calculated using the formula 1+X cu, where X is the value of the existing increase in the value of intellectual capital, which is defined as the ratio of the column “deviation in cu.” to the column "actual for the previous period". Otherwise 0.u. |

|||

|

Staff turnover |

If the staff turnover value is more than 5%, as well as in the case of an increase in this indicator compared to the level of the previous period, the value of this indicator is assessed as 0 cu, otherwise it is assessed as (1+X) cu, where X is the value of the existing decrease personnel turnover, which is defined as the ratio of the column "deviation in n.e." to the column "actual for the previous period" |

|||

|

|

||||

|

Output of granulated sugar |

If the standard level is exceeded, the value of this indicator is determined as 1+X cu, where X is the value of the existing overfulfillment. In this case, an overfulfillment of 1% corresponds to 0.01 c.u. Otherwise the value is assumed =0 |

|||

|

Beet losses during storage and transportation |

If the standard level is exceeded, the value of this indicator = 0 cu, if not exceeded, the value of this indicator is determined as 1+X cu, where X is the value of the existing savings. In this case, a savings of 1% corresponds to 0.01 USD. |

|||

|

|

||||

|

Costs of processing defective products |

If this indicator exceeds the level of last year, the value is taken equal to 0 cu. If this indicator decreases compared to the level of last year, the value is calculated using the formula 1+X cu, where X is the value of the existing reduction in costs for processing scrap, which is defined as the ratio of the column "deviation in n.e." to the column "actual for the previous period". |

|||

Using comparison rules, conditional estimates of deviations of selected indicators of the economic activity of the enterprise under study for the reporting period were generated (Table 1, column 9).

Next, the weight of the indicators was determined. For this purpose, a cost assessment was made of the fulfillment or non-fulfillment of these indicators. It did not take into account whether this assessment would be negative or positive (economic effect or damage); the value was taken modulo (Tables 3, 4).

Table 3

Determining the weight of competitiveness indicators of a conventional sugar plant for the 4th quarter. 2009

|

Indicators |

Unit. |

Valuation of the indicator |

Weight factor |

|

|

Marketing performance indicators |

||||

|

Fulfillment of the sales plan |

||||

|

Return on sales |

||||

|

Financial performance indicators |

||||

|

Accounts receivable level |

||||

|

Accounts payable level |

||||

|

Execution of the expenditure side of the cash flow budget |

||||

|

Execution of the revenue side of the cash flow budget |

||||

|

Economic performance indicators |

||||

|

Execution of the expenditure side of the budget of income and expenses |

||||

|

Profitability of production |

||||

|

Losses from accidents and failures caused by personnel |

||||

|

Return on equity |

||||

|

Innovation profitability ratio |

||||

|

Profit growth |

||||

|

Intellectual capital development performance indicators |

||||

|

The cost of a company's intellectual capital |

||||

|

Staff turnover |

||||

|

Performance indicators of production activities |

||||

|

Output of granulated sugar |

||||

|

Beet losses during storage and transportation |

||||

|

Performance indicators in the field of quality |

||||

|

Costs of processing defective products |

||||

Table 4

Cost assessment of the existing deviations in the actual values of the competitiveness indicators of a conventional sugar plant for the 4th quarter. 2009

|

Indicators |

Unit. |

Values |

|

|

Marketing performance indicators |

|||

|

Fulfillment of the sales plan |

|||

|

Amount of overspending/savings |

|||

|

Return on sales |

|||

|

cost of sales |

|||

|

cost of products that could be sold if the return on sales indicator is met |

|||

|

Financial performance indicators |

|||

|

Level of receivables and payables |

|||

|

absolute deviation from the accounts receivable standard |

|||

|

absolute deviation from the accounts payable standard |

|||

|

Execution of cash flow budget |

|||

|

Economic performance indicators |

|||

|

Execution of the expenditure part of the budget of income and expenses |

|||

|

absolute amount of overexpenditure/consumable savings |

|||

|

Profitability of production |

|||

|

absolute deviation of the indicator |

|||

|

production cost |

|||

|

cost of products that could be produced if the production profitability indicator was met |

|||

|

Losses from accidents and failures caused by personnel |

|||

|

actual amount of losses from accidents and failures caused by personnel |

|||

|

Return on equity |

|||

|

profit growth |

|||

|

Innovation profitability ratio |

|||

|

company profit from innovation implementation |

|||

|

Profit growth |

|||

|

profit growth |

|||

|

Intellectual capital development performance indicators |

|||

|

The cost of a company's intellectual capital |

|||

|

absolute amount of overexpenditure/revenue savings |

|||

|

Staff turnover |

|||

|

Actual number of personnel |

|||

|

Actual staff turnover |

|||

|

actual costs of training new employees |

|||

|

average actual costs for training 1 new employee |

|||

|

Valuation of staff turnover |

|||

|

Performance indicators of production activities |

|||

|

Granulated sugar output |

|||

|

Yield of granulated sugar according to the standard |

|||

|

The yield of granulated sugar in fact |

|||

|

Decrease/increase in granulated sugar production |

|||

|

Beet losses during storage and transportation |

|||

|

Volume of beets for processing |

|||

|

Standard losses, % |

|||

|

Actual losses |

|||

|

Excess/decrease against norm |

|||

|

Output of granulated sugar |

|||

|

Wholesale price of granulated sugar |

|||

|

Cost of unproduced granulated sugar |

|||

|

Performance indicators in the field of quality |

|||

|

Costs of processing defective products |

|||

|

absolute deviation of the indicator |

|||

Having received the weight of the indicators and multiplying it by the corresponding values of these indicators, we obtained estimates of the indicators taking into account the weight (Table 1, column 10-11). Having summed up these values, we obtain the final rating assessment of the competitiveness of a conventional sugar plant for the 4th quarter. 2009

This methodology is designed in such a way that the higher the competitiveness rating, the better the activity for the period under review. The minimum possible rating is 0. In the example we considered, the rating of the sugar factory under study was 0.889.

Obtaining a competitiveness rating for a reporting period for one enterprise does not make it possible to assess the effectiveness of business activities for a given period. To conduct a comparative analysis, the dynamics of these indicators for various agro-industrial enterprises and/or reporting periods is necessary.

Bibliography.

1. Rabinovich, L.M. Land market: problems, search, solutions / L.M. Rabinovich, V.G. Timiryasov, A.A. Sadretdinova. - Kazan: Taglimat Publishing House IEUP, 2005.

2. Khairullin, A.N. Factors of corporate sustainability / A.N. Khairullin, V.G. Timiryasov, L.M. Rabinovich. – Kazan: Taglimat Publishing House IEUP, 2006.

Such work" Sergey Demyanov

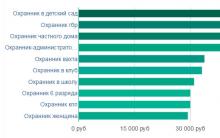

Unsweetened life Can a diabetic work as a security guard?

How long does it take for a parcel from China to Russia from Aliexpress?

How to find a good job - a detailed guide for those who want to get their dream job!

Presentation on the topic “Acmeism