Hello, friends!

What is enterprise planning? This is the optimal allocation of resources to achieve its goals. And what is the life of a single person or family? Isn't it the same?

Then why does any enterprise consider it vital to engage in planning, but a person (family) does not? The enterprise has a development plan, every citizen (family) should have a personal financial plan. How to compose it? This is what we will talk about today.

What is LFP and why is it needed? All of us have goals. These can be simple household goals, such as living to paycheck without debt, making repairs next year, or upgrading your computer.

Or maybe global ones - saving up for a car, an apartment, educating children, etc. You can figure out in your mind how much money you will need to achieve your goal, calculate income for this period, subtract expenses. To understand that with such a salary nothing can be achieved at all and go to the bank for a loan.

But even if you write down on a regular sheet of paper what you tried to keep in your head, the picture may change. A clear demonstration of the discrepancy between your expenses and income is more sobering than any medicine. Where exactly is the money flowing, how to stop this uncontrolled process, and what should be done so that your money river is replenished every year, and does not eventually turn into a swamp? These questions will be answered by a personal financial plan.

LFP is a financial instrument that helps to analyze and optimize the cash flows in which we are throughout our lives. And this allows, in turn, to develop a mechanism for achieving the goals set, to see the entire financial picture in its entirety for several years ahead.

Some people have been planning since childhood, then this habit brings excellent dividends in adult life.

I will tell about myself. I was born in the Soviet Union and went to pioneer camps in the summer with gingerbread, dryers and cookies in my bag. Everything is as it should be. Only for all the homemade gifts ended after 3-4 days, and only I had enough before the arrival of my parents with a new portion of treats. The fact is that I divided my reserves by the number of days remaining until the day of the visit and ate exactly as much as I measured out. And no more gingerbread.

In adult life, the ability to save and control ourselves allows our family to always live on income and get more out of life than you can expect from our salary. And ever since I became interested in the question personal finance things got even better. Therefore, on my own experience, I responsibly declare that LFP works. You just need to correctly compose it and proceed with its implementation. The result of the process should be financial independence.

How to make a personal financial plan?

Stages of LFP construction

Stage 1. Goal setting

In order to justify ourselves in our own eyes, we often convince ourselves that we are unable to achieve the goal. In fact, we are not powerless, but weak-willed.

François La Rochefoucauld

Where to begin? Set aside an hour of free time. Get paper and pen ready. Write down what you want to achieve in the near, medium and long term. In other words, set goals. It just needs to be done right.

| Wrongly formulated goal | Well formulated goal |

| Make repairs in the apartment | Make repairs in the apartment in 6 months. It will take about 100,000 rubles. |

| Go to the sea in summer | Go to the sea with the whole family in the summer of 2019 in Sochi. Estimated costs will be 100,000 rubles. |

| Buy a new car | In May 2020, buy a new Hyundai Creta car. Taking into account the sale of the old car, the surcharge will be 500,000 rubles. |

| Save up for your child's education | For 6 years, save up for the education of a child at Moscow State University. 4 years for 300,000 rubles. Total will need 1,200,000 rubles. |

The meaning, I think, is clear. Goals must have:

- time limit,

- monetary value,

- specifics (place of rest, number of people, brand of car, name of the university, etc.)

And they also need to be realistic. For example, I never set a goal for our family to buy a villa on an island in the ocean. Because I can distinguish a fantasy from a real dream, which must always come true.

Stage 2. Financial analysis

After setting goals, you should conduct a thorough analysis of your income, expenses, assets and liabilities. If you are leading, then no difficulties will arise. If not, then it is better to postpone the preparation of the plan for 2 - 3 months. And for this period, daily record all your income and expenses to the penny.

You can do this in a notepad with a regular pen, in Excel or Google Doc spreadsheets, in special programs on a computer or applications on a smartphone. Choose the method convenient for you. The main thing is to do this daily and to accustom the family to report their money receipts and expenditures to you if you make up the family PFP.

Without waiting for the data on monthly income and expenses, make another table on the analysis of assets and liabilities.

Assets are what brings you income. Liabilities are things that require expenses.

| Assets | Liabilities |

| An apartment that is used for renting out. The rental price minus utility costs is 20,000 rubles. per month. | The apartment, which is used for housing, has an area of 150 sq. m. |

| Deposit in a bank for 3 years at 7% per annum with interest capitalization. The initial contribution is 100,000 rubles. | Car Hyundai i30 2016 release. |

| A metal account in gold in the amount of 200,000 rubles. | Dacha 40 km from the city, which is used for family summer holidays. |

| Currency deposit in US$ for 1 year at 1.5% per annum in the amount of 3,000$. | Land plot for individual housing construction with an area of 10 acres, 3 km from the city with communications. |

| Bank loan for 3 years at 20% per annum. |

Please note that some articles from liabilities can be easily converted to assets. For example, rent out an unused garage or sell land if you do not plan to build a house on it. Likewise, a car, if it is used to generate income (taxi, freight), can go to the “Assets” section.

After you have a visual layout of your assets and liabilities, monthly income and expenses, you can proceed to the next step, “Review goals and prioritize”.

Stage 3. Adjustment of goals and optimization

This is one of the most difficult and painful stages. We have a lot of goals, we want to achieve them as soon as possible. But analysis of income and expenses shows that this is impossible. What to do?

Possible ways to solve the problem:

1. Review goals to highlight the most important and priority.

If the neighbors “leaked” you, then, of course, repairs in the apartment can be considered as priority task. And if not? Maybe we should postpone the repair for a year or two? Reread all the goals you wrote. What do you really want for real? Not that it was like a neighbor, friend, colleague. And not something that raises the status.

2. Adjustment of goals to change the timing of achievement and their cost.

It's great to want the latest iPhone, but with summer and another family vacation coming up, would you trade it for a piece of iron?

Although there are many such examples. My friends saved up for a year to travel to Thailand. But they bought a large plasma TV with this money, which ideally suited their empty wall. new apartment. To each his own.

3. Cost optimization.

If you already have before your eyes your expenses for 3 months, then you can easily find holes in the budget, and sometimes real “black holes” where money is poured. Buying expensive gifts, celebrating another birthday on a grand scale, going to cafes and restaurants, etc. The list is endless.

Just look at what is happening in supermarkets before the New Year. At this moment it seems to me that people whole year they didn’t eat anything, so that later they would get drunk ... Sorry, eat and drink for the whole next year. They smash the shelves with products, gifts, which the store employees kindly formed for you. It doesn't matter what you buy and at what price. The holiday is...

About bad habits - a separate conversation. I tried to convince people who smoked a pack a day to calculate their spending on cigarettes per year. Yes, they were horrified, but they did not quit. The same, by the way, applies to a cup of cappuccino in your favorite cafe every morning.

There are many . And it is not at all necessary to deny yourself or your family some weaknesses. In my article on the topic of saving, I showed far from all the tricks that help, for example, my family to live at a decent level and regularly save money to achieve goals.

4. Increase in income.

A great motivating and developing way. It was he who helped me get out of the budgetary swamp, into which university employees were driven by miserable wages and humiliating attitude from the state. I started learning new profession I have regained my self-respect and am confidently on my way to financial independence. And working at the university is now more of a hobby for me than a source of income.

What helped me and can help anyone:

- patience and perseverance - I had to study tons of information on the Internet to find something that could interest me in the issue of additional income;

- self-education - it is not necessary to take expensive courses to learn, start with free lessons, webinars, trainings, articles, books;

- discipline - every day I devoted to education for several hours;

- focus on results - I had a clear goal ahead, so nothing and no one could stop me.

And do not whine about beggarly wages and the indifference of the state. Nobody owes you anything. Do your own life and it will turn to face you.

All 4 considered methods can and should be applied simultaneously. Then it will be whole system rather than single attempts to change the situation for the better. And as they say, you can't argue against the system. Its main goal is to free up money from your budget for investment.

Stage 4. Creation of a reserve fund

What is a reserve fund and why is it needed, I have already considered in my article on financial independence. Therefore, I will only mention here that it is an obligatory part of a personal financial plan. Without an airbag, it will be painful to fall if something goes wrong in life. You were left without a job or your salary was drastically reduced, a serious illness requiring expensive treatment, and many other factors that are difficult to foresee. But you can protect yourself.

Have a bank deposit equal to 3 or 6 months of expenses, and your psychological well-being will be much better. And this will give confidence that you will solve all the problems during this time.

If it happens that the fund is completely or partially spent, the first thing you should do after the normalization of the situation is to replenish it to the optimal size.

Stage 5. Formation of an investment portfolio

This is the last and crucial stage, the result of which will be the achievement of your goals and the pride of your children for such “cool” parents. Where to start investing? From a plan, of course. But here one cannot do without the experience of competent financiers and consultants. Not everyone can afford them, although the costs pay off several times over.

There are our domestic experts. They are a real guide to action for me. You can gain experience in investing on your own, no one argues. Trial and error will give the result. The main thing is that it be exactly the one you are counting on.

My friend invested all the money he had in one of the mutual funds. For 1 - 2 years, he lost a lot of value. An acquaintance in a panic rushed to save the remaining savings. At the same time, he immediately violated 2 conditions for successful investment:

- Did not diversify the portfolio, i.e. invested all the money in one asset.

- I started to panic and do stupid things. Investing in mutual funds is a long-term project for several years. The fund both loses in value and rises. You can't rush. 1 year is not an indicator.

As a result, he does not trust any investment instrument and prefers to keep money in a bank account.

Determine your investment strategy. What risk are you willing to take?

Distinguish:

- conservative investment,

- moderate,

- high-risk or aggressive.

For different purposes - their investment instruments. But I repeat once again - without special knowledge, you can make a lot of mistakes.

The investment portfolio should include instruments with different levels risk. The older you are, the higher the proportion of conservative investments. Make a simple table for yourself. Under each type, put your share. For example:

| conservative investment | Moderate investment | Aggressive investments |

| 45 % | 35 % | 20 % |

Now in each group you need to write the selected investment instruments.

When the portfolio is formed, the main and most difficult part of the LFP remains - this is its implementation. Basic principles that you must strictly follow:

- Development of LFP for yourself, for your goals, income and expenses, and not blindly copying examples from books.

- Rigid discipline, which manifests itself in the regularity of investing over a long period of time.

- Annual revision of the plan and its adjustment taking into account external and internal changes in the situation.

- Diversification of the investment portfolio, i.e. investing money in various assets.

Conclusion

A personal financial plan is the most important document in your life. And the sooner you realize this, the easier it will be for you to fulfill it. Indeed, in planning, it is important to take into account all types of resources, including time.

If you wish, you can even draw up not one, but several plans. It all depends on the chosen type of planning. A short-term plan will help you save up for the most necessary purchases in the coming months. Medium-term - will allow you to achieve the goals that you planned to achieve in a few years. And long-term - it is worth compiling if the priority goal is to ensure a decent old age in a couple of decades.

But any of them can remain on paper if you don’t pick up a pen and notebook right now and write down your goals. A with tomorrow Do not start recording your income and expenses every day. I did this six months ago. Catch up.

Based on a survey of one and a half thousand people living in cities and rural areas, the Romir research holding found out how much money a Russian family needs for a normal life. According to the results of the study, in cities with a population of over a million, respondents called an income of 91.6 thousand rubles a month as “normal” for a family of three, and residents of rural areas - 61.5 thousand rubles a month.

Thus, the average Russian family needs 75.9 thousand rubles a month for a normal standard of living. However, in practice, it often turns out that even the most optimal amount of money ends before the next salary arrives. The reason for this lies in the large number of small unplanned expenses that are not controlled in any way.

Only 54% Russian families keep a written record of income and expenses of the family budget. At the same time, almost every tenth person does not know how much money he has and how much will be spent within a month.

Central Bank experts are confident that the financial plan will save and increase the family budget. And we will tell you what a family financial plan is, how to draw it up correctly, and how to control spending with it.

What is a family financial plan?

This is a long-term forecast of all cash spending for any period of time. It indicates how much money family members will earn during the specified period, and how they spend it, what they save for, and what risks they take into account.

According to popular belief, a financial plan is needed to spend less. But in fact, it is needed in order to get more for the same money. In fact, this life hack will save you from surprises.

Financial plan it will help you understand how to distribute income and expenses so that you can save and accumulate the necessary amount for the set period, or predict changes in expenses if you have to pay monthly.

What should be considered before making a plan?

Interests of all family members

The whole family should be aware of each other's personal goals (clothing for children, vacation for parents, and so on) and common goals. This will help to avoid financial conflicts.

insurance protection

Many families neglect life insurance, limiting themselves to compulsory medical insurance policy. But still, it is worth considering all possible risks: if suddenly one of the breadwinners cannot provide for the family, the family budget may not be ready for such a force majeure. Therefore, it is recommended to make insurance for each working family member in order to minimize the consequences of disability.

Save for retirement on your own

It is worth recognizing that the employer's pension contributions do not at all mean good security in old age. Therefore, think about the “pension” column in your financial plan.

Saving

A financial "airbag" can help in case of sudden expenses or loss of a job. At the same time, you can save money not only from your salary, but also use other opportunities such as tax deductions, or an investment account.

Inflation

An increase in the general level of prices for goods and services is usually not taken into account by anyone when planning savings. In order for your plan to reflect the real picture, plan for possible losses from inflation.

How to start?

Start keeping a spreadsheet of income and expenses.

Two or three months will be enough to understand how much money the family earns and how you spend it.

Accounting must be kept daily and record even the smallest expenses, which make up a significant part of the expenses. For convenient accounting, we recommend distributing expenses by category: rent, food, entertainment, medicine, purchases.

Analyze income and expenses

Find out what expenses you recur each month and how much you have to spend on them. Usually, most of the expenses are spent on medicine, clothing, food, transport and communications.

After calculating the mandatory items of expenditure, determine how much you can save or spend on other needs.

Build assets and get rid of liabilities

All purchases and property can be roughly divided into two categories: assets and liabilities. Assets are something that somehow increases income, and liabilities are something that does not bring income or reduces it. For example, a car can be an asset if it helps you work better and make more money, or a liability if you buy it to maintain status, for example.

Formulate goals

Determine the time frame for which you plan to achieve these goals. Planning can be long-term (5, 10 or even 20 years) or short-term (several months).

There are different ways to save money for different purposes. For example, you can have several envelopes, sign their purpose (“for vacation”, “for taxes”, “for unforeseen expenses” and others) and add cash there. Or you can make a separate contribution or deposit and transfer part of the money to this account.

Make a plan

List your monthly expenses. Consider different options for achieving your goals: saving, borrowing money, getting a loan. For each goal, choose the ones you want to stick to in your plan and in your life. Don't forget to factor in the amount you'll be putting away in savings.

A plan helps you keep track of progress towards your goal, notice problems early, adjust expenses when situations change, and stay motivated if you're dealing with long-term and challenging goals.

How to simplify accounting?

On the Internet, you can find many convenient scheduler programs for computers and smartphones that help you manage your budget and allocate finances wisely. For example, the Azlex Finance program can be used by several people both on a computer and on a phone. She deducts mandatory expenses for rent, education, or loans from total income, and distributes the remaining amount proportionally over days or weeks. There are also programs like Easyfinance, to which you can link bank card, and when paying for services or goods, the transaction will be automatically entered into the program. Or "Home Economics", which takes into account inflation.

But if you are more accustomed to controlling everything on your own, then the Central Bank offers an example of the simplest family financial plan - based on a table with formulas.

It can be used as the basis for your family plan.

Budget Rules

- Form a "reserve fund" by saving part of your salary. The amount can be from 10% to 20% of the total income, and then gradually increase.

- Make a monthly spending plan. Count everything - from groceries to mobile bank payments. This way you will understand how much money is usually spent on each family member and what you can save on.

- Make a plan for your annual spending so that you are no longer surprised. Do not forget about insurance, pension and wardrobe.

- Consider entertainment, which is also an important part of the family budget.

- Set yourself a specific goal. It is much easier to strive for something if you can imagine the result.

It is important to remember that saving does not mean permanent restrictions. A significant part of purchases is made spontaneously. And unplanned spending often causes holes in the budget. Therefore, we believe that saving is not a shame, making a shopping list is prudent, and buying the right thing cheaper than expected is nice.

Personal financial plan: instructions for drawing up

Making a personal financial plan

Many successful investors, when asked about the reasons for their success, often mention such a seemingly trivial thing as a financial plan - a personal enrichment project. Today you will learn about what a financial plan is for me, how to make it right and how to follow it, despite possible unforeseen force majeure.

Why make a financial plan?

I have been blogging for over 6 years now. During this time, I regularly publish reports on the results of my investments. Now the public investment portfolio is more than 1,000,000 rubles.

Especially for readers, I developed the Lazy Investor Course, in which I showed you step by step how to put your personal finances in order and effectively invest your savings in dozens of assets. I recommend that every reader go through at least the first week of training (it's free).

This is the first question you should ask yourself before making a family financial plan. Finding the answer to this question is very important, because without it you simply will not be motivated enough to implement a personal project on the path to financial independence.

A financial plan is necessary first of all so that you look at yourself as a functioning business and assess how this business is profitable or unprofitable. In other words, such a plan will become a kind of personal audit. financial condition. You will be surprised how much you can learn about yourself and your finances. Where does your hard earned money go? What additional sources of income do you have? Where can you save money, and where to direct additional financial resources? All these questions will be answered by a detailed plan.

In addition, creating a project to achieve financial independence will allow you to soberly assess your goals, their reality and achievability. Making a plan will help you focus on the most important, which will mark out secondary goals for which you currently do not have real resources. This is also very important from a psychological point of view, since sky-high goals are perceived by the subconscious as really unrealizable at this stage. For example, in your current position, you can hardly expect to buy a Porsche in the next couple of years. But the acquisition of land in a promising suburb may be a very realistic goal. In this way, your subconscious will eliminate the option of buying an expensive sports car and thereby free up energy to achieve a more tangible goal.

So, we figured out that a financial plan is the most important stage on the path to wealth. Let's proceed directly to its compilation.

Financial plan principles

Any financial plan begins with the definition of initial data. To do this, you need to make 2 plates. First you need to write down - everything that brings you money. Then you should mark all your liabilities - what you consistently spend your money on.

Here is an example of such a plan drawn up in an Excel spreadsheet.

It is very important to consider all assets and liabilities in your plan. It depends on how accurate and meaningful your financial plan will be. Note that things like a car can be both a liability and an asset. For example, if you use a car to earn money, this income must be indicated in the asset column. But if the car is just a means of transportation that you spend money on consistently, then you should record these expenses in the liability column.

Many who do not have tangible assets on their "balance sheet" may think that they do not have them at all. But it's not. Everyone has assets. Your main asset is yourself, your skills and abilities that you can use to generate income. First of all, this is your profession and the work for which you are paid money. Also, you can include in the asset absolutely everything that brings you income, even if it is insignificant and not obvious at first glance. When the table is compiled, you can proceed to the next part of the work on the financial plan - the analysis of assets and liabilities.

Analysis of assets and liabilities

Based on the results of compiling the table of income and expenses, you should have two numbers - total income and expenses. It often happens that these numbers do not correspond to your real financial situation. For example, annual income can significantly exceed expenses, but in fact there is practically no free money. In this case, you need to work more carefully on the list of liabilities and think about what exactly you did not include in the right column of your table. The real result, as a rule, is commensurate figures of income and expenses.

If you couldn't find what you did wrong, then do the following. During the month, write down all your expenses in detail, and at the end of the month, summarize. Most likely, you will find a lost item in your balance sheet.

When the numbers turned out to be more or less real, answer yourself the question of what exactly does not suit you in the current financial position. Think about what expenses you can reduce or eliminate them completely. For example, you noticed that you spend the lion's share of your income on food in restaurants. In this case, consider how you can save money. Perhaps it makes sense to dine at home more often or take food with you to work so as not to spend money on catering.

The second step is to analyze your income. Do not immediately look for ways to increase them. Better use the rule known among investors as “pay yourself”.

Pay yourself rule

The essence of the rule is that you need to set aside part of the money every time you receive income. Experts recommend saving 10%. This percentage is optimal for novice investors, since such a small deduction will be invisible to you. But at the same time, you will slowly and confidently form your “airbag”. Personally, I try to save at least 30%.

If it seems to you that you have nothing to save and that you live "penny for a penny", then you can be sure that this is not so. If you seriously decide to live not on 40,000 a month, but on 36,000, your brain will quickly adapt to this figure, and you can easily feel comfortable saving 4,000 a month at the same time.

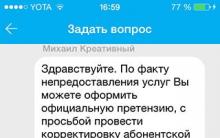

What to do with this money? If you have no savings at all, then start by building a financial airbag. You can start by opening a regular deposit with the right to replenish. For this I use contributions in . When your account has an amount equal to 6 monthly expenses, you can start investing in more profitable instruments. But even with a banal accumulation of funds in a bank account with an accrual of 8-9% per annum, you can count on the fact that in a few years your account will have a serious amount for you.

Results

The first step on the road to financial independence is important. The financial plan you just saw is a simple thing at first glance. But it will help you:

- Conduct an audit of your financial situation;

- Find weaknesses in your balance and eliminate them;

- Start investing not in liabilities that make you poorer, but in assets.

If you are a family person, then you need to draw up a family financial plan according to the example given above. In order to effectively implement the plan, it will not be superfluous to share it with all members of your family so that they will support you and follow the plan with you.

As you can see, there is nothing difficult in drawing up a financial plan. However, take it very seriously, because it depends on whether money will work for you or whether you will be doomed to work for money all your life. I suggest sharing your experience in the comments, who uses what programs and systems to account for personal finances.

All profit!

Greetings! I noticed that personal finance management is becoming a mega-popular trend in Russia.

Increasingly, people are turning to professionals for financial advice. Keep track of income and expenses household. Invest money in something. But many are sorely lacking in consistency!

And today we will talk about what a personal financial plan is, and how to correctly compose it.

LFP disciplines, motivates and helps to achieve goals. This is the very first step to!

A financial plan can be compared to a detailed travel itinerary. There is a start and end point of the path. There are intermediate landmarks and time limits. There are helper tools (compass, map, navigator). And the route itself from time to time will have to be adjusted to the current situation.

Do not like the comparison with the route sheet? Another good analogy is a weight loss chart.

There are two ways to lose extra pounds.

- Start running in the morning. For two weeks, eat germinated wheat sprouts, drinking them with clean spring water. Lose 3 kg. Be happy. Celebrate this business with pizza with sausage and a liter of beer. Berate yourself for being weak. Sleep through your morning workout. Slowly return to normal life. Gain 5 kg in a week

- Seek professional help from the very beginning. Think over a complex of trainings and a balanced diet. Lose 10 kg in a year and maintain that weight all the time. Stay healthy, balanced and self-confident after losing weight

People in a panic run for advice to the “money specialist”. And for some time follow his recommendations. And then the situation in the market levels off. And the financial plan "moves" as unnecessary.

A few years later, the situation repeats itself.

What is a good adviser? Competent specialist:

- Objectively assess the current financial situation and your opportunities (income-expenses, assets-liabilities). Even at this stage, you will learn a lot about your personal finances.

- Highlight strengths and weaknesses.

- Adjusts financial goals in terms of their reality and achievability.

- Will prescribe a clear step-by-step algorithm for achieving.

- Describe several possible scenarios for the future.

- He will select the right instruments, taking into account the specifics of the client (income level, risk appetite, investment period, and others).

All this, of course, you can do yourself. But, most likely, due to inexperience, you will make a lot of mistakes and lose a lot of money and time. For example, I did it myself, but after I was checked by a consultant.

Option number 2. On your own

However, no one bothers you to independently work out the “materiel” and draw up a financial plan yourself.

Hint options:

Books

Educational materials on the Web - the sea. Almost all of them can be downloaded for free in fb2 or epub format.

- Vladimir Savenok “How to compose LFP. The Path to Financial Independence. The author literally "on the fingers" tells what, how and why. Savenok even leads at the end excel sample as an example to fill. Another huge plus of the book is that it is based on the author's experience with Russian clients!

- Another excellent book: Andrey Paranich “LFP. Compilation Instructions. But I must say right away that just reading such books is not enough! Useful recommendations should be put into practice as soon as possible.

Educational "live" format (webinars, open lessons, trainings, courses)

During the course, you will work through a lot of useful things: from personal finance planning and time management to business relationships and loans with investments.

Stages of compiling LFP

How to make LFP on your own? As usual - "eat the elephant in pieces."

Here is mine short instruction step-by-step independent preparation of a financial plan.

First stage. We formulate financial goals

I am sure that this phrase causes a gag reflex in many. But without goal setting, alas, can not do. In order not to be scattered on global or secondary goals, answer three questions first:

- What monthly income do you want to receive in the future?

- At what age do you plan to retire?

- What tasks need to be solved within the next 5-10 years?

I promise it will clear my head a bit. And you can prioritize everything.

Second phase. Assessing the value of your goals

An example of the distribution of funds among different assets:

- 20% off purchase financial instruments to create an additional source of income (stocks, bonds, mutual funds)

- 25% in real estate

- 25% in pension savings

- 20% to own business

- 10% to the bank on the account and deposits

Sixth stage. Creating an airbag

Before embarking on active investments, you need to “insure”. The road ahead is long and difficult. And during this time, anything can happen. will not let you retreat from LFP even in the most difficult periods! A little lower I will briefly analyze so that you understand that free cheese only happens in a mousetrap.

How to implement LFP taking into account force majeure? Consider risk management from the very beginning!

It includes four items:

- Insurance

- Creation of a reserve

- Risk diversification

- Liquidity care

Insurance

To be honest, I am opposed to insuring "everything against everything." In Russia, the institution of insurance is expensive and not always honest. But at a minimum, it is worth insuring the life and health of the main breadwinner of the family. And expensive property (apartment, house, car).

financial reserve

Frequently asked questions and life hacks

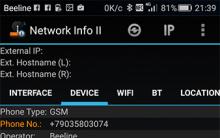

In what electronic program to make LFP?

LFP can be easily compiled in the good old Microsoft Excel or Google Doc (for access from different gadgets). And you can use special software.

I also advise you to download budgeting applications to your phone or computer - they greatly simplify life and automate the accounting of income and expenses. Good reviews, for example, about Home Bookkeeping and EasyFinance. I am using CoinKeeper.

What information is needed to compile the LFP?

At a minimum, the figure of monthly income and expenses divided into categories. Before you draw up a document, you need to clearly keep home accounting for at least 2-3 months.

What is more important: cutting costs or increasing income?

Theoretically, both are important. But as practice shows, the total economy regime is incompatible with the thinking of a wealthy person. Achieving monetary goals, denying yourself the most necessary for years, is not the best way.

Current income should be enough to maintain a comfortable standard of living (everyone has their own)! Plus, there should still be something left for the stash, insurance and investments.

Hence the conclusion: it is possible and necessary to optimize costs. But the main focus should be on increasing income: active and passive. Constantly ask yourself the question: where and on what can I earn extra money?

TOP 9 mistakes in LFP development

Fuzzy financial goals

The blurring of goals is the leader of the conditional hit parade of mistakes in the personal financial plan. It is very important to form them as specifically as possible: with amounts and terms.

Just in case: "become rich", "get rid of debt" and "achieve financial freedom" - but sweet dreams.

Excessive optimism in assessing one's own capabilities

Do not set yourself too ambitious and obviously impossible goals. Especially in the short and medium term.

Such Napoleonic plans are doomed to failure from the outset. You should not once again convince yourself that "this nonsense does not work" or "I'm a complete loser."

Excessive pessimism when setting goals

Underestimation always leads to a delay in the achievement of goals. This is not as scary as overestimation, but it also greatly weakens motivation.

Financial goals, deadlines and ways to achieve them should be realistic and a little difficult for you personally. Agree, “earning 100 rubles a day” is more than a real task. But do we need such a small goal?

Alien targets

Why financial advisers do not welcome "amateur" in the preparation of LFP? Not only because they lose income from their paid consultations. Most often, Russians draw up a plan based on ready-made examples from books and publications. Why is it dangerous?

The LFP of a Russian is fundamentally different from the LFP of an American or a German. The plan of a Muscovite is from the plan of a resident of Ryazan or New Vasilki. LFP of a single employee - from a LFP of a private entrepreneur with a wife and three children.

Well, and besides, it’s not a fact that someone else’s financial goal will suit you in principle. The plan, first of all, is developed for yourself!

Force majeure expenses are not taken into account in LFP

The life of each of us is full of surprises and surprises. 90% of them give an additional burden on the family budget. And it is worth taking into account force majeure costs even when compiling the LFP. Be sure to save up a stash for a rainy day.

Yes, yes, I'm talking about a stash, which for some reason many do not consider as a "must have" thing. With it, you will feel much more comfortable, and if force majeure does happen, you will be ready for this both economically and psychologically.

The plan does not include an increase in daily expenses

Statistics show that as we age, we spend more and more on household chores. An apartment, a car, having children, helping elderly parents and grown children, spending on their own health.

But even if for 20 years you buy the same thing every month, the level of spending will be . Therefore, when compiling the LFP, we assume an increase in current costs by at least 10% annually.

Calculation for passive income

is the dream of every investor. But you can afford a comfortable life “on interest” only when you have solid capital and practical experience in the field of investment. Getting both takes time, patience and discipline!

Calculation for a constant return on investment

Fixed income on the market is guaranteed by just a couple of conservative instruments! For example, highly reliable bonds or deposits in a state bank (often even nominal).

In all other cases, income is a variable and floating value. And this point must be taken into account when compiling the LFP. Do not start from the maximum possible profitability! Always aim for the average.

LFP is not implemented in practice

One of the most common mistakes! LFP is a map-route to achieve your dreams. The plan is absolutely useless if you just print it out and hang it on the wall. Every day you need to take tiny steps towards intermediate "destinations".

Imagine that you have compiled an excellent route for a three-day ascent to a mountain peak. We bought everything we needed, packed a backpack, but never left the house. As a result, the cherished intention is as far away as before.

It's the same with LFP. If the plan is to "increase monthly income by 20%", then you need to look for another job or create your own business. If you planned to set aside 10,000 rubles for investments every month, then you will have to do this not “when you remember”, but every month.

Otherwise, the plan will remain a beautiful sample table in Excel.

Summing up

Actually compose basic plan it's not that hard. It is much more difficult to strictly adhere to it for years. However, I still recommend showing your first LFP to a professional!

Unfortunately, any plan is not a panacea and not a "secret tool" of millionaires. This is just the first step to financial freedom. Tested on myself: it really helps to take personal funds under control and achieve goals without spraying on nonsense. Only in this way you can avoid blunders and immediately move in the right direction. After all, the most important thing in this life is time. Is not it?

Do you already have it? Subscribe to updates and share links to fresh posts with friends on social networks!

The presence of a sufficient amount is not only financial independence, but also the possibility of successfully implementing one's intentions. Proper management of sources of income, strengthening the security of this area help to gain confidence in the management of available resources. The planned goals are achieved with the least or optimal costs. It is known that they use a personal financial plan (PFP) for stability and increase in income. Even simply compiled, it will help you live without debt, within your means, improve your well-being.

How to make a personal financial plan and why without it you are doomed to failure?

Let us examine in detail what management is for, what this concept includes and how it is feasible in reality. Ordinary people, if they keep records of the household budget, do not make clear routines. Although it is possible that they still have such an intention in one form or another. Most of the wealthy subordinate the monetary sphere to planning. According to the survey, the needs of the layman (goals) correspond to the following list:

- a lot of money or an increase in their amount;

- housing, improvement of conditions;

- the vehicle is owned;

- work less, mostly manage your wealth or live off the interest of your savings;

- the ability to travel;

- pay off debts.

When asked how ordinary people are going to implement this, they answer that they intend more. But they cannot say what they are doing for this or what progress will be in terms of income. In order to achieve the above goals, it is necessary to master personal finance management, which includes:

- understanding what a financial plan is and why it is required;

- algorithm for its compilation;

- correct;

- goals;

- methods of increasing the effectiveness of the implementation of intentions;

- ways to avoid errors.

When all aspects are taken into account, it will be possible to successfully draw up own plan. Let's take a closer look at why this is needed. The presence of such a routine, set out in clear algorithms, can be compared to a guidebook or road map. Having a personal financial plan will allow you to properly move towards your goals. And also choose the best path with the least number of obstacles, taking into account all possible aspects.

Planning will provide necessary knowledge for comfortable achievement of milestones goals. It will take no more than 3 hours. But the intentions will be clearly described, there will be a concept about the methods of its implementation. Those who manage money affairs in this way achieve their goals much faster. How to make a personal financial plan, we will consider further.

The 6 Steps to Making a Personal Financial Plan

Accounting will provide a clear picture of the movement of money. It should be clear to a person what they are spent on, which items of the family budget remain stable, and which ones are constantly changing. Personal finance management is impossible without such a picture. To carry out the process correctly, you need to start keeping such accounting. In this case, an initial idea of \u200b\u200bthe state of affairs will be obtained, from which you can build on. Drawing up a personal home financial plan takes place in stages. Having developed it, you need to agree on the details, after which access to agreements that increase income will open. Monthly savings will be invested in them. The result is automatic. In order to give a successful momentum to the process, periodic adjustment is required. Plans are revised as wealth and circumstances change. Let's take a closer look at the steps below and other aspects.

Planning steps

- You should start with, decide what you want to achieve. These intentions may be short-term or long-term. And also vary in importance. But all of them must be specified, formulated in monetary terms. For example, if someone wants to buy an apartment or a car, they must indicate the characteristics, brand, cost.

- requires an indication of the deadline for achieving the target, and not just the amount required for this. That is, individual intentions and motivations are measured in time units, in addition to the monetary equivalent. The period required to complete the assigned tasks should be specified in relation to the available capabilities. For example, a family wants to buy a car in 3 years, and renovate an apartment in 10 years. It is important to match reality so that intentions are not doomed to failure.

- The next step in solving the problem of how to write a personal financial plan is to describe the funds and sources of funds. This is a very important step that requires most of the time. Success in achieving goals depends on it by 90%. Calculate how much you can save each month. Determine the size of assets (income), liabilities (expenses). It is their difference that represents the amount of money allocated for accumulation.

- Managing personal finances at stage 4 involves creating additional income. Profit can be obtained by successfully investing money.

- Calculating risks could be the next step. For long-term accumulation, the method of saving money in the form of cash is not suitable. The danger is their availability for arbitrary spending, as well as possible inflation. Therefore, finance is invested in a variety of assets, which will allow you to receive income to capital. Investments are also associated with the risk of losing part of the funds, and therefore it is necessary to choose the most comfortable level of this risk. So profitability is related to the rate of growth of capital investments, which (in turn) determines the time to achieve the goal. But the speed regime, as with road traffic, is less secure.

- The last step is implementation and adjustments along the way. LFP, designed in the form of a table, accurately reflects the future state of finances. But if you do not take action to save money, and do not look for additional sources, the plan will not be able to change the current wealth. We need investment projects, appropriate insurance and other implementation tools. Implementation requires the use of ways to increase capital.

Financial tasks will become possible for resolution only if there is a plan and these methods.

We formulate financial goals

An integral part of the question of how to draw up a personal financial plan is the definition of goals, their clarification by parameters, as well as in monetary terms. Otherwise, the budget of a family or an individual will be organized randomly, in the form of chaos. Aimlessness leads to lack of results. Such an organization of willpower is needed both in and in the creation personal capital. Further stages do not make sense without a specific formulation: what should be strived for.

Calculate the cost of your goals

One of the tasks of the financial plan is to calculate the amounts needed to achieve the goals. In order to determine whether the implementation of the target date is possible, it is necessary to consider cash flow. We add the rate of return with the appropriate level of risk and calculate the amount of capital after the planned number of years. The sufficiency of the sum is the solution of the problem. But the lack of funds will require a number of changes, the options for which must be foreseen in advance.

Families usually have several long-term goals with different priorities and costs. It is not always realistic to reach them all at the same time. For this, there are various scenarios. A personal or family financial plan, such as getting an education, may receive the highest priority. But the fulfillment of this task will not allow the realization of other intentions. Parents will not be able to leave for a well-deserved rest earlier or it will be impossible to improve their living conditions. Then the second-priority goals are postponed in time to a more distant date. So we choose best option from a number of possible scenarios.

Analyze your current financial situation

The action plan for includes an analysis of the situation. Big goals are filled with investment funds like a container. The value of the flow is determined by regular contributions to the implementation project, which is related to the speed of progress towards the target. Its size is the main parameter for long-term financial plans, depending on the personal budget.

Assets and liabilities are also subject to analysis. We enter the values taken into account in the table, and the data may not be recorded with perfect accuracy. The main thing is to get a general idea and determine the proportion of costs. After receiving the amount of the monthly balance, it will be possible to adjust the goals and deadlines. The discrepancy between these last parameters motivates the search for additional ways of implementation.

Adjust goals

Analysis of assets and liabilities that generate income and expenses, as well as their subsequent adjustment, can increase the investment flow. This may be the elimination of costs that the family does not need. The ratio will improve, which will accelerate the achievement of goals. At the stage of making amendments, an inventory of the financial condition is carried out. The situation is clearly visible as a starting point for further progress. It is recommended to update the long-term plan every 3 or 5 years.

In particular, if the amount that you decide to save regularly is insufficient, you need to find a way to increase income. Or cut spending. It is also possible to perform both actions at the same time.

Cost reduction

Target investments, set aside with regularity to achieve a particular goal, can be obtained in the required amount by. A properly organized budget, revision of expenses, removal of those that are actually not needed helps to reduce costs. But also typical mistake is an excessively large amount set aside monthly. You should not exhaust yourself with austerity, as "Spartan" conditions can be harmful. As a result, goals and plans will lose their meaning. Therefore, a financial reserve is needed that allows you to live more freely.

Income increase

Only the difference between income and expenses can be invested in a goal. Many families have funds for regular investments. But they do not make these contributions because they are not familiar with the tools. Investment plans that include personal capital guarantees do exist and are available. You need to learn and use them.

Make an investment plan

For successful cash investments there are a number of instruments, the profitability and risk of which are directly dependent on the duration of the scheduled terms. Example: You need to accumulate an amount for a vacation that is expected in a year. Includes ticket price and additional expenses. Ensuring security and stability, we use interest on a bank deposit, where the reliability is 100%. To travel to another state, it is better to open a foreign currency account. For the purpose of the future education of children, the purchase of shares is more suitable. Weighing the available instruments for investments, we choose the most appropriate for the circumstances.

Form a reserve fund

We should not forget about the possible depreciation of money - inflation. With long-term financial planning this is especially true. Reserves created specifically for such cases will help against the interference of such factors. For example, the so-called “compound interest” is tied to inflation. It is known that the return on investment increases during this period. But the real figure of personal income requires deducting the percentage of current inflation from the percentage of profit. There are investment calculators that make similar adjustments to the calculation.

Self-discipline and strict adherence to the plan

Making a financial plan is only half the task. The main difficulties usually follow after this, when it will be necessary to adhere to it. A 1-hour routine takes months or decades to complete. Success depends on the person, him. With an excessively long period, it should be broken down into stages and each should be reached. Another recommendation is to immediately set aside the intended amount when receiving income in order to prevent its accidental waste.

How to disable ads on Android: remove pop-up ads

The Russian received a term and a million fine for "piracy Negative consequences of the law

Identification of key factors

The criteria for classifying organizations and individual entrepreneurs as small and medium-sized businesses have changed

See what "Royalty" is in other dictionaries Pitfalls of legislation