The traditional and most developed form of international economic relations is foreign trade in goods.

The following terms are used to characterize trade between countries:

International or world trade - trade between all countries of the world. The sphere of international commodity-money relations, which is a combination of foreign trade of all countries of the world.

Interstate, mutual, bilateral trade- Trade between two countries.

International trade- trade of one country with the rest of the world. Foreign trade consists of two main flows - export and import.

Export- sale of goods, providing for its export from the country.

Import- the purchase of goods, providing for its import into the country.

To characterize foreign trade, there are the following indicators.

Foreign trade turnover- characterizes the participation of an individual country in international trade and is calculated as the sum of the value of exports and imports.

Foreign trade balance- characterizes the balance of foreign trade of a particular country and is calculated as the difference between the cost volumes of exports and imports. The excess of the volume of exports of goods over the volume of imports provides the country with a surplus trade balance (a positive balance trade balance TB). If the volume of imports is greater than the volume of exports, there is a passive trade balance (negative TB balance).

Terms of trade (terms of trade, terms of sale)- an indicator characterizing the conditions that develop for the foreign trade of a country or a group of countries in the world market, and representing the ratio of export and import price indices:

I At T = I X / I M× 100%.

Determines the purchasing power of exports of a country or group of countries, i.e. the quantity of goods that can be imported with their export earnings. The growth of the terms of trade index indicates an improvement in the situation for the country in the world market, and, conversely, its decrease indicates its deterioration.

A quantitative indicator of international or world trade is volume of world (international) trade- characterizes the total volume international trade all countries of the world. Calculated as world exports (since one country's exports are another's imports, adding world exports and imports would result in a double count).

Foreign trade policy - an integral part of foreign economic policy aimed at developing and regulating trade relations with other countries of the world and their groupings in order to strengthen the position of the country and its business in the world economic arena.

Autarky- economic isolation of the country from other countries, the creation of a closed economy within a separate state.

In its purest form, autarky manifested itself in the conditions of subsistence farming.

In the second half of the XX century. the liberalization of the economy began to intensify, independence from the influence of the state, i.e. a trend towards the abolition of restrictions on trade and the movement of factors of production, towards a transition from autarky and protectionism to free trade. Currently, there are two main areas of foreign trade policy: protectionism and free trade (free trade policy).

Protectionism (cover, patronage) - a policy aimed at protecting the domestic market and actively encouraging national companies to enter foreign markets.

Protectionism was the first policy adopted by states that were formed at the dawn of capitalism. Protectionism was intended to promote the development of an industry that was still in its infancy and at the stage of manufacture. Starting from the second half of the 19th century, Great Britain and France switched to a policy of free trade, while Germany and the USA, where the process of formation of industrial capitalism was just beginning, adhered to a policy of protectionism. This policy was intensified in all industrialized countries during the era of the formation of monopolies, during the First and Second World Wars, the deep economic crisis of 1929-1933.

In the postwar years, industrialized countries are moving towards the liberalization of foreign trade.

Liberalization- a form of foreign trade (foreign economic) policy that involves the removal of all sorts of barriers that impede the development of foreign trade and foreign economic relations in general.

The opposite of protectionism is free trade.

free trading(free trade) – exchange of goods and services between countries, freed to the maximum extent from restrictions in the form of customs duties, quantitative and other non-tariff barriers.

The openness of the economy leads to increased competition in the country and to an increase in the efficiency of the economy (usually in the long term).

Unlike developed countries, many developing countries are pursuing a policy of protectionism, protecting the newly emerging national industry.

Instruments of state regulation of foreign trade are divided into tariff and non-tariff ones.

Customs tariff - this is a systematized list of customs duties that are levied on goods when imported, and in some cases when exported from a given country .

Customs tariff - a collection (set) of customs duty rates applied to goods transported across the customs border of the country, systematized in accordance with the Commodity Nomenclature of Foreign Economic Activity.

Customs duty - state monetary fees collected by customs institutions from goods, valuables and property transported across the customs border of the country.

Non-tariff restrictions- “any action, other than tariffs, that impedes the free flow of international trade”, such as embargoes, subsidies, licenses.

Importance of foreign trade for the national economy. Foreign trade is the interaction of a country with foreign countries regarding the movement of goods and services across national borders.

Foreign trade is characterized by the concepts of export and import: the first involves the export of goods and services abroad and the receipt of foreign currency in return, and the second - their import from abroad with the appropriate payment. Export, like investment, increases a country's aggregate demand and sets in motion the foreign trade multiplier, creating primary, secondary, tertiary, etc. employment. An increase in imports limits this effect due to the outflow of financial resources abroad.

Profitability of foreign trade. The theory of comparative advantage. Export in foreign trade, according to A. Smith, becomes profitable if the costs of producing goods within the country are much lower than those of other states. In this case, goods produced by the national economy have absolute advantages over foreign competitors and can be easily sold abroad. On the other hand, no state can have an absolute advantage in all produced goods, therefore, it is necessary to import those that are more expensive domestically and cheaper abroad. Then at the same time there is a direct benefit from both exports and imports.

Based on the absolute advantages of A. Smith, D. Ricardo formulated the theory of comparative costs (advantages), according to which, when determining the profitability of foreign trade, one should compare not the absolute, but the relative effect, and not the costs themselves, but their ratios. At the same time, it should be taken into account that, by producing certain goods in conditions of limited resources, the country is deprived of the opportunity to produce others that are no less necessary for it, therefore, in accordance with the theory of comparative advantages of D. Ricardo, a situation is quite possible in which it is profitable for the country to import goods, even if their domestic production is cheaper. In this case, A. Smith's theory of absolute costs becomes a special case of the theory of comparative costs.

The theory of comparative costs of D. Ricardo in modern conditions is supplemented by the theory of Heckscher-Ohlin, named after two Swedish economists, who proved that countries tend to export not only those goods that have absolute and relative advantages, but also in the production of which relatively excess factors of production are intensively used , but import goods for the production of which there is a shortage of factors in the country. Unlike A. Smith and D. Ricardo, their modern followers believe that both parties benefit from foreign trade - both this country and the rest of the world.

Foreign trade is the trade relations of a given country with other countries, which include both the import, or import, of goods, and their export, or export. The totality of foreign trade relations between different countries forms international trade. As part of this trade, over time, an international division of labor has formed, which underlies international trade relations. Foreign trade arose back in the days of natural production, and rapidly developed in the pre-capitalist era, entering into new forms with the advent of capitalist relations.

Foreign trade of the country

Foreign trade is the exchange of a country with other countries, which includes paid exports and imports of goods and services. The term "foreign trade" applies only to a single country.To characterize both international trade and foreign trade, indicators of the total trade turnover, commodity and geographical structure are used.

Foreign trade turnover is the sum of the value of exports and imports of a country.

The value of foreign trade is calculated for a certain period of time at current prices of the respective years using current exchange rates.

The physical volume of foreign trade is calculated at constant prices and allows making the necessary comparisons and determining its real dynamics.

The commodity structure of world trade is the ratio of commodity groups in world exports.

Geographic structure - the distribution of trade flows between individual countries and their groups, allocated either on a territorial or organizational basis. Organizational geographical structure - data on international trade between countries belonging to separate integration and other trade and political groups, or allocated to a specific group according to certain criteria. The main forms of international trade are the export and import of goods.

The indicators reflecting the country's participation in international trade are export and import quotas. The export quota is calculated as the ratio of exports of goods and services to GDP and shows what share of all manufactured products in the country is sold on the world market. The import quota is calculated as the ratio of imports to the volume of domestic consumption of the country, which includes the totality of national production and import stocks, and shows what is the share of imported goods and services in domestic consumption.

International trade consists of two counter flows of goods - exports and imports and is characterized by a trade balance and trade turnover.

The trade balance is the difference between the value of exports and imports. Trade turnover - the sum of the value of exports and imports.

The subjects of international trade are all states of the world, transnational corporations and regional integration groups. The objects of international trade are the products of human labor - goods and services.

Given that the objects of international trade are goods and services, there are two forms of it: international trade in goods and international trade in services. International trade in goods is a form of communication between producers of different countries, arising on the basis of the international division of labor and expressing their mutual economic dependence.

In the international practice of statistical accounting of exports and imports, the date of registration is the moment when goods pass through the customs border of the country. The cost of exports and imports is calculated in most countries at contract prices reduced to a single basis, namely: export - at FOB prices, import - at CIF prices.

Statistical assessment of goods on FOB terms (free on board - free on board) includes, in addition to the cost of the goods themselves, all costs associated with its delivery to the ship, including loading on board. For overland transportation, the fob price means the price of the goods on the terms “free-land border of the exporting country”, which, in addition to the cost of the goods themselves, also includes the cost of its delivery to the border of the exporting country. The CIF price (cif - cost, insurance, freight - cost, insurance, freight) includes the cost of the goods on FOB terms - the port of departure plus the costs of insuring the goods in transit and transporting them (sea freight) to the port of destination. For land transportation, the concept of "cif price" corresponds to the price "ex-border of the importing country".

The value of world imports is always higher than the value of exports by the sum of the cost of freight and insurance, because world exports are valued at the FOB price and imports at the CIF price.

Accounting for counterparty countries, that is, countries between which foreign trade is carried out, is carried out according to the "production - consumption" method. In accordance with this method, imports are recorded according to the country of production (origin of the goods), and exports are recorded according to the country of consumption of the goods.

The UN Statistical Commission recommends taking into account in exports and imports all goods and material values that, as a result of their export or import, reduce or increase the material resources of the country. Thus, exports and imports also include goods, the import-export of which was carried out on a non-commercial basis, that is, in the manner of providing gratuitous assistance or in the form of gifts.

The volume of world trade does not include the cost of all types of services, including material ones (construction and installation works, design, survey work, patents, licenses, printing of books, promotional materials).

The development of international trade has received a powerful impetus under the influence of the processes of globalization of the world economy, liberalization in the trade and political sphere, the expansion of preferential trade within the framework of regional economic associations, the deepening of international industrial and scientific and technical cooperation, the rapid growth in sales of progressive high-tech products, first of all, office and telecommunication equipment, incorporating the latest achievements of scientific and technical progress.

The main and urgent task for the enterprises of the Republic of Belarus at present is the formation of their TPN abroad. This will increase the efficiency of promoting goods to consumers, optimize the costs of promoting your own products, achieve stability, reliability and competitiveness in foreign markets, as well as basic positions in the further development and expansion of the market.

The formation of a commodity distribution system and a distribution network depends on a number of factors:

The nature and capabilities of the enterprise;

- the nature, volume and range of products;

- features of the market (economic, legal, scientific and technical, cultural and demographic, geographical, etc.).

Marketing activity is related to the market and is aimed at it.

In this regard, the processes taking place in the market, its changes and dynamics cannot but affect the activities of manufacturers. That is why international marketing activities involve the study, analysis and accounting of the market situation, as well as an active targeted impact on foreign markets.

The process of developing and implementing methods for the consistent development and retention of foreign markets provides for:

Initial study of the features of international markets, characteristics of the world market with the obligatory consideration of trends in their change;

- creation of an information database of economic, political, legal, scientific and technical characteristics that determine the processes and situation in international markets;

- analysis of the international business environment in specific foreign markets;

- setting goals for actions in foreign markets;

- selection of foreign markets on the basis of selection and ranking, acceptable for further activities, and the study of the characteristics of the selected markets;

- determination of the method of market development (market penetration): export, Team work, investment;

- development of private strategies for the marketing complex (commodity, price, communication, distribution) for work in foreign markets;

- Creation of services for the organization and management of international business.

With the development of foreign economic activity, this process becomes more complicated in accordance with the change in goals and objectives.

In addition, there are a number of features that should be taken into account, namely:

Dynamism and variability of the business environment in foreign markets;

- difficulty in obtaining the information necessary to carry out activities in foreign markets;

- the need for systemic and active, rather than episodic processing of markets at various stages of product promotion;

- the need to take into account the peculiarities of international cooperation and a foreign business partner;

- the presence of higher risks of activity in foreign markets;

- complication of organizational forms and managerial aspect of activity.

General marketing functions have universal application in both domestic and foreign markets. However, significant differences in the marketing environment of the domestic and foreign markets should be taken into account.

The enterprise is a complex self-organizing, self-regulating system that interacts in external environment both vertically and horizontally. The marketing environment is a set of entities operating outside the firm, organizational structures, forces and conditions in which the marketing activities of the enterprise are carried out. The macro-environment of marketing is a set of conditions that actively influence the activities of the company. These are common external factors - economic, political and legal, scientific and technological, natural and climatic, geodemographic, cultural.

The marketing microenvironment is the conditions that ensure the life of the company. The marketing microenvironment is formed by factors that are closely related to the firm, directly interacting with it and affecting its relationship with customers. These include: the company itself, its customers and contact audience (society), suppliers, intermediaries, competitors.

At the same time, it must be taken into account that within the marketing system there is pressure on the firm from elements of micromarketing, that is, from consumers with market power; suppliers providing the company with the necessary raw materials and materials; intermediaries that ensure the connection of the company with the target market of consumers; and, of course, from competitors.

Competition within the microenvironment increases due to the influence that suppliers and intermediaries have on the firm. For example, suppliers may withdraw from partnerships, raise prices, or cease their business activities. Competitors, in turn, can activate the methods of competition, switch to the production of a substitute (substitute product) product. Buyers - prefer the goods of other firms, change quantitatively and qualitatively.

The study of the system of five components of the marketing environment, which is based on a certain degree of dependence of the company on the elements of the microenvironment and its superiority over them, is a tool for developing marketing strategies that allow the company to achieve a stable competitive position in the market.

In this regard, it is necessary to investigate:

Quantitative and qualitative characteristics of the target consumer (cultural characteristics and values, attitude to the product, price, etc.);

- quantitative and qualitative characteristics of suppliers;

- features of the TPS and intermediaries;

- quantitative and qualitative characteristics of competitors and the level of competition.

In other words, it is necessary to influence the microenvironment, changing and adapting it to the dynamics of the macroenvironment.

The active or passive position of the perception of the marketing environment is determined by the goals and capabilities of the company, that is, the rationality of its activities. Passive perception of the marketing environment involves an analysis of the forces acting in it and the development of measures to avoid the threats of the environment or take advantage of its favorable opportunities, that is, adapt to it; does not involve attempts to change the environment. Active perception of the marketing environment involves managing the environment through active actions that affect the consumer society and marketing environment factors; to a lesser extent or not at all involves simple observation and adaptation to ongoing changes.

Thus, the international marketing environment in which enterprises that produce and sell goods and services operate is becoming more complex. Firms succeed as long as they and their products and how they are promoted fit this environment.

Marketing impact is possible only on the basis of complex targeted monitoring, that is, the collection, systematization and analysis of information. In this regard, there is a need to actively use SWOT analysis - to identify and separate key factors influencing the strategic development of a company or industry into external and internal, positive and negative.

Internal factors (competitors, suppliers, intermediaries, customers and contact audiences) and external (economic, political and legal, scientific and technical, natural and geographical, cultural and demographic) can have both positive and negative impact on the company's activities, that is create opportunities or pose threats. At the same time, systematizing internal and external factors, it is necessary to develop strengths in the activities of the enterprise and compensate for weaknesses, seize opportunities and avoid threats. That is why the goals of SWOT analysis are an integrated assessment and forecasting of the activities of a firm or industry; development of a balanced strategy. As a rule, the results of the SWOT analysis are presented in tabular form.

Based on the results of the SWOT analysis, situations are predicted and a management solution is developed to prevent or overcome threats and mitigate risks in the company's activities. For example, at present, this type of analysis is actively used by marketing services of such enterprises as MTZ, MAZ, Milavitsa, Belaruskali, etc. The decisive role in monitoring markets should belong to the National Center for Marketing and Price Study, which is under the patronage of the Ministry of Foreign Affairs of the Republic of Belarus . It is this organization that should accumulate information and help domestic producers monitor markets.

The most significant, from the point of view of using the marketing mix, are the following goals of the enterprise: analysis of the sales structure, analysis of cost recovery, profit and cost savings, enterprise growth, and so on. Evaluation of products and programs is possible on the basis of various criteria. The most commonly used indicators in this role are sales volume and cost coverage. Analysis of the sales structure shows, first of all, the absolute and relative values of products and product groups and deviations from the planned values and indicators for the past period of time. The results of the sales assessment provide information about the product that should be excluded from the production program, since this reduces the level of marketing, and, consequently, the economic potential of the enterprise as a whole. For this, a concentration analysis is carried out, a variant of which can be the so-called ABC analysis. According to him, the products of the enterprise under study are divided into three classes according to selected criteria (an example of this can be sales, cost coverage, profits, as well as all manufactured goods) and distributed according to the share of each type of product in the total sales of the enterprise. The goods distributed in this way conditionally make up three groups: A - the group of the highest priority goods; B - a group of transitional products and C - the main candidates for dropping out of the production program of the enterprise.

In fact, ABC-analysis is a range ranking according to different parameters. It is possible to rank in this way both suppliers, and stocks, and buyers, and long periods of sales - everything that has a sufficient amount of statistical data. The result of ABC analysis is the grouping of objects according to the degree of influence on the overall result.

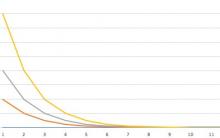

ABC analysis is based on the principle of imbalance, during which a graph of the dependence of the cumulative effect on the number of elements is built. Such a graph is called a Pareto curve, a Lorenz curve, or an ABC curve. Based on the results of the analysis, assortment positions are ranked and grouped depending on the size of their contribution to the cumulative effect.

Conclusions: in modern conditions, the country's active participation in world trade is associated with significant advantages: it allows more efficient use of the resources available in the country, join the world achievements of science and technology, more short time to carry out structural restructuring of its economy, as well as to meet the needs of the population more fully and diversified.

The main goal of monitoring the operating environment in foreign markets is to develop a management decision that ensures the achievement of a sustainable competitive position of domestic producers in foreign markets when creating and actively using TPS.

Regulation of foreign trade

A practical instrument of protectionist policy is the customs regulation of foreign trade. There are two main groups of methods of protectionism: customs-tariff and non-tariff. Customs tariff methods involve the establishment and collection of various customs duties for foreign trade activities. Non-tariff methods, of which there are up to 50, are associated with the establishment of various prohibitions, quotas, licenses and restrictions in the field of foreign trade. In fact, the foreign trade policy of any country is based on a combination of these two groups of methods.The most common and traditional way of customs and tariff regulation of foreign trade is the customs duty.

Customs duty is an indirect tax that is levied on goods entering or leaving the customs territory, and which cannot be changed depending on two factors: the general level of taxation and the cost of services provided by customs.

Since the customs duty is an indirect tax, it affects the price of the goods. In customs practice, only movable tangible property is called a commodity.

A customs territory is a territory in which exports and imports are controlled by a single customs authority. The boundaries of the customs territory may not coincide with the border of the state. For example, with customs unions of several states. Or when, due to geographical conditions, the establishment of customs control is not possible or convenient. The borders of the customs territory are established by the government of each country.

Customs duty has two essential features. First, it can be withdrawn only by the state. And so it goes to the state (federal), and not the local budget. Secondly, import duty applies to goods of foreign origin. And export (albeit an atypical type of duty) - to goods of domestic production. In this regard, an important problem in customs practice is the correct and accurate determination of the country of origin of goods.

The product code is determined according to the harmonized system of description and coding of goods (HS) generally accepted in the world.

According to the method of calculating the fee can be:

1) ad valorem;

2) specific;

3) combined.

Ad valorem duties are set as a percentage of customs value goods. Specific - depending on the units of measurement of goods (for 1 ton, for 1 piece, for 1 cm3, etc.). Combined combines ad valorem and specific accruals. Customs duty rates are associated with various regimes of foreign trade activity. The minimum rate (called the base rate) is set for goods originating from countries with which there is an agreement on the most favored nation in trade (MFN). Maximum - for countries with which no MFN agreement has been concluded. The preferential, or preferential, rate is the lowest and is set on goods originating from a number of developing countries. In addition, according to world foreign trade rules, there is a group of the poorest countries whose agricultural products and raw materials are not subject to customs duties at all.

The higher the tariff level, the more reliably it protects national firms. But in order to understand who is personally protected by the tariff, it is necessary to consider the structure of production.

A tariff on a product of any industry is protection, but only in relation to the firm that produces it in the country. It also protects the income of workers and employees employed in these firms and creating "added value". In addition, the tariff protects the income of industries that supply this industry with raw materials and materials.

Thus, the tariff on goods (for example, refrigerators) supports not only firms that produce them, but also working firms, suppliers of parts. This makes it difficult to measure the effect of a tariff on the firms that produce the good. The position of firms that produce goods is also affected by tariffs on imported goods, which represent cost elements for them (firms), for example, imported components.

Therefore, a complete model of the interaction of supply and demand, simultaneously covering several industry markets, is required. To simplify the model, another measurement method is used. This method quantifies the impact of the entire tariff system on the value added of a unit of output produced by a given industry. At the same time, the production of the industry and subcontractors, as well as prices, do not change.

Thus, the actual level of protective tariff (the effectiv rate of protection) in a particular industry is defined as the value (in%) by which the added value of a unit of output created in this industry increases as a result of the operation of the entire tariff system.

The actual level of the protective tariff in a particular industry may differ significantly from the amount of tariff paid by the consumer of the “nominal level of the protective tariff”.

The effective customs duty rate characterizes two main principles that underlie the overall effect of protectionism:

Industry revenues or value added will be affected by trade barriers, not only erected on imports, but also operating on the industry's raw materials and materials market;

however, if the final product of an industry is protected by a higher duty than its intermediate products, the actual protective tariff will exceed its nominal level.

After World War II, the role of non-tariff methods began to grow. This is due to several reasons.

First, since the 1950s as a result of multilateral negotiations, it was possible to significantly reduce the average world level of customs duties. And the expansion of non-tariff methods was partly a response to this decline. Secondly, increased competition in world markets has forced many countries to take measures to protect domestic producers. Thirdly, the sharp increase in imports in many countries increased the trade deficit, which seriously worsened the financial position of these countries. Fourth, the aggravation of the problem of unemployment has also contributed to the strengthening of non-tariff methods to prevent the closure of domestic enterprises under the blows of foreign competitors.

Measures of non-tariff regulation are very diverse. Some of them can be attributed to the legitimate functions of the state, for example, import quotas. Others are aimed at discriminating against foreign trade partners. For example, Colombia forced steel importers to buy a certain amount of more expensive domestic steel for each ton of imported products.

The most common type of non-tariff barriers are import quotas. An import quota is the amount of a foreign good that can be brought into a country in a given period of time. For example, the import quota for Japanese cars in the US is 2.3 million units per year. In addition, the United States has import quotas for meat and dairy products and tobacco.

What are the reasons for using quotas? First, the quota allows you to fix the cost of imports. This is especially important in the face of fierce foreign competition and a passive trade balance. Secondly, quotas enable the government to pursue a more flexible foreign trade policy. Because international trade agreements do not allow higher tariffs, it is easier to impose stricter import quotas.

The impact of quotas on the domestic market depends on the level of demand and the volume of production of domestic producers. If quotas do not cover the total demand in the domestic market, then they not only reduce imports, but also lead to an increase in domestic prices compared to world prices.

In addition to quotas, special barriers are now quite widely used: strict requirements for the technical safety of goods, sanitary and environmental standards, requirements for tare and packaging. Today, about 27% of all imports of industrially developed capitalist countries fall under the influence of non-tariff barriers, in the USA - 42% of imports.

Export promotion occupies a special place in the system of protectionist measures. This is due to the increased dependence of the country's economic growth on participation in international trade. The growth of exports characterizes the economic progress of the country and contributes to the improvement of the standard of living of the population. The accumulation of foreign exchange reserves creates conditions for the implementation of various economic development programs.

With regard to export promotion, the policy of subsidizing is most often applied. Export subsidies allow firms to reduce the cost of exports and strengthen their positions in the markets of other countries. The state also bears the costs of sales promotion export goods by organizing advertising and providing other marketing services. The tax system may also provide for the establishment of tax incentives for exporters depending on the volume of exports. On average, export subsidies are small, but for individual goods as well as firms they can be significant. In general, export subsidies in the manufacturing industry of developed countries do not exceed 1% of the value of exports. Agriculture uses the largest percentage of subsidies. The leading capitalist countries are carrying out state programs to support farmers' incomes through guaranteed purchases of surplus agricultural products. They also pay bonuses for refusing to sow certain areas. In particular, the countries of the European Community, in order to reduce the budgetary costs of supporting farmers, sold surplus products at a loss at low prices. Soviet Union.

In addition to subsidizing, dumping is one of the methods of foreign trade policy. Dumping is international price discrimination. In this situation, the exporting firm sells its product in one foreign market cheaper than in another. Robbery dumping (predutory dumping) is called the temporary establishment low prices, aimed at ousting a competitor from this market, with the subsequent restoration of the price level. Persistent dumping continues indefinitely.

Foreign trade in goods

Foreign trade is an international exchange of goods, works, services, information, results of intellectual activity, including exclusive rights to them (intellectual property). According to Russian legislation, a commodity is any movable property (including all types of energy) and aircraft, sea vessels, inland navigation vessels, space objects classified as real estate that are the subject of foreign trade activities.Exclusive rights to the results of intellectual activity (intellectual property) include:

Exclusive rights to literary, artistic and scientific works, programs for electronic computers and databases;

related rights: to inventions, industrial designs, utility models, as well as means of individualization of a legal entity equated to the results of intellectual activity (company names, trademarks, service marks) and other results of intellectual activity and means of individualization, the protection of which is provided for by law.

Unlike goods, services in most cases do not take a materialized form. The only exceptions are certain types of services, such as computer software products, various documentation, etc.

Foreign trade in goods is divided into different groups depending on the subject of foreign trade and the nature of the implementation of foreign trade operations:

1. Trade in fuel and raw materials and agricultural goods.

A raw material is a complex that combines materials directly extracted from the environment (oil, ores, timber, etc.) and semi-finished products, that is, materials that have been processed, but not consumed as finished products, but acting, in turn, raw materials for the production of finished products (metals, chemical products, etc.). All diverse types of raw materials are divided into two large groups: industrial and agricultural.

Depending on the forms of international trade, commodities are divided into exchange (cereals, sugar, natural rubber, cotton, certain types of non-ferrous metals) and non-exchange (oil, natural gas, coal, ferrous and non-ferrous metal ores, timber, pulp and paper and other goods). ). Transactions for goods of the first group are concluded at the relevant commodity exchanges, and the sale of goods of the second group is carried out under short- and long-term contracts.

2. Trade in machines and equipment.

Machinery and equipment in foreign trade practice are sold and bought in the form of ready-to-use products (cars, machine tools, etc.): in disassembled form for subsequent assembly in the buyer's country: in the form of units, parts and individual parts within the framework of cooperation agreements or as spare parts for Maintenance and repair of previously delivered equipment in the form of complete facilities (workshops and sections of industrial enterprises, finished enterprises, power plants, etc.).

Each of these types of supplies has its own characteristics:

Trade in finished products intended and suitable for direct final consumption is the most common type of supply of various types of vehicles, general engineering products, technical goods for cultural and household purposes. Its feature is that the product is transferred to the buyer in a form ready for operation. Delivery is carried out directly by the manufacturer or through intermediaries of various kinds at world or contractual yens. The seller enterprise provides pre-sale service of products, which consists in re-preservation of products after transportation, giving them a marketable appearance, their adjustment and testing, issuing a warranty certificate, fine-tuning products taking into account the interests of the importer, as well as after-sales service. Payments for products can be made in the exporter's currency, the importer's currency or in the currency of a third country;

trade in disassembled products is intended for the subsequent progressive assembly of finished products in importing countries and is carried out in markets protected by high customs barriers from the import of finished products. Import of disassembled products is usually subject to lower customs duties and has a number of advantages associated with the use of local cheap labor in their assembly (“screwdriver technology”), more preferential taxation, lower land rent, etc. Export of a number of goods in assembled the form is simply objectively impossible (reactors, port cranes, etc.);

trade in complete equipment involves the supply of technological complexes with a full range of services for their design, construction, adjustment, preparation for operation in local conditions. A variety of complete deliveries is the execution of contracts on a turnkey basis, which provides for a set of works, from the preparation of a feasibility study, the construction of an object, and ending with its commissioning, and payment after its acceptance by the customer. Such agreements also provide for the supply of necessary materials and tools, training of local personnel, assistance in organizing and managing the production process, and ensuring the operation of the facility during the warranty period.

3. One of the varieties of foreign trade in goods is counter deliveries. They are export-import transactions, the terms of which provide for counter obligations of exporters to purchase goods from importers for a part or the full value of the exported products.

The main forms of counter deliveries are:

Barter transactions representing a non-currency, balanced, value-based exchange of goods at contractual or world prices. main reason they are the lack or lack of convertible currency among partners and its instability;

counter purchases of exporters for a part of the cost of the supplied goods;

compensation agreements under which the repayment of a financial or commodity loan provided by a party supplying technological equipment is carried out by the supply of goods produced on this equipment, or by the supply of goods produced by other enterprises;

repurchase of obsolete products when selling newer models and modifications. At the same time, the residual value of returned products is included in the price of new products: operations with tolling raw materials, involving the processing of raw materials mined in one country by the production facilities of another country with payment for the cost of processing and transportation by additional supplies of raw materials. Such operations are justified when there are huge stocks of raw materials or waste and there are no or insufficient capacities for their processing.

In any form of counter deliveries, a valuation of the transferred products is necessary in order to create conditions for an equivalent exchange, as well as for customs accounting, determining insurance payable in case of loss of goods, and evaluating claims. Penalties in this case are carried out by reducing supplies or additional supplies. With advance deliveries, the enterprise delivers its goods to a foreign counterparty in advance. The proceeds are credited to a special conditional account of the western partner, which then delivers its goods to the original (advance) supplier and receives payment from the above account.

Thus, the receipt of payment by the Western firm for the goods shipped by it is guaranteed, and the advance supplier, if the Western partner fails to fulfill counter obligations, freely receives the proceeds back.

Foreign trade in services has a number of features in comparison with trade in goods.

First, services, unlike goods, are produced and consumed in most cases simultaneously and are not subject to storage. Therefore, the provision of various services is based mainly on direct contracts between their producers and consumers and does not involve the use of intermediaries.

Secondly, services play an important and growing role in increasing the competitiveness of goods in the foreign market. The impact of services on trade in knowledge-intensive goods, which require significant amounts of maintenance, information and advisory services, is especially great.

Thirdly, foreign trade in services encounters more barriers than trade in goods, since services are usually more protected by the state from foreign competition.

Fourth, not all types of services, unlike goods, are involved in international economic circulation. This mainly concerns services that come mainly for personal consumption (utilities, domestic services etc.).

Foreign trade in services includes various types of foreign economic activity, both traditional and modern (related to the export of new technologies, knowledge and experience), among which the most common are the following:

1. Export of transport services or international transportation intended for the movement of goods (cargo) and people (passengers) between two or more countries, that is, in international communications. There are direct international messages served by one mode of transport, and mixed (combined) messages, in which two or more modes of transport are sequentially used. International transportation carried out by national carriers of various countries, using for this their rolling stock (sea and river vessels, aircraft, wagons, cars), as well as transport networks (railway, road, river, air) and transport hubs (sea and river ports, airports, railway stations and bus stations, cargo and passenger terminals).

In international trade, various types of basic terms for the delivery of goods are used, taking into account the transport factor in the foreign trade price. They regulate the obligations of the parties to ensure the transportation of goods at various stages of their movement from the warehouse of the supplier to the warehouse of the recipient, provide for the distribution of transport and other costs associated, in particular, with the risk of accidental loss or damage to goods along the way.

Currently, when concluding contracts, the Incoterms rules are applied, which include the following basic conditions and their interpretation:

"Free enterprise" means that it is the seller's responsibility to present the goods to the buyer directly at his warehouse (ie, factory, mine, plantation, etc.). The buyer bears all costs and risks associated with the delivery of the goods to the destination;

"Free at Ship's Side" (PAS) (named port of shipment) implies that the seller's obligations are deemed to be fulfilled when the goods are delivered on board the ship. Further costs and risks are borne by the buyer, including for clearing the goods from duties and obtaining an export license and other similar documents;

Free on Board (FOB) (named port of shipment) obliges the seller to obtain, at his own expense, an export license or other document authorizing the export of the goods, and to bear all costs necessary for loading them on board the vessel, including loading costs. The cost of shipping the goods is borne by the buyer;

Cost and Freight (CFR) (named port of destination) obliges the seller to pay the costs and freight for bringing the goods to the port of destination, but the risk of loss or damage to the goods passes to the buyer at the port of shipment;

Cost, Insurance and Freight (CIF) (named port of destination) is the same as CFR, but the seller undertakes the additional obligation to insure the goods against accidental loss;

"Delivery free ship" (DES) (named port of destination) means that the seller bears all costs associated with bringing the goods to the named port. Further costs are borne by the buyer, including payment of customs duties and fees;

"Delivered free-to-quay" (DEQ) (duty paid... named port) obliges the seller to place the goods at the disposal of the buyer after payment of customs duties and taxes for import at the port of destination. Further costs and risks are borne by the buyer;

“Delivered Free-Front” (DAF) (name of border point) assumes that the seller bears all costs and risks until the goods are placed at the disposal of the buyer at the agreed place at the border, including payment of customs duties, taxes and fees in the country of departure of the goods;

"Delivered Duty Paid" (DDP) (name of destination in the country of the importer) imposes a maximum of obligations on the seller, including the conclusion of contracts with carriers of various modes of transport, the execution of transport and other documents, the completion of customs formalities, obtaining export and import licenses;

Free Carrier (FCA) (name of destination) is intended for use in intermodal transport. The seller is obliged at his own expense to deliver the goods to the point specified in the contract and hand them over to the carrier, as well as obtain an export license. The buyer must conclude a contract with the carrier for the carriage at his expense of the goods to the final destination. The risk of accidental loss or damage to the goods passes from the seller to the buyer at the time of its transfer to the carrier;

"Freight Paid To..." (CPT) (named destination) obliges the seller to bear the costs of paying freight to destination and obtaining an export license. The buyer must pay her other costs associated with the delivery of the goods;

"Freight and insurance paid to..." (CIP) (named destination) means that the seller, in addition to paying the freight and export license, must provide transport insurance against the risk of loss or damage to the goods in transit.

2. International tourism makes the largest contribution to international trade in services and accounts for about 25%. The basis of the tourism industry is formed by enterprises organizing tourist trips and selling vouchers and tours, providing services for the accommodation and meals of tourists (hotels, campsites, etc.), their movement around the country, as well as government, information, advertising, tourism research and training for her personnel, enterprises for the production and sale of goods of tourist demand. Investments made at a time in the construction of hotels, transport hubs and arteries, places of leisure, etc. quickly pay off and, under certain conditions, bring a stable and high income. There are three main types of international tourism: recreational, scientific and business.

3. Trading in licenses is the main form of transfer of technology and is the transfer, under certain conditions, to an entity of the rights to use an invention, know-how, trademarks, etc. for a specified period for an appropriate fee. If technical innovations are not protected by a patent, then we are talking about a non-patent license, which accounts for the bulk of licensed trade. The most widespread are license agreements that provide for a comprehensive international technological exchange with the provision of know-how and other services for the implementation of the transferred technology. The license agreement clearly and unambiguously defines the type of license (non-patent or patent), the scope of rights to use the transferred technology (full, simple or exclusive), the scope and boundaries of the technology, the duration of the license agreement, the form of payment (royalties or lump-sum payments). Royalties are set in the form of fixed rates, which are paid by the licensee at agreed intervals during the duration of the license agreement, that is, they are periodic deductions. The lump-sum payment is a one-time remuneration for the right to use the subject of the license agreement until profit is received from its use, and is the actual price of the license. During the term of the license agreement, the receiving party (licensee) is obliged to inform the seller (licensor) of all changes in technology.

4. International engineering is a complex of industrial, commercial, scientific and technical services related to the design of industrial enterprises, scientific and technical centers, infrastructure, etc.

Engineering services are provided by specialized firms or industrial, construction and other companies and are divided into two main groups:

A) services related to the preparation of the technological process, including pre-project, design, post-project and special services;

b) services related to the optimization of operation processes, enterprise management and product sales. Engineering services are paid by agreement: either by the time in the form of payments at hourly or daily rates, or after the fact (corresponding costs plus remuneration are reimbursed). In construction, as a rule, payment for engineering services is set as a percentage of the cost of work.

5. International leasing is a long-term lease of production equipment, vehicles, computer technology, warehouses. This is a specific form of financing capital investments, in which an enterprise that does not have foreign exchange funds to acquire the corresponding object in full ownership gets the opportunity to operate it. Leasing operations provide certain benefits to all parties involved. Lease payments are generally considered operating expenses and are therefore not taxable. In addition, the tenant has the opportunity, after the expiration of the contract, to redeem the leased item at the residual value into his property or conclude a new license agreement for new, more modern equipment, while avoiding losses associated with obsolescence of means of production. At the same time, customs duty is levied on the residual value of the purchased equipment, which means serious savings for the tenant. According to the rules of the International Monetary Fund, liabilities arising from leasing are not included in the volume of the state's external debt. Therefore, he finds support from the state.

International leasing includes direct and indirect foreign leasing. With direct foreign leasing, lease relations arise between legal entities of different countries. Direct foreign leasing is divided into export (in which the leasing company buys equipment from a national company and then presents it to the lessee abroad) and import (when the lessor purchases equipment from a foreign company, then provides it to the domestic lessee). In indirect foreign leasing, the lessee and the lessor are legal entities of one party, but the capital of the lessor is partially owned by foreign persons or the lessor is a subsidiary of a foreign multinational corporation.

Along with long-term lease (leasing), short-term lease (rating) and medium-term lease (hairing) are also used in international trade.

Short-term rentals are rare in international practice. The subject of a rating contract is usually vehicles, tourism and other non-durable goods. Medium-term lease contracts are more common. The subject of such contracts may be vehicles, road construction machines, assembly equipment, agricultural machines.

The lease contracts fix the retention of ownership rights to the leased item by the lessor and contain obligations for the operation and maintenance of the leased items, the obligations of tenants not to disclose technical secrets and other conditions similar to those contained in sales contracts (force majeure, etc.) . A leasing contract is always concluded for a certain period of time, with the tenant being given the right to extend the lease term or buy the leased item.

Foreign trade operations carried out in international trade include the following main types: export, import, re-export and re-import operations.

Export transactions include actions for the sale and export of goods abroad for their transfer to the property of a foreign counterparty. Export may also include the sale of goods and services to foreign persons operating in the territory of the exporting country.

Import operations are the activities of purchasing and importing foreign goods for their further sale in the importer's domestic market.

Re-export operations are understood as the export abroad of previously imported goods that have not been processed in the re-exporting country. In this case, it is allowed to carry out additional operations that do not change the name of the product. Thus, a product can be prepared for re-export based on the requirements of the countries of consumption: special marking can be applied, packaging can be changed, etc. However, the excess of the cost of additional processing operations of the product over half of its export price is the basis for turning such operations into export ones. An example of a re-export operation is the purchase of components abroad with their further re-export as part of complete equipment. Re-export can take place when selling goods through exchanges and auctions, when implementing large projects in free economic zones, or is carried out with the aim of making a profit on the difference in prices. Re-export does not include the transit of goods through a country.

Re-import operations include purchase operations with import from abroad of goods previously exported and not subjected to processing abroad. Re-import is considered, in particular, the return from abroad of goods that the buyer refused, or the return of goods previously delivered to intermediaries, but not sold by them abroad. Re-import does not include the return of goods that were previously exported abroad for consignment, exhibitions, fairs, under the terms of temporary import and lease, since their export was not accompanied by a sale.

Development of foreign trade

Taking into account competitive advantages and weaknesses Russia can try to determine the medium-term prospects for the development of its foreign trade. Obviously, in Russian exports, fuel and raw materials will remain the main position for a long time to come. However, for Russia it is quite realistic to deepen the degree of processing of raw materials and, on this basis, increase the share of exports of such goods as cellulose, chemical products, fertilizers, etc.There are opportunities for stabilizing and expanding traditional engineering exports, which include cars and trucks, power and road equipment, equipment for geological exploration, etc. Taking into account the availability of a fairly cheap labor force, it is very promising to create assembly plants from components imported into Russia, oriented to the domestic and foreign markets.

There are certain prospects for expanding the export of science-intensive products, which is closely related to the conversion and commercialization of defense complex enterprises (in particular, the export of aerospace technologies and services, laser technology, equipment for nuclear power plants, and modern weapons).

With the development of domestic agriculture and light industry Obviously, the share of consumer goods in Russian imports will decrease and the share of investment goods - machinery and equipment - will increase.

The prospects for the development of Russia's foreign trade largely depend on the realization of the competitive advantages of its industrial complex. In addition to raw materials, these include: a fairly high level of skilled labor with its comparative cheapness, as well as significant amounts of accumulated basic production assets and funds of universal processing equipment, which makes it possible to reduce the capital intensity of technological modernization of production; availability of unique advanced developments and technologies in a number of sectors of the economy, mainly related to the military-industrial complex.

However, the use of these advantages is constrained by a number of reasons. This is the underdevelopment of the financial and organizational infrastructure of foreign trade cooperation; lack of a developed system of state support for exports; difficulty adapting to conditions mass production based on competitive technologies concentrated in the defense complex and intended for small-scale or single-piece production; low production efficiency and an extremely high share of material costs, even in advanced industrial sectors.

The structure of Russian foreign trade was previously not typical for a developed country. At present, these are mainly fuel and energy, simple chemical and petrochemical goods, ferrous and non-ferrous metals, and weapons.

Significant changes have taken place in the commodity structure of Russian imports. The share of investment goods in it decreased, while the share of consumer goods increased, accounting for about 40% of total imports.

With a population of almost 150 million, with significant energy resources, sufficiently highly skilled labor resources at a reduced cost of labor, Russia is a huge market for goods, services and capital. However, the degree of realization of this potential in the foreign economic sphere is very modest. Russia's share in world exports was about 1.3%. The state of Russian foreign trade is still painfully affected by the sharp reduction in economic ties with other former Soviet republics as a result of the collapse of the USSR and the curtailment of trade with the former socialist countries - members of the CMEA, which were the main consumers of domestic engineering products.

But if the role of Russia in world trade is small, then for her the importance of the foreign economic sphere is very significant. The value of Russia's export quota, calculated on the basis of the purchasing power parity of the ruble against the dollar, is about 10%, dividing between far and near abroad in a ratio of approximately 5:1. Foreign trade remains an important source of investment goods, and also plays an important role in supplying the Russian population with food and various consumer goods.

Foreign economic trade

The term "foreign economic activity (FEA)" is commonly understood as the process of implementing foreign economic relations, including trade, joint ventures and the provision of services. Currently, foreign economic activity plays an important role in the functioning of the national economy, representing the main way of integrating Russia into world economy, as well as acting as one of the most significant sources of state revenue.Among the many existing forms of foreign economic activity, one of the most significant should be singled out - foreign trade, which is understood as trade between countries, consisting of exports and imports of goods and services, carried out mainly through commercial transactions formalized by foreign trade contracts.

The concept of "foreign trade activity (FTA)" is defined in the Federal Law "On the Fundamentals of State Regulation of Foreign Trade Activity" as an activity for the implementation of transactions in the field of foreign trade.

The mentioned law also distinguishes four groups of objects of foreign trade:

Foreign trade in goods - import or export of goods;

- foreign trade in services - the provision of services / performance of works, including the production, distribution, marketing and delivery of these services / works;

- foreign trade in information - information acts either as an independent object of foreign trade activity, or as an integral addition to other objects of foreign trade activity;

- foreign trade in intellectual property - the transfer of exclusive rights to intellectual property or the granting of the right to use intellectual property.

Speaking about the structure of foreign trade, we immediately recall the existence of such concepts as the import and export of goods, in other words, the import and export of goods.

The main trading partners of Russia in export were: the Netherlands, Italy, Germany, China, Turkey and others. As for the goods themselves, Russia should be noted as largest exporter military weapons, products of the fuel and energy complex, machinery and equipment, wheat and other grains.

In today's unstable and unstable economic environment, ensuring a high level of efficiency of foreign economic activity requires a continuous increase in efforts to improve it. Despite the differences, all forms of foreign economic activity are interconnected, which leads to the implementation of foreign economic activity as a single uninterrupted process. The progress of foreign trade created the prerequisites for the emergence of other forms of foreign economic activity, the development of which led to the transformation of the latter into the most important subsystem of the national economy.

Foreign trade - trade between countries, consisting of export (export) and import (import) of goods and services. Foreign trade is carried out mainly through commercial transactions formalized by foreign trade contracts.

Foreign economic activity is an important part of international economic relations. It stimulates an increase in the competitiveness of national products, a reduction in domestic prices for goods and an increase in the efficiency of national production through the use of advanced engineering and technological solutions, contributing to the transition to a new technological level. Foreign trade as a part of foreign economic activity characterizes not only the system of commodity circulation, but also the sphere of interrelated state interests of different countries in building a mutually beneficial partnership of counterparties, participants in foreign trade activities. International trade reflects the total volume of foreign trade of most countries of the world community, and the total amount of sales of goods and services within its framework forms international trade. Foreign trade operations in the international market are the interaction of commodity producers and commodity-consumers of different countries, the result of which is the value of the volume of foreign trade of states. Foreign economic activity is a significant component for the Russian economy and the system of foreign economic relations: exports and imports prevail in the formation of Russia's balance of payments, providing a positive balance not only for current operations, but also for the basic balance.

Measures of foreign trade

Limiting the admission of certain types of goods of foreign origin to public procurement in order to protect the domestic market and Russian manufacturers. Unilateral measures of non-tariff regulation of imports. The introduction of bans on the import and circulation in Russia of certain categories of goods. Special economic measures to ensure the security of the Russian Federation.Administrative measures of state regulation of foreign trade activities, involving a direct (administrative) impact on the subjects of international trade, determine the structure of the national market of the Russian Federation, protecting it not only from excessive import supplies of goods, but also from a potential shortage of goods in the domestic market of the country. These include: import licensing; import quotas. Licensing of imports as an instrument of state foreign trade regulation, according to the international trade practice that has developed in Russia, occupies a leading place in the system of administrative measures to protect sectors of the Russian economy from foreign competition. It is a quantitative restriction in the form of a right or permission from authorized government bodies to import goods into the customs territory of the Russian Federation. As you know, the practice of foreign trade activities has developed two forms of import licensing: automatic licensing of imports; non-automatic import licensing. Automatic import licensing is an administrative procedure used when importing goods into Russia, when approval of an application for a license is given in all cases without exception.

It applies subject to the following preconditions:

1) the presence of an application, i.e. official application to the authorized government body in writing with a request to obtain an import license agreed with the country - the exporter of the goods;

2) any person, enterprise or institution that fulfills the legal requirements of an authorized government authority to carry out import operations, including the import of goods subject to automatic licensing, is equally entitled to apply for and obtain an import license;

3) Automatic licensing of imports may be maintained as long as the circumstances giving rise to its introduction prevail and the underlying administrative objectives cannot be achieved in a more appropriate manner.

Temporary restrictions on the import of goods of an administrative nature can, in essence, include declarative (automatic) licensing of imports of certain categories of goods (for monitoring purposes), such as: carpets and textile floor coverings originating from the EU; color TVs; white sugar, raw sugar, starch syrup. It is assumed, and should be supported, that automatic licensing will help limit the import of cheap and low-quality imported products into the Russian Federation and thereby temporarily protect the interests of domestic producers. Non-automatic import licensing, as a diametrically opposed form to automatic import licensing, in our opinion, has a number of limitations.

In particular:

1) non-automatic import licensing should not restrict or disrupt the importation of goods into the customs territory of the Russian Federation in addition to the impact caused by the imposition of this restriction;

2) in the event of the introduction of non-automatic import licensing for purposes other than quantitative restrictions on the import of goods into the Russian customs territory, all participants in foreign trade operations must be admitted to the information necessary and sufficient to understand the basis for granting and/or distributing import licenses;

3) procedures for non-automatic import licensing in terms of scope and duration should be appropriate to the measure for which they are used, and administratively should not be more onerous than necessary to maintain the applied measure.

Automatic and non-automatic licensing of imports is formalized by a special document called a license, which establishes the procedure and contains permission to move a certain amount of goods across the customs border of the Russian Federation.

Quoting (contingenting) of imports as a specific instrument of state foreign trade regulation has not yet found an adequate place in Russia in the system of non-tariff measures to protect sectors of the national economy from foreign competition. Suffice it to say that limiting the quantity of goods in the form of an import quota became somewhat widespread in Russian foreign trade practice only in the second half of the 1990s. In particular, attempts to introduce a quota were made in relation to the import of textile and alcoholic products, as well as ethyl alcohol produced from food raw materials.

Meanwhile, the import quota (contingent) as a special measure to protect the domestic market, affecting directly the quantitative and cost of imported goods, has a number of obvious and proven advantages in practice.

First of all, the import quota guarantees that the import of goods into the customs territory of the Russian Federation will not exceed the specified value, since it deprives foreign companies of the opportunity to expand the supply of products by Russian market by reducing export prices and thus allows domestic producers who are afraid of price competition to retain a certain share in the domestic market.

The accumulated international and domestic experience in the customs and tariff regulation of foreign trade activities, as well as the above analysis, allow us to identify a number of tools for protecting the domestic market from undesirable competition from foreign companies.

The first tool: non-tariff measures aimed primarily at creating equal conditions for competition in the national (domestic) market. The application of special protective measures, anti-dumping measures and compensatory measures will ensure "selective" protection of the interests of domestic producers in cases of violation of the normal conditions of competition by increased, dumped or subsidized imports of goods into the customs territory of the Russian Federation, causing significant damage (or a real threat of significant damage) to those or other specific sectors of the Russian economy. The procedures for such measures should be simple, "transparent" and well-tested in practice by objective criteria, and the application of other non-tariff measures to regulate import operations, such as standards, requirements for packaging, labeling, etc., should be associated solely with security purposes, protection of life and health of consumers.

When implementing non-tariff measures, first of all, it is necessary to strive for transparency, openness and predictability of their application. Therefore, it is advisable to create an effective mechanism for a special judicial (or administrative) resolution of disputes that systematically arise between economic operators and executive authorities in connection with decisions affecting business interests in the field of foreign economic relations. At the same time, administrative regulatory measures must be reduced to a reasonable optimum, ensuring reasonable and reliable state control over economic activity.

The second tool for the implementation of foreign trade and economic policy: the principle of reciprocity within the framework of generally recognized norms and rules of international trade. The best conditions for the access of foreign goods to the customs territory of the Russian Federation should be ensured primarily for those countries that provide domestic producers with conditions comparable in terms of volume and economic effect for the delivery of goods to their national markets. From this point of view, it is obvious that there is a need to revise approaches to reforming and developing the contractual and legal framework for foreign economic relations both with third countries and with integration international organizations.

The third instrument is the formation of a system of control over the provision of Russia's rights arising from bilateral and multilateral international trade agreements. This tool is necessary for an adequate response to any cases of violation of such rights, discrimination of Russian enterprises, their goods and services in foreign markets. Russian economic operators should receive equal opportunities to protect their economic interests.

The fourth tool: targeted support for structural changes in Russian exports. It should be focused on those sectors of the national economy that have real or potential competitiveness.

Currently, these include aircraft manufacturing, commercial space launch services, as well as some other science- and capital-intensive industries. Such support should be provided in forms that exclude the possibility of legal use of protectionist instruments by trading partners.

And, finally, the fifth tool: the implementation of the "dictatorship" of the law. The problems of changing existing and developing new legislation are so large-scale that, according to preliminary estimates of specialists, it will take at least 3 years to bring legislative framework foreign trade activities in Russia in accordance with the requirements of the WTO.

The model of interaction between Russia and the global world market that has developed to date does not correspond to either its potential competitive capabilities or its long-term economic interests. In this regard, the issue of Russia's accession to the World Trade Organization is of fundamental importance. Entering the WTO, Russia sets itself a number of important goals. First, Russia seeks to become an equal trading partner on the world market and create more favorable conditions for its exports. At the same time, it is necessary to proceed from the fact that as a result of accession to the WTO, the problems of discriminatory attitudes towards Russia by Western countries, which do not always recognize Russia as a country with a market economy, should be resolved. Secondly, Russia is interested in the WTO system of maintaining discipline in international trade, including the dispute resolution mechanism. Thirdly, accession to the WTO will allow Russia to transfer trade and economic relations with other countries and groups of countries to an equal, predictable, long-term economic and legal basis. And, finally, fourthly, the process of joining the WTO will create additional incentives for the harmonization of Russian legislation and bringing it into line with international requirements. In a more concrete sense, the conditions for accession to the WTO are a compromise worked out in the course of negotiations, a consensus reached through mutual concessions and mutual, often tough, commitments. Russia faces a difficult task - to determine not only national economic interests and priorities, obligations and conditions that guarantee national economic security, but also to be able to defend them in the course of difficult negotiations, in the conditions of the economic pressure of Western countries that have already manifested themselves, their attempts to achieve unilateral market opening, non-reciprocal concessions, unwillingness to recognize the fact that many enterprises and sectors of Russian industry have comparative advantages that allow them to export goods at competitive prices and significantly influence the formation of world prices.

Foreign trade policy